CBRE Kuala Lumpur Retail MV 2010 Q2

-

Upload

juzaili-js -

Category

Documents

-

view

221 -

download

0

Transcript of CBRE Kuala Lumpur Retail MV 2010 Q2

8/12/2019 CBRE Kuala Lumpur Retail MV 2010 Q2

http://slidepdf.com/reader/full/cbre-kuala-lumpur-retail-mv-2010-q2 1/4© 2010, CB Richard Ellis, Inc.

Kuala Lumpur RetailSecond Quarter 2010 www.cbre.com.my

CB RICHARD ELLIS

The current sentiment in the retailmarket is positive. As of end-2Q 2010,

both the Malaysian Institute of Economic

Research (MIER)’s Consumer Sentiment

Index (CSI) and Business Conditions

Index (BCI) remained above their long-

term thresholds at 110.4 and 119.6,

respectively. Despite the government’s

stated plans to slowly cut back on

subsidies for food and oil, but MIER

projects overall consumer price inflation

to grow by 2.2% in 2010, which is well

within the preferred range.

During the period, the overall vacancy

rate at prime shopping centres within the

Klang Valley was 6%, while those for

prime centres in the city-centre were

slightly higher, at just under 10%.

2010 is a review year for a number of

significant mega-malls, including Suria

KLCC, KL Pavilion, Gardens, Mid-Valley,

Sunway Pyramid and AEON Bukit Tinggi.

During Q2 2010, we saw prime rents in

some leading shopping centres begin to

increase, with reports that prime rents in

Suria KLCC and Mid-Valley have already

risen by 10-30% in some cases. We are

now seeing an increase in retailer

demand, which was almost zero in 2009.

Many retailers have specific allocations

for multiple new outlets this year.

New launches during the quarter included Empire Gallery and Jusco

Mahkota Cheras, both of which opened

in April 2010, with a combined net

lettable area (NLA) of 500,000 square

feet. As many as seven new malls,

namely 1 Shamelin, One Mont' Kiara,

CITTA, SS2 Mall, Subang Avenue,

Space U8 and First Subang are

expected to be completed during the

remainder of 2010, accounting for well

over two million square feet of NLA. Thisfigure excludes Viva Mall and Fahrenheit

88, which are also expected to open this

year after undergoing repositioning, and

Kenanga Wholesale City, a strata-title

development targeting wholesalers.

Notable transactions during the quarter include the signing of Parkson (122,000

square feet), MBO Cinemas (26,000 square

feet), and Superstar Karaoke (11,000

square feet) at KL Festival City. CBRE was

involved in all three transactions, along with

the placement of a number of F&B options

at CITTA.

The most significant acquisition activity

during Q2 2010 involved the two-recently

launched REITs, Sunway Real Estate

Investment Trust (SunREIT) and

CapitaMalls Malaysia Trust (CMMT).

CapitaMalls Asia is the sponsor of CMMT,

which will be the largest "pure-play" retail

REIT in Malaysia, with a net asset value of

RM 2.13 billion. The REIT has a total of

1.35 billion units, of which 787 million units

(58%) were offered to institutional investors

in Malaysia and overseas, and to retail

investors in Malaysia only. Cornerstone

investors for this REIT include the

Employees Provident Fund (EPF) and

Great Eastern Life Assurance (M) Bhd. The

REIT’s portfolio comprises Gurney Plaza in

Penang, a 62% interest in Sungei Wang

Plaza in Kuala Lumpur, and The Mines in

Selangor, a total net lettable area of around

1.88 million square feet.

SunREIT, with a total net asset value of RM

3.79 billion, is comprised of eight properties,

of which three, namely Sunway Pyramid

Shopping Mall, Sunway Carnival ShoppingMall and Suncity Ipoh Hypermarket, are

retail properties. These three retail

properties account for 67% of SunREIT’s

net property income and also 67% of the

portfolio’s combined gross floor area (GFA)

and were assigned a purchase

consideration of RM 2.6 billion. The REIT’s

cornerstone investors include the

Government of Singapore Investment

Corporation (GIC), Employees Provident

Fund (EPF), Permodalan Nasional Bhd(PNB) and Great Eastern Life Assurance

(M) Bhd.

Quarterly News

• A significant announcement

during the quarter was the

fact that Japan's Fast

Retailing Co, the operator of Uniqlo casual wear shops,

has set up a joint venture

with a unit of DNP Holdings

(DPBM.KL) to open stores

in Malaysia. Reports

indicate that Uniqlo outletswill be situated in Suria

KLCC and Fahrenheit 88,formerly KL Plaza.

• Also significant is the news

that Carrefour, the world’s

second-largest retailer, may

exit from Malaysia, Thailandand Singapore. In Malaysia,

the big-box retailer has 23

stores, worth an estimated

RM 1.5 billion, which are

now the subject of muchspeculation, with local and

foreign retailers showinginterest. Carrefour has so

far refused to comment on

the matter.

Change From

1Q 2010 2Q 2009

Supply

Prime Rents

Occupancy

*The arrows are trend indicators overthe speci fied t ime period and do notrepresent a positive or negative value.(e.g., absorption could be negative,but still represent a positive trend overa specified period.)

Quick Stