BEYOND BOUNDARIES - Metacorp€¦ · METACORP BERHAD ( 93570-P ) 1, Jalan Batu Caves, 68100 Batu...

Transcript of BEYOND BOUNDARIES - Metacorp€¦ · METACORP BERHAD ( 93570-P ) 1, Jalan Batu Caves, 68100 Batu...

METACORP BERHAD ( 93570-P )

1, Jalan Batu Caves, 68100 Batu Caves, Selangor Darul Ehsan, Malaysia.Tel : 03-6195 1111 Fax : 03-6188 0101

w w w . m t d g r p . c o m

B E Y O N D B O U N D A R I E S

LAPORAN TAHUNAN 2008 ANNUAL REPORT

METAC

OR

P BERH

AD 93570-P AN

NU

AL REPO

RT 2008

Metacorp Berhad (Metacorp) is an investment holding company involved in property development & investment, quarrying and solid waste management concessions.

Metacorp was first listed on the Second Board of Bursa Malaysia Securities Berhad on 18 December 1991 before moving to the Main Board on 20 July 2001.

Metacorp Properties Sdn Bhd and Metacorp Development Sdn Bhd spearhead the Group’s property development activities comprising residential, commercial and industrial projects at the flagship project – the 742-acre Taman Tasik Utama in Ayer Keroh, Melaka and landbank of 1,015 acres in Metacorp Development .

The Group is also involved in the 160-acre Taman Sutera mixed development in Kajang, Selangor Darul Ehsan, which is owned by associate Modal Ehsan Sdn Bhd and managed by a unit of Metacorp. Meanwhile, the Group’s first high end residential project in the Klang Valley is undertaken by Landview Towers Sdn Bhd. The Group’s investment property arm, Exclusive Skycity Sdn Bhd is the owner of Bangunan Shell in Kuala Lumpur.

Subsidiary Dimensi Timal Sdn Bhd is in quarry business while 50%-owned unit E-Idaman Sdn Bhd, via wholly owned Environment Idaman Sdn Bhd will undertake the solid waste collection and cleansing management in the northern states.

Meanwhile, Sinomast Metacorp Labuan Ltd, which is Metacorp’s 50:50 joint venture with PT. Bintang Sinomast Limited, has secured a 30-year concession for a coal terminal project at Cigading Port, Cilegon, Indonesia. The job was awarded to PT. Cigading International Bulk Terminal (CIBT), which is 95% owned by Sinomast Metacorp.

Metacorp is a member of the MTD Group, one of Malaysia’s key infrastructure companies involved in privatised infrastructure development, construction and engineering, property development and other construction related activities.

METACORP BERHAD ( 93570-P )

1, Jalan Batu Caves, 68100 Batu Caves, Selangor Darul Ehsan, Malaysia.

Tel : 03-6195 1111 Fax : 03-6188 0101

w w w . m t d g r p . c o m

B E Y O N D B O U N D A R I E S

LAPORAN TAHUNAN 2008 ANNUAL REPORT

METACO

RP BERHAD 93570-P ANNUAL REPORT 2008Corporate

Profile

contents

2 Corporate Information

3 Corporate Structure

4 Profile of the Board of Directors

8 Report of the Audit Committee

13 Statement on Corporate Governance

22 Additional Compliance Statement

24 Statement on Internal Control

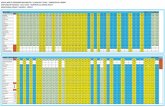

27 Group 5-Year Financial Highlights

28 Chairman’s Statement / Penyata Pengerusi

38 Analysis of Shareholdings

41 Financial Statements

129 List of Properties

130 Notice of Annual General Meeting

135 Statement Accompanying Notice of Annual General Meeting

• Form of Proxy

Metacorp Berhad

2

corporate information

BOARD OF DIRECTORSNoN-INdepeNdeNt NoN-executIve chaIrmaN

dato’ dr. Nik hussain bin abdul rahman

Group maNaGING dIrectordato’ azmil Khalili bin dato’ Khalid

SeNIor INdepeNdeNt NoN-executIve dIrectordato’ Yu Wen chieh

INdepeNdeNt NoN-executIve dIrectordato’ Ir. a. rashid bin omar

Nik mohd Ghazi bin Nik mohd Kamil

AUDIT COMMITTEEDato’ Yu Wen Chieh, chairman

Dato’ Ir. A. Rashid bin OmarNik Mohd Ghazi bin Nik Mohd Kamil

NOMINATION COMMITTEEDato’ Ir. A. Rashid bin Omar, chairman

Dato’ Yu Wen ChiehNik Mohd Ghazi bin Nik Mohd Kamil

REMUNERATION COMMITTEEDato’ Yu Wen Chieh, chairman

Dato’ Dr. Nik Hussain bin Abdul RahmanDato’ Ir. A. Rashid bin Omar

Nik Mohd Ghazi bin Nik Mohd Kamil

COMPANY SECRETARYChan Bee Kuan

REGISTERED OFFICE1, Jalan Batu Caves68100 Batu CavesSelangor Darul EhsanTel : 03-6195 1111Fax : 03-6188 0101Website : www.mtdgrp.com

SHARE REGISTRARMega Corporate Services Sdn BhdLevel 15-2, Faber Imperial CourtJalan Sultan Ismail50250 Kuala LumpurTel : 03-2692 4271Fax : 03-2732 5388

AUDITORSErnst & YoungChartered AccountantsLevel 23A, Menara MileniumJalan DamanlelaPusat Bandar Damansara50490 Kuala Lumpur

SOLICITORSLee Hishammuddin Allen & Gledhill

PRINCIPAL BANKERSCIMB Bank Berhad CIMB Investment Bank Berhad

STOCK EXCHANGE LISTINGMain Board, Bursa Malaysia Securities BerhadStock Name : METACORStock Code : 8389

2008 annual report

3

corporate structure

100% METAURUS SDN BHD

80% DIMENSI TIMAL SDN BHD

100% METACORP EQUITY SDN BHD

70% SESENI ENERGY SERVICES

SDN BHD

100% SESENI ENERGY SERVICES

(JOHOR) SDN BHD

50% E-IDAMAN SDN BHD

100% ENVIRONMENT IDAMAN

SDN BHD

100% METACORP PROPERTIES SDN BHD

100% MTD SADEC SDN BHD

100% METACORP DEVELOPMENT

SDN BHD

100% WONDERFUL HAVEN SDN BHD

100% EXCLUSIVE SKYCITY SDN BHD

100% PUNCAK GAYA SDN BHD

100% LANDVIEW TOWER SDN BHD

40% MODAL EHSAN SDN BHD

100% METACORP AUSTRALIA PTY LTD

50% WHITSUNDAYS HERMITAGE PTY LTD

50% SINOMAST METACORP

(LABUAN) LTD

95% PT. CIGADING

INTERNATIONAL BULK TERMINAL

75% WINCON DEVELOPMENT CEYLON (PRIVATE) LIMITED

14.6% MTD ACPI ENGINEERING BERHAD*

as at 22 July 2008

Property Development & Investment Overseas Others

Construction &Engineering

Notes:

* Listed on the Main Board, Bursa Malaysia Securities Berhad

Metacorp Berhad

4

profile of theboard of directors

dato’ Yu WeN chIeh Senior Independent Non-Executive Director

dato’ dr. NIK huSSaIN BIN aBduL rahmaNChairman

Non-Independent Non-Executive Director

dato’ aZmIL KhaLILI BIN dato’ KhaLId Group Managing Director

Non-Independent Executive Director

2008 annual report

5

profile of the board of directors(contd.)

dato’ dr. NIK huSSaIN BIN aBduL rahmaNChairmanNon-Independent Non-Executive Director

A Malaysian, aged 72, Dato’ Dr. Nik Hussain was appointed to the Board of Metacorp Berhad on 1 February 2002 and re-designated as Executive Chairman on 28 February 2002 and subsequently, as Non-Executive Chairman on 26 February 2007. He is a member of the Remuneration Committee.

Dato’ Dr. Nik Hussain holds a Bachelor in Dental Surgery from the University of Singapore. He served in the Malaysian civil service as Deputy Minister of Works and Deputy Minister of Telecommunications and Posts from 1976 to 1984 before venturing into the corporate sector. Dato’ Dr. Nik Hussain is also the Group Executive Chairman of MTD Capital Bhd, the Non-Independent Non-Executive Chairman of MTD InfraPerdana Bhd and MTD ACPI Engineering Berhad. He also sits on the board of several private limited companies.

dato’ aZmIL KhaLILI BIN dato’ KhaLId Group Managing DirectorNon-Independent Executive Director

A Malaysian, aged 48, Dato’ Azmil was appointed an Executive Director of Metacorp Berhad on 1 February 2002 and re-designated as Group Managing Director on 28 February 2002.

Dato’ Azmil graduated with a Bachelors Degree in Civil Engineering and subsequently with a Masters in Business Administration. He began his career with a United Kingdom company, Tarmac National Construction and upon his return to Malaysia worked for Trust International Insurance and Citibank NA.

He joined MTD Group in 1993 as its General Manager, Corporate Planning. In 1996, he was appointed Group Managing Director of MTD Capital Bhd. In his capacity as MTD Group Managing Director, he concurrently holds the position of Group Managing Director of MTD Capital Bhd, Metacorp Berhad, MTD InfraPerdana Bhd and MTD ACPI Engineering Berhad and also the Chairman of the foreign subsidiaries of MTD Capital Bhd namely, MTD Walkers PLC, a company listed on the Colombo Stock Exchange, Republic of Sri Lanka and South Luzon Tollway Corporation, Philippines. Apart from MTD Group, Dato’ Azmil is the Chairman and Independent Non-Executive Director of Daya Materials Berhad, director of Touch ’n Go Sdn Bhd (formerly known as Rangkaian Segar Sdn Bhd), the Electronic Toll Collection operator and Environment Idaman Sdn Bhd, a solid waste concession company. Dato’ Azmil is also a Trustee of the Perdana Leadership Foundation.

dato’ Yu WeN chIeh Senior Independent Non-Executive Director

A Malaysian, aged 71, Dato’ Yu was appointed an Independent Non-Executive Director of Metacorp Berhad on 9 February 2002 and subsequently, as Senior Independent Non-Executive Director on 1 August 2002. He is also the Chairman of the Audit Committee and Remuneration Committee and a member of the Nomination Committee.

Dato’ Yu received his Fellowship Diploma in Civil Engineering from the Royal Melbourne Institute of Technology in 1961, and is a member of the Institute of Engineers, Malaysia and a Professional Engineer registered with the Board of Engineers, Malaysia. Prior to his retirement in 1991, he was the Director-General of Malaysian Highway Authority. Dato’ Yu is also a Senior Independent Non-Executive Director of MTD Capital Bhd.

Metacorp Berhad

6

profile of the board of directors(contd.)

NIK mohd GhaZI BIN NIK mohd KamILIndependent Non-Executive Director

dato’ Ir. a. raShId BIN omar Independent Non-Executive Director

2008 annual report

7

dato’ Ir. a. raShId BIN omar Independent Non-Executive Director

A Malaysian, aged 59, was appointed an Independent Non-Executive Director of Metacorp Berhad on 18 October 2005. Dato’ Rashid is also the Chairman of the Nomination Committee and a member of the Audit Committee and Remuneration Committee.

Dato’ Rashid holds a Bachelor of Science (Engineering-Civil) from the University of Glasgow, Scotland. He is a Fellow member of the Institute of Engineers, Malaysia and a Professional Engineer registered with the Board of Engineers, Malaysia. He served in the Ministry of Works, Malaysia and Public Works Department (PWD), Malaysia from 1975 till 2005. His last position prior to his retirement in 2005 was Director, Management Corporate Branch of PWD, Malaysia. Dato’ Rashid is also an Independent Non-Executive Director of MTD ACPI Engineering Berhad.

NIK mohd GhaZI BIN NIK mohd KamILIndependent Non-Executive Director

A Malaysian, aged 59, was appointed to the Board of Directors of Metacorp Berhad on 24 May 2007. He is also a member of the Audit Committee, Remuneration Committee and Nomination Committee.

Nik Mohd Ghazi holds a Diploma in Business Studies, UITM. He joined UMBC Bank Berhad, Kuala Terengganu in 1973 as the Officer in charge of Branch Operation and Bumiputra Credit and eventually became the Branch Manager in 1985. UMBC Bank Berhad later merged to become Sime Bank Berhad (now known as RHB Bank Berhad). In 1987, he was transferred to head office in Kuala Lumpur to be the Section Head of Credit Administration & Credit Control and Branch Supervision in one of the Regional Offices until his retirement in 1998.

Notes:-

Family relationship with Director and/or major shareholdersDato’ Dr. Nik Hussain bin Abdul Rahman is the father-in-law of Dato’ Azmil Khalili bin Dato’ Khalid. Dato’ Dr. Nik Hussain bin Abdul Rahman and Dato’ Azmil Khalili bin Dato’ Khalid are deemed major shareholders of the Company, and their interests in the securities of the Company are set out in the Analysis of Shareholdings of this Annual Report.

Saved as disclosed herein, none of the other Directors have any family relationship with any Directors and/or major shareholders of the Company.

Conflict of interestNone of the Directors have any conflict of interest with the Company.

Convicted of offencesNone of the Directors have been convicted of any offence within the past ten (10) years other than traffic offences.

profile of the board of directors(contd.)

Metacorp Berhad

8

report of theaudit committee

1. MEMBERSHIP AND MEETINGS

The Audit Committee comprises the following members and details of attendance of each member at meetings held during the financial year ended 31 March 2008 are as follows:

members Number of meetings

held attendance

dato’ Yu Wen chieh

Chairman/Senior Independent Non-Executive Director

5 4

dato’ Ir.a.rashid bin omarMember/ Independent Non-Executive Director

5 4

dato’ azmil Khalili bin dato’ Khalid

Member/ Non-Independent Executive Director

(Resigned on 31 January 2008)

4* 3

encik Nik mohd Ghazi bin Nik mohd KamilMember/ Independent Non-Executive Director(Appointed on 24 May 2007)

5 5

* Reflects the number of meetings held during the time the director held office

2. COMPOSITION AND TERMS OF REFERENCE

2.1 composition

The Audit Committee shall be appointed by the Board from among their number and shall comprise not fewer than three (3) members, all of whom shall be non-executive directors. The majority of the Audit Committee shall be independent directors.

At least one member of the Audit Committee shall be: -

a. a member of the Malaysian Institute of Accountants (“MIA”); or

b. if he is not a member of the MIA, he must have at least 3 years of working experience and:i. he must have passed the examinations specified in Part I of the First Schedule of the Accountants

Act 1967; or ii. he must be a member of one of the associations of accountants specified in Part II of the First

Schedule of the Accountants Act 1967; or

2008 annual report

9

report of the audit committee(contd.)

2. COMPOSITION AND TERMS OF REFERENCE (CONTD.)

c. fulfils such other requirements* as prescribed or approved by Bursa Malaysia Securities Berhad (“Bursa Securities”).

The members of the Audit Committee shall elect a Chairman from amongst themselves who is an Independent Director. No alternate Director of the Board shall be appointed as a member of the Audit Committee

In the event of any vacancy in the Audit Committee resulting in the non-compliance of the Listing Requirements of Bursa Securities (the “Listing Requirements”), the Board shall ensure that the vacancy is filled within three months.

The Board shall review the term of office and performance of Audit Committee and each of its members at least once in every three years.

2.2 meetings

The Audit Committee shall meet at least four times a year. In addition, the Chairman may call for additional meetings at any time at the Chairman’s discretion. The Audit Committee may also invite any officer or employee of the Group to be in attendance to assist in its deliberations. At least once a year the Audit Committee shall meet with the external auditors without any executive board member present.

2.3 Quorum

The meetings shall have a quorum of two (2) members who are independent directors.

2.4 Secretary

The Secretary of the Audit Committee shall be the Company Secretary.

The Secretary shall be responsible for drawing up the agenda with concurrence of the Chairman and circulating it, supported by explanatory documentation to members of the Audit Committee prior to each meeting.

The Secretary shall also be responsible for keeping the minutes of meetings of the Audit Committee, circulating them to members of the Audit Committee and to the other members of the Board.

* (a) a degree/masters/doctorate in accounting or finance and at least 3 years’ post qualification experience in accounting or finance; or (b) at least 7 years’ experience being a chief financial officer of a corporation or having the function of being primarily responsible for the management

of the financial affairs of a corporation.

Metacorp Berhad

10

2. COMPOSITION AND TERMS OF REFERENCE (CONTD.)

2.5 authority

The Audit Committee shall, in accordance with a procedure to be determined by the Board and at the expense of the Company,

a. be authorised to investigate any activity within its terms of reference. All employees shall be directed to co-operate with any request made by the Audit Committee;

b. have full and unrestricted access to any information pertaining to the Company or the Group;

c. obtain outside legal or other independent professional advice and secure the attendance of outsiders with relevant experience and expertise if it deems necessary;

d. be able to convene meetings with the external auditors, the internal auditors or both, excluding the attendance of other directors and employees, whenever necessary; and

e. be able to make relevant reports when necessary to the relevant authorities if a breach of the Listing Requirements occurs.

2.6 duties and responsibilities

The duties and responsibilities of the Audit Committee are :-

a. to review the quarterly, and annual financial statements prior to the approval by the Board, focusing particularly on:-• anychangesinorimplementationofnewaccountingpoliciesandpractices;• significantadjustmentsarisingfromtheaudits;• compliance with the applicable approved accounting standards, other statutory and legal

requirements; and• thegoingconcernassumption;

b. to review any related party transaction and conflict of interest situation that may arise within the Group including any transaction, procedure or course of conduct that raises questions of management integrity;

c. to review and monitor the effectiveness of internal control system;

d. to review the extent of compliance with established internal policies, standards, plans, procedures, laws and regulations;

e. to obtain assurance that proper plans for control have been developed prior to the commencement of major areas of change within the Group;

report of the audit committee(contd.)

2008 annual report

11

2. COMPOSITION AND TERMS OF REFERENCE (CONTD.)

f. to review with the internal and external auditors the nature and scope of the audit plan and audit report;

g. to review any matters concerning the appointment and re-appointment, audit fee and any questions of resignation or dismissal of external auditors;

h. to review and evaluate factors related to the independence of internal and external auditors and assist them in preserving their independence;

i. to review internal and external auditors’ findings arising from audits, particularly any comments and responses in management letters as well as the assistance given by the employees of the Group in order to be satisfied that appropriate action is being taken;

j. to recommend to the Board steps to improve the system of internal control derived from the findings of the internal and external auditors and from the consultations of the Audit Committee itself;

k. to review with the external auditors the Statement on Internal Control of the Group for inclusion in the annual report;

l. to prepare the annual Audit Committee report to the Board which includes the composition of the Audit Committee, its terms of reference, number of meetings held, a summary of its activities and the existence of an internal audit function and a summary of the activities of that function for inclusion in the annual report;

m. to review the adequacy of the scope, functions, competency and resources of the internal audit function, and that it has the necessary authority to carry out its work;

n. to review the performance of the internal audit function and report to the Board when necessary; and

o. to carry out any other function that may be mutually agreed upon by the Audit Committee and the Board when deemed necessary and appropriate.

3. SUMMARY OF ACTIVITIES

During the financial year under review, the Audit Committee carried out its duties as set out in the terms of reference and the activities are summarised as follows : -

• Reviewedtheexternalauditors’scopeofworkandtheirauditplanfortheyear.Priortotheaudit,representativesfrom the external auditors presented their audit strategy and plan.

report of the audit committee(contd.)

Metacorp Berhad

12

3. SUMMARY OF ACTIVITIES (CONTD.)

• Reviewedwith theexternal auditorson the resultsof their audit, theauditedfinancial statementsand themanagement letter.

• RecommendedfortheBoard’sconsiderationthere-appointmentofexternalauditorsandtheauditfees.

• Reviewed the quarterly financial statements and annual audited financial statements of the Group beforerecommending them for approval of the Board.

• Reviewedandapprovedtheinternalauditplan.

• Reviewedthe internalaudit reportspresentedby internalauditorsanddiscussedonmanagement’sactionstaken to improve the system of internal control and any outstanding matters.

• ReviewedtheauditreportonInformationSystemSecurityoftheGroupInformationTechnologyEnvironment.

• Reviewed theAuditCommitteeReportandStatementon InternalControland its recommendations to theBoard for inclusion in the Annual Report.

• ReviewedrelatedpartytransactionsoftheCompanyandoftheGroup;and

• VerifiedtheallocationofEmployeeShareOptionScheme(“ESOS”)optionsduringtheyeartoensurethatthiswas in compliance with the allocation criteria set and in accordance with the bye-laws of the ESOS.

4. INTERNAL AUDIT FUNCTION

The Internal Audit Function is carried out by the Group Internal Audit Department (the “Group IAD”) of MTD Capital Bhd, the holding company. Group IAD assists the Audit Committee (AC) in discharging its duties and responsibilities, and is independent of the activities they audit. The primary role of the department is to undertake independent, regular and systematic review of the system of internal control within the Group, so as to provide reasonable assurance that such system is sound, and that established policies and procedures are adhered to and continue to be effective and satisfactory.

In developing the Audit Plan, internal audit assignments are prioritised based on the results of the risk assessment exercise, audit cycle and discussions with Senior Management. The Annual Audit Plan is presented to the Audit Committee for approval.

The results of audit exercise are reported to the AC. The AC reviews the key concerns/issues raised by the Group IAD. The responses from the management and action plans are regularly reviewed and followed up by the Group IAD and the AC through Audit Tracking Register.

report of the audit committee(contd.)

2008 annual report

13

statement oncorporate governance

The Board of Directors (“Board”) recognises that conformance to the Malaysian Code on Corporate Governance (Revised 2007) (“the Code”) is crucial for a company to be successful in order to ensure the satisfaction of the investors and stakeholders and to safeguard their interests.

The Board is committed to support the Code and has embedded in Metacorp Berhad and its subsidiaries (“Group”) a framework of structures, processes and values to promote corporate credibility and to provide investors and stakeholders the assurance that the Board maintains good corporate governance and ethics to enhance the performance of the Group with the objective of increasing the value of the Group’s assets and shareholders’ investment. The framework is also intended to complement the Management in the attainment of sound business practices and strengthening its resources to manage the emerging market challenges faced by the Group.

The Board is pleased to report to the shareholders of the Company on the corporate governance practices within the Group as prescribed by the Code, for the financial year ended 31 March 2008.

A. DIRECTORS

a1. the Board

The Board, with its collective overall responsibility in providing leadership to the Group, plays a key role in the entrenchment of the culture of good corporate governance in the Group by charting the vision and mission of the Group to guide in the establishment of corporate strategies and goals aimed at directing management performance to enhance the success of the Group, including optimising long-term returns to increase shareholders’ values and meet the expectation of stakeholders.

The Board leads, controls and oversees the conduct of the Group’s business to ensure it is being properly managed to safeguard the Group’s assets and shareholders’ investment which inter-alia, includes:-

a) Reviewing and approving strategies, business goals and plans, policies and procedures to serve as a guide to the management to operate and manage the business of the Group;

b) Where it is appropriate, key performance indicators are being established to monitor the achievement of business goals and to ensure the implementation of business plans as well as the effectiveness of the processes in place;

c) Continuously ensuring the effectiveness and adequacy of a sound system of internal control within the Group for management reporting and oversight, independent assurance against any material misstatement, loss or fraud, and identifying and managing the exposure to potential or principal risks that would impact on the Group;

d) Decision making on a formal schedule of matters reserved to itself which includes the overall group strategy and direction, acquisition and investment policy, approval of major capital expenditure for projects, and significant financial matters; and

e) Evaluating the viability of business propositions or corporate proposals, changes to the management and control procedures within the Group.

Metacorp Berhad

14

A. DIRECTORS (CONTD.)

The Board established inter-alia the following committees: Audit Committee, Nomination Committee, Remuneration Committee (collectively referred to as “Board Committees”) and Management Committee and delegated certain functions to the Board Committees within clearly defined operating structure, lines of responsibilities and authority. The Board Committees in assisting the Board are either empowered to act independently or on behalf of the Board but the ultimate responsibilities for the final decision on matters of paramount importance however, lies with the entire Board. The effectiveness and performance of each Board Committee, its structure, composition and responsibilities are evaluated annually with reference to its respective terms of reference.

The Board delegated to the Management Committee the responsibilities for all aspects of the day-to-day management of the Group. The Management Committee is supported by a management team with the requisite experience and skill and headed by the Group Managing Director. The Board receives comprehensive management reports including but not limited to operation and financial reporting based on annual budgets and quarterly financial results, to enable the Board to monitor the achievement of major operations within the Group.

Training and succession plan are on-going attuned to organisational objectives to ensure orderly management transition in the Group towards continuity in creating and developing an internal pool of talents as successors to grow with the Group and to support the Group’s operation and future developments.

a2. Board composition and Balance

The Board has five (5) members comprising one (1) Non-Independent Executive Director, three (3) Independent Non-Executive Directors and one (1) Non-Independent Non-Executive Director. The profile of each Director is set out in the Profile of the Board of Directors.

The Independent Directors which make up 60% of the Board membership is in compliance with Paragraph 15.02 of the Listing Requirements of Bursa Malaysia Securities Berhad (“Bursa Securities”) [“Listing Requirements”].

The Board comprises a mix of Executive Directors and Non-Executive Directors. The Non-Executive Directors

possess an appropriate range of skill and experience including industry knowledge, accounting, financial, technical, management and business acumen to deal with the diverse business needs of the Group.

The roles of the Chairman and the Group Managing Director are distinct and separated with clear division of responsibilities to ensure a balance of power and authority which are clearly defined in the Board Charter. The Chairman is responsible for leading the Board to ensure its effectiveness and integrity, the entrenchment of good corporate governance practices within the Group as well as maintaining effective communication between shareholders/investors and the Board. The Group Managing Director has the overall responsibilities of managing the day-to-day operation and business of the Group including implementation of policies and procedures and decision of the Board and vice-versa reports, communicates and clarifies to the Board on matters pertaining to business results and operation of the Group.

statement on corporate governance(contd.)

2008 annual report

15

A. DIRECTORS (CONTD.)

The Non-Executive Directors are independent of the management and do not participate in the day-to-day dealings/business or have other relationship with the Group which could materially interfere with the exercise of their independent judgement in the Board. Their independence attribute to effective independent supervisory function involving overseeing and monitoring the effectiveness of the management and their ability to challenge the decision of management is considered a means of protecting the interests of minority shareholders and stakeholders. Dato’ Yu Wen Chieh is the Senior Independent Non-Executive Director to whom concerns relating to the Company may be conveyed.

The Board periodically and on an annual basis, reviews the experience, mix of skill and other qualities of the Board to ensure effective discharge of its duties and responsibilities in enhancing the success of the Group. Taking into account of the current Board and the specific business of the Group, the Board believes that the current composition and size of the Board are appropriate to ensure no individual Director or group of Directors dominate the decision-making of the Board and is effective representation for the minority shareholders of the Company.

a3. Board meetings

Board Meetings for each calendar year are scheduled at the beginning of the year. The Board meets regularly to consider the business of the Group. During the financial year ended 31 March 2008, the Board met four (4) times. The record of attendance of each Director during the financial year ended 31 March 2008 is as follows:-

Name of director attendance

dato’ dr. Nik hussain bin abdul rahman(Non-Independent Non-Executive Director)

3/4

dato’ azmil Khalili bin dato’ Khalid(Non-Independent Executive Director)

4/4

dato’ Yu Wen chieh(Senior Independent Non-Executive Director)

3/4

dato’ Ir. a. rashid bin omar(Independent Non-Executive Director)

3/4

Nik mohd Ghazi bin Nik mohd Kamil(Independent Non-Executive Director) (Appointed on 24 May 2007)

4/4

statement on corporate governance(contd.)

Metacorp Berhad

16

A. DIRECTORS (CONTD.)

The Chairman sets the agenda for each Board meeting which is distributed together with the notice of meeting in advance to each Director. The matters for discussion and decision-making by the Board are formalised and the proceedings and resolutions passed at each Board meeting are recorded in the minutes which are confirmed by the Board in the next succeeding meeting and signed by the Chairman of the meeting as a correct record of the proceedings thereat. The Directors may request for clarification or comment on the minutes prior to confirmation of the minutes. The Chairman of the respective Board Committee would inform the Board of any salient matters and/or reports would be appended to the minutes of the Board meeting for Directors’ notation. The Board also exercises control on matters that require Board’s approval by way of circulation of Directors’ Resolutions in writing.

Besides Board meetings, consultation and sharing of expertise and experience among Directors are freely and frequently held. In the event of any potential conflict of interest situation, the Directors concerned will declare their interests to the Board immediately and will abstain from deliberations and decisions in the matters in which they are interested. The management staff or professional adviser are invited to Board meetings to brief or provide details pertaining to any matters tabled at the Board meetings or to explain or clarify on issues that may be raised by the Board.

a4. Supply of Information

Prior to Board meetings, all information relevant for the understanding of the Board on matters to be tabled for deliberation at the Board meeting are distributed by the Company Secretaries in advance for review by the Directors and this helps facilitate the efficient use of meeting time.

In the circulation of Directors’ Resolutions in writing to the Board members, proposal papers and supporting documents are attached to provide detailed information and explanation on the purpose of the resolution to be passed. The management endeavours to provide the Board with materials that are as concise as possible, yet give Directors sufficient information to make informed decisions. On an on-going basis, the Board is provided with information pertaining to the progress of business operations or significant projects, details on business propositions and corporate proposals undertaken or to be undertaken by the Group, to enable the Directors to understand the business operations, proposals and/or challenges faced by the Group.

The Board collectively or individually is authorised to take such independent professional advice as it considers necessary in furtherance of their duties at the expense of the Company. All Directors have unrestricted access to the management staff to seek further information, updates or explanation on any aspect of the Group’s operation or business to fulfil their duties.

statement on corporate governance(contd.)

2008 annual report

17

A. DIRECTORS (CONTD.)

The Directors also have access to the advice and services of qualified Company Secretaries in the course of discharging their duties and fulfilling their obligations to statutory requirements, the Listing Requirements or other regulations, whether as a full board or in their individual capacity. Any appointment of Company Secretaries or removal is a matter for the Board as a whole.

The Directors are regularly updated on new statutory and regulatory requirements relating to their fiduciary duties and responsibilities, to enable them to keep abreast of new developments.

a5. appointment of directors

The Nomination Committee was established on 22 August 2003. Its members comprise exclusively of Independent Non-Executive Directors and are as follows: -

member designation

Dato’ Ir. A. Rashid bin Omar ChairmanIndependent Non-Executive Director

Dato’ Yu Wen Chieh Senior Independent Non-Executive Director

Nik Mohd Ghazi bin Nik Mohd Kamil Independent Non-Executive Director

The term of office of the members of the Nomination Committee shall be for a period of two (2) years and may be re-nominated and appointed by the Board from time-to-time.

The duties and responsibilities of the Nomination Committee are defined in its terms of reference approved by the Board which inter-alia includes review and assessment of the effectiveness, size and composition of the Board and Board Committees; and skill and experience of its individual members. The Nomination Committee annually reviews and assesses the effectiveness of the Board and Board Committees as a whole, and the contribution of each individual Director.

The Nomination Committee is responsible for making recommendation for any appointment to the Board. In evaluating the suitability of new nominees, the Nomination Committee takes into account the requisite qualification and experience of the potential candidate to meet the relevant requirements of the Listing Requirements, including general understanding of business and other disciplines relevant to the success of a public listed company in today’s business environment.

statement on corporate governance(contd.)

Metacorp Berhad

18

A. DIRECTORS (CONTD.)

a6. re-election or re-appointment of diretors

The Board recommends directors for re-election and/or re-appointment by shareholders at every annual general meeting (“AGM”) pursuant to the Company’s Articles of Association and the Companies Act, 1965.

i) All Directors are subject to retirement by rotation and in ascertaining the number of directors to retire, the Company shall ensure all directors shall retire from office at least once in every three (3) years but shall be eligible for re-election.

ii) One-third (1/3) of the Directors or the number nearest to one-third (1/3) shall retire from office at every AGM and if eligible, may offer themselves for re-election.

iii) Directors who are appointed by the Board to fill a casual vacancy shall hold office only until the next following AGM and shall then be eligible for re-election but shall not be taken into account in determining the Directors who are to retire by rotation at the meeting.

iv) The Group Managing Director shall retire from office at least once in every three (3) years, but such re-election shall be subject always to the provision stated in item (ii) above.

v) Directors over seventy (70) years of age are required to submit themselves for re-appointment as Directors annually by way of a resolution in accordance with Section 129(6) of the Companies Act, 1965.

The details of Directors standing for re-election and/or re-appointment at the forthcoming Twenty-Fifty (“25th”) AGM are set out in the Notice of 25th AGM.

a7. directors’ training

All the Directors have completed the Mandatory Accreditation Program. In the spirit of continuous education for Directors, the Company had organised a half day in-house training on “Directors’ Challenges in Corporate Governance and Risk Management” conducted by Columbus Circle Governance Sdn Bhd in the financial year ended 31 March 2008. All Directors attended the aforementioned training except Dato’ Yu Wen Chieh due to other commitment.

B. DIRECTORS’ REMUNERATION

The Remuneration Committee was established on 1 August 2002. Its members comprise mainly Independent Non-Executive Directors and are as follows:-

statement on corporate governance(contd.)

2008 annual report

19

B. DIRECTORS’ REMUNERATION (CONTD.)

member designation

Dato’ Yu Wen Chieh ChairmanSenior Independent Non-Executive Director

Dato’ Dr. Nik Hussain bin Abdul Rahman Non-Independent Non-Executive Director

Dato’ Ir. A. Rashid bin Omar Independent Non-Executive Director

Nik Mohd Ghazi bin Nik Mohd Kamil Independent Non-Executive Director

The term of office of the members of the Remuneration Committee shall be for a period of two (2) years and may be re-nominated and appointed by the Board from time-to-time.

The duties and responsibilities of the Remuneration Committee are defined in its terms of reference approved by the Board, which inter-alia includes annual review of the remuneration packages of the Directors. The Remuneration Committee is mindful that the remuneration packages for the Executive Directors should be attractive to retain the Directors in the Board to run and lead the Group successfully. The level of remuneration rewarded to the Directors is reflective of the corporate performance of the Group and individual’s performance and achievements during the financial year under review. The remuneration packages are also linked to the Group’s policies and benchmarked against practices of comparable public listed corporations to be competitive. The Board makes changes to directors’ remuneration packages upon the recommendation of the Remuneration Committee and following discussion and approval by a majority of the Board.

The determination of the remuneration packages for Non-Executive Directors is a matter to be decided by the Board as a whole. None of the Directors participate in any way in determining their individual remuneration package. The Company reimburses expenses incurred by Directors in the course of their duties as Directors.

The fees payable to the Directors are determined by the Board and are subject to the approval of the shareholders of the Company at the AGM.

1. The aggregate remuneration of the Directors categorised into appropriate components during the financial year ended 31 March 2008 is as follows:-

descriptionexecutive directors

rm (‘000)Non-executive directors

rm (‘000)total

rm (‘000)percentage

%

Salaries 245 152 397 56

Fees 28 129 157 22

Bonuses & Benefits-in-kind

90 61 151 22

Total 363 342 705 100

statement on corporate governance(contd.)

Metacorp Berhad

20

B. DIRECTORS’ REMUNERATION (CONTD.)

2. The number of Directors whose total remuneration from the Group falls within the following bands are as follows:-

Number of directors

remuneration Band executive Non-executive total

Below RM50,000 - 3 3

RM150,001 to RM200,000 - 1 1

RM300,001 to RM350,000 1 - 1

C. RELATIONSHIP WITH SHAREHOLDERS/INVESTORS

The AGM and extraordinary general meetings remain the principal forum for dialogue with shareholders. At each AGM, the Board presents the progress and performance of the Group and shareholders are encouraged to raise questions on the proposed resolutions and the business and operation of the Group. The Board will address all questions and clarifications required by the shareholders.

The Company encourages dialogues with institutional investors, fund managers and analyst to foster understanding of the Company’s activities and from time to time do participate in meetings or conferences to ensure that an updated progress and development of the business of the Group is well communicated and the corporate objectives are understood clearly by existing and prospective investors.

The Company maintains a dedicated website at www.mtdgrp.com which provides easy access to information on the Company’s latest events, news, announcements to Bursa Securities, financial results and other corporate information.

Shareholders may raise any queries or contact the Company or the Company’s Registrar during office hours and the officer in-charge will attend accordingly to the queries.

statement on corporate governance(contd.)

2008 annual report

21

D. ACCOUNTABILITY AND AUDIT

(i) Financial reporting

In presenting the annual financial statements and quarterly financial results, the Board had ensured that the Group adopts appropriate accounting policies and standards and consistently applied prudent judgements supported by reasonable estimates so that the financial statements represent a true and fair assessment of the Company and Group’s financial position. The Board vested responsibilities on the Audit Committee to ensure that the Company maintains proper accounting records, review and assess the accuracy and adequacy of all the information to be disclosed and ensure that the financial statements are in compliance with the Companies Act, 1965, the Listing Requirements and the applicable approved accounting standards in Malaysia.

A statement by the Directors of their responsibilities for the financial statements is incorporated within the Directors’ Report and Statement by Directors.

(ii) Internal control

The Board had conducted a review of the effectiveness and adequacy of the Group’s System of Internal Control. The state of internal control within the Group and reports of the results are set out in the Statement on Internal Control.

(iii) relationship with auditors

The Board, through the Audit Committee, maintains a formal and transparent relationship with its external auditors, Messrs Ernst & Young, in seeking professional advice and ensuring compliance with the accounting standards of Malaysia. Matters that require the Board’s attention are highlighted by the external auditors to the Audit Committee and the Board through the issuance of management papers and reports.

(iv) audit committee

The Audit Committee consists of three (3) members in compliance with Paragraph 15.10(1)(a) and 15.10(1)(b) of the Listing Requirements. Bursa Securities had granted the Company an extension of time until 30 September 2008 to comply with the composition of the Audit Committee pursuant to Paragraph 15.10(1)(c) of the Listing Requirements.

The Audit Committee meets with the external auditors, without the presence of the Executive Directors at least once a year, to encourage the external auditors to raise discussion on potentially adverse audit issues at a relatively early stage and to allow the external auditors to broach sensitive problems in an uninhibited manner pertaining to audit plan or audit findings and other relevant audit or accounting issues. The Audit Committee also meets with the external auditors, whenever it deems necessary.

The role of the Audit Committee in relation to the external auditors, the composition, terms of reference and a summary of activities of the Audit Committee are set out in the Report of the Audit Committee.

statement on corporate governance(contd.)

Metacorp Berhad

22

additional compliance statement

utilisation of proceeds

During the financial year, there were no proceeds raised from any corporate proposal.

Share Buy-Back

During the financial year, the Company did not enter into any share buy-back transactions.

options, Warrants or convertible Securities

During the financial year, the company issued 1,536,000 ordinary share of RM0.50 each for cash pursuant to the Employee Share Options Scheme of the Company (“ESOS”) at an average price of RM0.50 per ordinary share. The ESOS lapsed on 28 March 2008.

american depository receipt (“adr”) or Global depository receipt (“Gdr”) programme

During the financial year, the Company did not sponsor and/or participate in any ADR or GDR programme.

Imposition of Sanctions and/or penalties

There were no sanctions and/or penalties imposed on the Company and its subsidiaries, directors or management by the relevant regulatory bodies during the financial year.

Non-audit Fees

The amount of non-audit fees paid to the external auditors by the Group for the financial year is RM37,169.

variation in results

There were no material variation between the audited results for the financial year ended 31 March 2008 and the unaudited results for the financial year ended 31 March 2008 released on 29 May 2008.

profit Guarantees

During the financial year, the Company had not provided any profit guarantees nor is there any profit guarantee given to the Company.

material contract

Save as disclosed below, neither the Company nor any of its subsidiaries had entered into any material contract which involved Directors’ and/or major shareholders’ interests, either still subsisting at the end of the financial year 31 March 2008 or entered into since the end of the previous financial year:

On 10 April 2008, the Company and its holding company, namely MTD Capital Bhd (“MTD”) had entered into a Selective Capital Repayment Agreement in respect of the proposed selective capital repayment exercise pursuant to Section 64 of the Companies Act, 1965 (“Proposed SCR”) which will result in the Company being taken private. MTD will grant an interest-free loan to the Company amounting to RM71.19 million for the purpose of funding in full, the repayment of the cash amount

2008 annual report

23

additional compliance statement(contd.)

under the Proposed SCR. The Proposed SCR will result in the reduction of the existing issued and paid-up share capital of the Company as at 31 March 2008 of RM340.41 million comprising 680.81 million ordinary shares of RM0.50 each in the Company (“Metacorp Shares”) to RM269.21 million comprising 538.43 million Metacorp Shares by way of cancellation of 142.38 million Metacorp Shares held by the shareholders of the Company other than MTD and Lambang Simfoni Sdn Bhd (“LSSB”). Upon completion of the Proposed SCR, MTD and LSSB shall collectively hold 100% equity interest in the Company. The Proposed SCR is conditional upon approvals being obtained from the shareholders, relevant authorities, creditors and bondholders of the Company.

On 17 July 2008, the Company announced that the Ministry of International Trade and Industry, via its letter dated 16 July 2008, has no objection to the Proposed SCR, subject to the Company obtaining the approval of the Securities Commission (“SC”) for the Proposed SCR and adhere to the Guidelines on the Acquisition of Interests, Mergers and Take-Overs by Local and Foreign Interests issued by Foreign Investment Committee.

On 7 August 2008, the Company announced that SC and SC (Equity Compliance Unit) have approved the Proposed SCR on 6 August 2008. The SC’s approval is subject to the following conditions:

(i) CIMB Investment Bank Berhad (“CIMB”)/the Company should inform the SC upon completion of the Proposed SCR; and

(ii) CIMB/the Company should fully comply with the relevant requirements pertaining to the implementation of the Proposed SCR under the Guidelines of the Offering of Equity and Equity-linked Securities.

revaluation policy

The Company does not have a revaluation policy on landed properties.

recurrent related party transactions (“rrpt”)

The information on RRPT for the financial year is set out in the financial statements.

DIRECTORS’ RESPONSIBILITIES FOR THE FINANCIAL STATEMENTS

The Board is responsible for ensuring that the annual audited financial statements of the Company and the Group have been properly drawn up in accordance with the provisions of the Companies Act 1965, applicable Financial Reporting Standards in Malaysia and the Listing Requirements of Bursa Malaysia Securities Berhad so as to give a true and fair view of the state of affairs and of the results and cash flows of the Company and the Group, for the financial year ended 31 March 2008.

In presenting the financial statements, the Directors have:-

• adoptedappropriateaccountingpolicies,consistentlyappliedandsupportedbyreasonableprudentjudgementandestimates and prepared on going concern basis; and

• ensuredthattheCompanyandtheGrouphavecompliedwithapplicableFinancialReportingStandards.

The Board has overall responsibility for taking such steps as are reasonably open to them to safeguard the assets of the Group and to prevent and detect fraud and other irregularities.

Metacorp Berhad

24

statement oninternal control

INTRODUCTION

The Malaysian Code on Corporate Governance requires the board of listed companies to maintain a sound system of internal control to safeguard shareholders’ investments and the Company’s assets. Paragraph 15.27(b) of the Listing Requirements of Bursa Malaysia Securities Berhad requires the Board of Directors (the “Board”) of listed companies to include a statement in their annual report about the state of their internal control. Paragraph 15.24 of the Listing Requirements states that the external auditors must review the statement made by the Board with regard to the state of internal control and reports the results thereof to the Board.

BOARD RESPONSIBILITY

The Board acknowledges that it is responsible for the Company and its subsidiaries’ (the “Group”) system of internal control (“Group Internal Control System”) and the review of its adequacy and integrity.

The Group Internal Control System manages but does not eliminate the risk of failure to achieve business objectives. The Group Internal Control System provides only reasonable but not absolute assurance against material misstatement, loss or fraud.

The Board has in place an ongoing process, for identifying, evaluating, monitoring and managing the significant risks affecting the achievement of its business objectives throughout the period. The process is regularly reviewed by the Board and accords with the Statement on Internal Control: Guidance for Directors of Public Listed Companies.

KEY INTERNAL CONTROL PROCESSES

enterprise risk management

A Group-wide risk management framework was established applicable to all functions in the Group, in operational, financial and support areas. In this structured risk management framework, the principal risks facing an operating unit of the Group are regularly reviewed and assessed, together with steps to manage those risks. The results of these reviews are placed on risk registers and, where necessary, specific action plans are developed to treat those risks with appropriate key performance indicators so as to monitor the implementation of these plans as well as the effectiveness of the processes.

In addition, periodic exercises are to be carried out at Group level, on a bi-annual basis, to identify key issues affecting the Group as a whole, the changing risk profile and the emerging issues that may have an impact on the Group’s business objectives. The output of these assessment and reviews will be reported to the senior management, the Audit Committee and the Board which will have the ultimate responsibility to continuously assess the effectiveness of the risk management processes so that the Group’s systems and internal controls are such designed to ensure that the Group’s exposure to principal risks is properly managed.

In this way, the systematic approach in the Group-wide risk management will help to optimise the effects of uncertainties or risks on the Group’s business objectives.

2008 annual report

25

KEY INTERNAL CONTROL PROCESSES (CONTD.)

audit committee (ac)

The Audit Committee (AC), which is chaired by an independent non-executive director deliberates on findings and recommendations for improvement proposed by the internal and external auditors. The AC also evaluates the adequacy and effectiveness of the Group’s risk management and system of internal control. Apart from reviewing the annual audit plan, the AC assesses the scope and quality of audit performed.

Further details on the AC are set out in the Audit Committee Report.

Internal audit Function

The Internal Audit Function is carried out by the Group Internal Audit Department (the “Group IAD”) of MTD Capital Bhd, the holding company. The Group IAD independently carries out its function and provides the AC and the Board with the assurance on the adequacy and integrity of the system of internal control.

The Group IAD reviews the internal control in the activities of the Group’s businesses based on the annual audit plan. The annual audit plan is reviewed and approved by the AC and the findings of the audits are submitted to the AC for review at their periodic meetings. The Group IAD adopts a risk-based approach when establishing its audit plan and strategy. The responses from Management and action plans are regularly reviewed and followed up by the Group IAD and the AC.

other Key elements of Internal control

Apart from the above, the other key elements of the Group Internal Control System include: -

• Limitsofauthorityareestablishedtogovernthemanagementoffinancialandnonfinancialapprovallimits.

• Formaloperatingstructureinplacewithclearlydefinedlinesofresponsibilityandaccountability.

• VariousCommitteeshavebeenestablishedtoassisttheBoardindischargingitsduties.Amongthecommitteeare:-- Audit Committee- Nomination Committee- Remuneration Committee- Management Committee

• ManagementCommitteeMeetingsareheldonaregularbasistoidentify,discussandresolvestrategic,operational,financial and key management issues.

• PoliciesandProceduresforkeyprocessesaredocumentedtoprovideguidancetoalllevelsofstaff.Thesepoliciesand procedures are reviewed and regularly updated when necessary.

• Whereappropriate,certaincompanieshavetheISOaccreditationfortheiroperationalprocesses.

statement on internal control(contd.)

Metacorp Berhad

26

KEY INTERNAL CONTROL PROCESSES (CONTD.)

• Comprehensivesystemsofoperationsandfinancial reporting to theBoardbasedonquarterly resultsandannualbudgets. In the event of variances, measures are followed up and subsequent actions proposed are taken.

• Provisionsofregularandcomprehensiveinformationtomanagementandemployees.

• Properguidelinesforhiringandterminationofstaff,andannualperformanceappraisalsystemareinplace.

• Traininganddevelopmentprogrammesareidentifiedandscheduledforemployeestoacquirethenecessaryknowledgeand competency to meet their performance and job expectations.

• AdequateinsurancesofthemajorassetsandresourcesoftheGroupareinplacetoensurethatthesearesufficientlycovered against any mishap that may result in material losses to the Group.

• Regularvisitstooperatingunitsbyseniormanagementandinternalauditors.

The Board is of the view that the system of internal control instituted throughout the Group is sound and effective. Notwithstanding this, reviews of all control procedures will be continuously carried out to ensure the ongoing effectiveness and adequacy of the system of internal control, so as to safeguard shareholders’ investment and the Group’s assets.

REVIEW OF THE STATEMENT BY EXTERNAL AUDITORS

The external auditors have reviewed this Statement on Internal Control for inclusion in the annual report for financial year ended 31 March 2008 and reported to the Board that no material issue has come to their attention that causes them to believe that the statement is inconsistent with their understanding of the process adopted by the Board in reviewing the adequacy and integrity of the system of internal control.

statement on internal control(contd.)

2008 annual report

27

group 5-year financial highlights

Metacorp Berhad

28

Dear valued shareholders,

On behalf of the board of Metacorp Berhad, I am pleased to present the 25th Annual Report

and Audited Financial Statements of the Group and the Company for financial year ended 31

March 2008 (FY08).

Para pemegang saham yang dihargai sekalian,

Bagi pihak lembaga pengarah Metacorp Bhd, saya dengan sukacita membentangkan Laporan Tahunan dan Penyata Kewangan Beraudit ke-25

Kumpulan dan Syarikat bagi tahun kewangan berakhir 31 Mac 2008 (TK08).

FINaNcIaL perFormaNce For the year under review, Metacorp reported a pre-tax profit of RM9.97 million (2007 : RM88.89 million) on revenue of RM56.42 million (2007 : RM78.97 million), representing a year-on-year decrease of 88.8% and 28.5% respectively. However, if the write back of provision for potential damages amounting to RM94.60 million were excluded from last year’s pre-tax profit, current year profit would reflect improvement in property development & investment and positive contribution from associates and jointly controlled entities. Also, following the disposal of the energy division last year, it has ceased to be a loss contributor to the Group. Earnings per share amounted to 0.7 sen for FY08 against 11.1 sen a year ago.

dIvIdeNdThe board has proposed a final dividend of 1 sen per share less 25.0% income tax (2007 : first & final dividend of 1 sen per share less 26.0% income tax). Together with an interim dividend of 1 sen less 26.0% income tax paid on 23 January 2008, total gross dividend for the year under review amounted to 2 sen per share (2007 : 1 sen per share).

propertY deveLopmeNt & INveStmeNtThe Property Development and Investment are the Company’s main revenue generators, boosted by operations in Malaysia and Australia. The two segments contributed RM19.08 million to bottomline for FY08 compared to RM17.57 million in the preceding year. During the year under review, Taman Tasik Utama (TTU) has launched three phases involving 54 units of single storey terrace with gross development value (GDV) of RM7.50 million, 46 units single storey semi-detached worth RM13.10 million and 29 units of retail outlet at GDV of RM7.80 million. The respective take up rates of 98.0%, 89.0% and 52.0% for the three phases reflect the continuing strong support from buyers in Melaka.

chairman’s statementpenyata pengerusi

Taman Tasik Utama (TTU) in Ayer Keroh, Melaka

2008 annual report

29

2008 annual report

DATO’ DR NIK HUSSAIN BIN ABDUL RAHMANChairman / Pengerusi

chairman’s statement (contd.)penyata pengerusi (samb.)

preStaSI KeWaNGaNBagi tahun yang ditinjau, Metacorp mencatat keuntungan sebelum cukai sebanyak RM9.97 juta (2007 : RM88.89 juta) daripada hasil sebanyak RM56.42 juta (2007 : RM78.97 juta), mewakili penurunan dari setahun ke setahun masing-masing sebanyak 88.8% dan 28.5%. Walau bagimanapun, jika kemasukan semula peruntukan bagi kerosakan potensi berjumlah RM94.60 juta tidak diambil kira daripada keuntungan sebelum cukai tahun lalu, keuntungan tahun semasa akan menunjukkan peningkatan dalam pembangunan & pelaburan hartanah dan sumbangan positif daripada syarikat-syarikat bersekutu serta entiti yang dikawal bersama. Penyumbang kerugian kepada Kumpulan juga kini tiada lagi berikutan pelupusan bahagian tenaga pada tahun lepas. Pendapatan sesaham bagi TK08 adalah sebanyak 0.7 sen berbanding 11.1 sen setahun lalu.

dIvIdeNLembaga pengarah telah mencadangkan satu dividen akhir sebanyak 1 sen sesaham tolak cukai pendapatan sebanyak 25.0% (2007 : dividen pertama & akhir sebanyak 1 sen sesaham tolak cukai pendapatan sebanyak 26.0%). Berserta dengan satu dividen interim sebanyak 1 sen tolak cukai pendapatan sebanyak 26.0% yang dibayar pada 23 Januari 2008, jumlah dividen kasar bagi tahun yang ditinjau adalah berjumlah 2 sen sesaham (2007 : 1 sen sesaham).

pemBaNGuNaN & peLaBuraN hartaNahPembangunan dan Pelaburan Hartanah adalah penjana hasil utama Syarikat yang didorong oleh operasi di Malaysia dan Australia. Kedua-dua segmen tersebut menyumbangkan RM19.08 juta kepada asas bagi TK08 berbanding RM17.57 juta pada tahun sebelumnya. Pada tahun yang ditinjau, Taman Tasik Utama (TTU) telah melancarkan tiga fasa yang meliputi 54 unit rumah teres setingkat dengan nilai pembangunan kasar (GDV) sebanyak RM7.50 juta, 46 unit rumah berkembar setingkat bernilai RM13.10 juta dan 29 unit lot kedai dengan GDV sebanyak RM7.80 juta. Kadar pengambilan bagi ketiga-tiga fasa tersebut yang masing-masing sebanyak 98.0%, 89.0% dan 52.0% menggambarkan sokongan kukuh yang berterusan daripada para pembeli di Melaka.

Metacorp Berhad

30

chairman’s statement (contd.)penyata pengerusi (samb.)

The Company is also pleased that TTU has continued to serve Universiti Teknikal Malaysia Melaka (formerly known as Kolej Universiti Teknikal Kebangsaan Malaysia) as centre for higher education.

Taman Sutera in Kajang, in which the Company has 40.0% interest via Modal Ehsan Sdn Bhd, launched 300 units of low medium/medium cost apartment with a GDV of RM24.30 million and 207 units of double storey terrace with a GDV of RM59.50 million during the year, with take up rates of 53.0% and 65.0% respectively. Taman Sutera has been managed by a unit of Metacorp since 2007 to provide planning, sales and marketing services.

Following the strategic acquisition of a piece of land in Bangsar last year, Metacorp’s wholly owned unit, Wonderful Haven Sdn Bhd had on 18 September 2007 acquired 11 pieces of land in Bukit Damansara for RM66.00 million. The landbank, with a combined aggregate land size of 6.06 acres located at a prime and sought after residential area in Kuala Lumpur is in line with the Company’s business plan to expand its presence within the Klang Valley, focusing on high-end development.

The Company has also gained from the higher rental income from its investment property, Bangunan Shell, following a revision in rental rates agreed between Exclusive Skycity Sdn Bhd and Shell Malaysia Trading Sdn Bhd.

QuarrYING Our quarry business under Dimensi Timal Sdn Bhd, on the strength of its monthly production of between 200-300 cubic metres, is one of the largest dimension stone quarries in Malaysia. The export of the high quality commercial granite, Jeli Blunero is targeted for markets in Italy, China, Thailand and Indonesia. The unit continues to face stiff competition from China, which produces cheaper but lower quality granite. On the local market, our granite was selected to be used for the Vice Chancellor’s Office, Universiti Putra Malaysia, Serdang, Malaysia Institute for Road and Safety in Kajang, Business Residence FELDA Terengganu, Hotel Seri Malaysia, Kepala Batas and the Madge Condominium, Kuala Lumpur. We are also proud of the extensive use of our granite in the new MTD HQ Building, Batu Caves and in TTU, Melaka.

SOLID WASTE MANAGEMENT The Company’s joint venture unit, E-Idaman Sdn Bhd has yet to start its operations of solid waste collection and cleansing management in the Northern Region pending finalisation of tariff and concession agreement covering the 1 year interim and 22 years full privatisation by the Ministry of Housing and Local Government. The Company hopes the concession agreement will be formalised by end of this year and E-Idaman Sdn. Bhd to commence interim operation early next year. This division is expected to provide a steady income stream to the Company for the next 22 years.

The Shell Building, Damansara Heights, KL MTD New HQ, KL

2008 annual report

31

chairman’s statement (contd.)penyata pengerusi (samb.)

Syarikat turut sukacita dengan TTU yang terus menyediakan khidmat kepada Universiti Teknikal Malaysia Melaka (dahulu dikenali sebagai Kolej Universiti Teknikal Kebangsaan Malaysia) sebagai pusat pengajian tinggi.

Taman Sutera, Kajang di mana Syarikat mempunyai kepentingan sebanyak 40.0% melalui Modal Ehsan Sdn Bhd, telah melancarkan 300 unit pangsapuri kos sederhana rendah/sederhana dengan GDV sebanyak RM24.30 juta dan 207 unit rumah teres dua tingkat dengan GDV sebanyak RM59.50 juta pada tahun ini. Kadar pengambilan bagi kedua-dua pembangunan tersebut, masing-masing adalah sebanyak 53.0% dan 65.0%. Taman Sutera telah diuruskan oleh sebuah unit dalam Metacorp sejak tahun 2007 untuk menyediakan perkhidmatan perancangan, penjualan dan pemasaran.

Berikutan pembelian strategik sebidang tanah di Bangsar pada tahun lepas, unit milik penuh Metacorp iaitu Wonderful Haven Sdn Bhd, telah membeli 11 bidang tanah di Bukit Damansara pada 18 September 2007 dengan kos berjumlah RM66.00 juta. Dengan gabungan saiz tanah agregat seluas 6.06 ekar yang terletak di kawasan bertaraf perdana dan berpermintaan tinggi di Kuala Lumpur, jumlah tanah simpanan kini adalah sejajar dengan rancangan perniagaan Syarikat untuk meluaskan liputannya di Lembah Klang dengan memfokus kepada pembangunan hartanah bernilai tinggi.

Syarikat juga telah mendapat keuntungan daripada pendapatan sewa yang lebih tinggi daripada hartanah pelaburannya iaitu Bangunan Shell, berikutan satu semakan semula kadar sewaaan yang dipersetujui antara Exclusive Skycity Sdn Bhd dan Shell Malaysia Trading Sdn Bhd.

peNGKuarIaNBerdasar kekukuhan pengeluaran bulanannya sebanyak antara 200-300 meter padu, perniagaan kuari syarikat di bawah Dimensi Timal Sdn Bhd adalah antara kuari batu terbesar di Malaysia. Eksport granit komersial berkualiti tinggi dikenali sebagai Jeli Blunero disasarkan untuk pasaran di Itali, China, Thailand dan Indonesia. Unit tersebut terus menghadapi persaingan sengit daripada China yang mengeluarkan granit yang lebih murah tetapi dengan kualiti yang lebih rendah. Di pasaran tempatan pula, granit kita telah dipilih untuk digunakan bagi Pejabat Naib Canselor, Universiti Putra Malaysia, Serdang, Institut Keselamatan dan Jalan Raya Malaysia di Kajang, Business Residence FELDA di Terengganu, Hotel Seri Malaysia, Kepala Batas dan Madge Condominium, Kuala Lumpur. Kita turut berasa bangga dengan penggunaan granit kita secara meluas di Bangunan Ibu Pejabat MTD yang baru di Batu Caves dan di TTU, Melaka.

peNGuruSaN SISa pepejaLUnit usahasama Syarikat, E-Idaman Sdn Bhd, masih belum memulakan operasi pengutipan dan pengurusan pembersihan sisa pepejal di Wilayah Utara kerana masih menunggu proses akhir perjanjian tarif dan konsesi yang meliputi 1 tahun interim dan 22 tahun penswastaan oleh Kementerian Perumahan dan Kerajaan Tempatan. Syarikat tersebut berharap perjanjian konsesi ini akan dapat diselesaikan menjelang akhir tahun ini agar E-Idaman Sdn Bhd dapat memulakan operasi interimnya pada awal tahun depan. Bahagian ini dijangka menyediakan aliran pendapatan yang stabil kepada Syarikat untuk jangkamasa 22 tahun akan datang.

Taman Sutera Kajang Apartment

Universiti Teknikal Malaysia Melaka in TTU, Ayer Keroh, Melaka

Metacorp Berhad

32

overSeaS veNtureSThe Company’s overseas ventures are now in different stages, which we believe will yield long-term benefits to the Group’s earnings.

On 13 July 2007, PT Cigading International Bulk Terminal (CIBT) secured the exclusive rights from PT Krakatau Bandar Samudera to develop, run and operate the coal terminal for the loading, stacking and discharging for export of coal at the Cigading Port, Indonesia for a period of 32 years. CIBT is 95% owned by Sinomast Metacorp (Labuan) Ltd, which in turn is a 50:50 joint venture between Metacorp and PT Bintang Sinomast Ltd of Hong Kong. In June 2008, CIBT held the groundbreaking ceremony for the coal terminal with the intention to start the first phase development soon and to complete it in two years. The first phase will have a handling capacity of 10.0 million tonnes. The availability of the coal terminal will ensure coal exporters of supply as well as provide warehousing facilities.

On 6 February 2008, Metacorp completed the acquisition of 75.0% interest in Wincon Development Ceylon (Private) Ltd (WDC) from Pembinaan Wincon Sdn Bhd for USD2.93 million. WDC has a Tripartite Agreement with the Board of Investment and Ministry of Public Administration, Management & Reforms of Sri Lanka to build housing for public sector employees, of which the construction of the Pilot Project in Galle has already started.

Our Australian joint venture unit, Withsundays Hermitage successfully completed the Blue Horizon Resort in Airlie Beach, Queensland in October 2007. In Melbourne, Metacorp Australia further acquired two pieces of land. Presently, the unit has three pieces of land with total land area of 3,271 square meters acquired for a total of AUD12.1 million. Our first small development in Melbourne involving two semi-detached units at Morris Street were successfully completed and sold in October 2007 for AUD1.6 million. The bigger development at Wreckyn Street with a gross development value of AUD20.9 million has to-date sold over 50% of the apartments. On 7 May 2008, Metacorp announced that the Group had terminated the joint venture with Saigon Jewelry Company (SJC) of Vietnam due to non-fulfillment of certain conditions regarding the development terms by SJC.

chairman’s statement (contd.)penyata pengerusi (samb.)

The Housing for Public Sector Pilot Project in Galle, Sri LankaGroundbreaking ceremony of CIBT Coal Terminal in Cilegon, Indonesia

2008 annual report

33

peNeroKaaN perNIaGaaN Luar NeGaraPerniagaan luar negara Syarikat kini berada di tahap baru di mana kita percaya akan mendatangkan manfaat jangka panjang kepada pendapatan Kumpulan.

Pada 13 Julai 2007, PT Cigading International Bulk Terminal (CIBT) telah mendapatkan hak eksklusif daripada PT Krakatau Bandar Samudera untuk membangun dan menyediakan khidmat sokongan, tenaga kerja, operasi dan logistik dalam mengendalikan eksport arang batu di terminal Pelabuhan Cigading, Cilegon, Banten, Indonesia untuk tempoh 32 tahun. CIBT yang merupakan sebuah unit pegangan 95.0% Sinomast Metacorp (Labuan) Ltd, adalah usahasama 50:50 antara Metacorp dan PT. Bintang Sinomast Ltd Hong Kong. Pada 27 Jun 2008, CIBT telah mengadakan majlis pecah tanah terminal batu arang dan sekaligus menandakan bermulanya pembangunan fasa pertama dalam masa terdekat ini. Apabila siapnya pembangunan fasa tersebut dalam masa dua tahun akan datang, ianya dijangka mempunyai kapasiti pengendalian sebanyak 10.0 juta tan metrik. Dengan adanya terminal arang batu ini akan memastikan bekalan arang batu untuk dieksport adalah mencukupi selain menyediakan kemudahan pergudangan.

Pada 6 Februari 2008, Metacorp telah menyelesaikan pengambilalihan 75.0% kepentingan dalam Wincon Development Ceylon (Private) Ltd (WDC) daripada Pembinaan Wincon Sdn Bhd dengan harga USD2.93 juta. WDC mempunyai Perjanjian Tiga Hala dengan Lembaga Pelaburan dan Kementerian Pentadbiran, Pengurusan & Pemulihan dan Perumahan Awam Sri Lanka untuk membina perumahan bagi kakitangan sektor awam di mana pembinaan bagi Projek Perintisnya telah pun dimulakan di Galle.

Unit usahasama kita di Australia iaitu Withsundays Hermitage telah berjaya menyiapkan Blue Horizon Resort di Airlie Beach, Queensland pada bulan Oktober 2007. Sementara itu, dua bidang tanah lagi telah dibeli di Melboyrne oleh Metacorp Australia. Kini, unit tersebut mempunyai tiga bidang tanah dengan jumlah keluasan 3,271 meter persegi yang dibeli dengan kos berjumlah AUD12.1 juta. Pembangunan kecil pertama kita di Melbourne melibatkan dua buah unit rumah berkembar di Morris Street yang berjaya disiapkan dan dijual pada bulan Oktober 2007 dengan harga AUD1.6 juta. Pembangunan yang lebih besar di Wreckyn Street dengan nilai pembangunan kasar sebanyak AUD20.9 juta pula, hingga kini, telah berjaya menjual sebanyak lebih 50% daripada pangsapurinya.

Pada 7 May 2008, Metacorp mengumumkan bahawa Kumpulan telah menamatkan usahasama dengan Saigon Jewelry Company (SJC), Vietnam disebabkan oleh pelanggaran syarat-syarat tertentu dalam terma pembangunan oleh SJC.

chairman’s statement (contd.)penyata pengerusi (samb.)

Airlie Beach Resort, Queensland (left) and Wreckyn Street, Melbourne (right)

Metacorp Berhad

34

corporate deveLopmeNtOn 26 February 2008, the Company has received a letter from its holding company, MTD Capital Bhd on a privatisation offer via a selective capital repayment to all other shareholders of Metacorp. Shareholders will receive a capital repayment of 50 sen per share held in Metacorp as well as one share in MTD ACPI Engineering Berhad for every 20 Metacorp shares.

On 10 April 2008, the independent directors of Metacorp have deliberated on the proposal and have decided to accept MTD’s request for Metacorp. Pending regulatory and shareholders’ approvals, the proposed exercise is expected to be completed by fourth quarter of 2008.

proSpectS The operating environment is becoming increasingly challenging and tough due to rising prices of steel, concrete, cement and diesel. The Government has also lifted the ceiling prices of certain steel and cement products for further liberalisation in those industries.

The property market is expected to moderate as consumers turn cautious amidst inflationary pressure led by rising food and energy prices. In addition, financing will be stricter as banks implement tougher measures to manage risks. Nonetheless, the Government’s incentives for the property market would still encourage buying interest especially for the medium to high-end development projects.

As a reputable developer with a proven track record, the Company can leverage on its expertise to control costs better while optimising sales by offering affordable and value-for-money to prospective home-buyers. The Company is mindful that rising operating costs will add more pressure on the margins and will strive to mitigate the impact by taking strategic positions in materials procurement.

Despite the challenging and tough environment, the Group’s flagship, TTU will continue to stay focus on its core business, which is to launch and deliver more quality, innovative and reliable designed products in a timely manner. TTU expects brisk sales of 70 units of double storey superlink, 76 units of single storey terrace and 116 units of shoplots and corporate suites, which have a combined GDV of RM41.30 million.

The Company’s first high-end residential project by Landview Towers Sdn Bhd, involving five units of four storey detached house at the well established residential area of Bangsar, will begin construction late of this year. We expect the RM30.0 million project to generate positive interest from investors due to their potential appreciation value.

chairman’s statement (contd.)penyata pengerusi (samb.)

2008 annual report

35

perKemBaNGaN KorporatPada 26 Februari 2008, Lembaga Pengarah telah menerima surat daripada syarikat pegangannya, MTD Capital Bhd berhubung tawaran penswastaan melalui pembayaran balik modal secara selektif kepada semua pemegang saham Metacorp yang lain. Para pemegang saham tersebut akan menerima pembayaran balik modal sebanyak 50 sen bagi setiap saham yang dipegang dalam Metacorp serta satu saham dalam MTD ACPI Engineering Berhad bagi setiap 20 saham Metacorp.

Pada 10 April 2008, para pengarah bebas Metacorp telah berbincang berkenaan cadangan tersebut dan mengambil keputusan untuk menerima permintaan MTD terhadap Metacorp. Tertakluk kepada kelulusan pihak penguatkuasa peraturan dan para pemegang saham, cadangan pelaksanaan tersebut dijangka akan selesai menjelang suku tahun keempat 2008.

proSpeKPersekitaran operasi kini semakin mencabar dan sukar disebabkan oleh kenaikan harga besi, konkrit, simen dan diesel. Kerajaan juga telah memansuhkan harga siling bagi jenis-jenis besi dan produk simen tertentu untuk meliberalisasikan lagi industri tersebut.

Pasaran hartanah dijangka akan menjadi lebih sederhana kerana pengguna akan bersikap lebih berhati-hati dalam suasana tekanan inflasi yang disebabkan oleh kenaikan harga makanan dan tenaga. Selain itu, pembiayaan akan menjadi lebih sukar berikutan pelaksanaan langkah yang lebih ketat oleh bank-bank untuk menguruskan risiko. Walau bagaimanapun, insentif yang diberikan oleh Kerajaan bagi pasaran hartanah akan dapat menggalakkan minat pembeli hartanah khususnya bagi projek-projek pembangunan kos sederhana dan mewah.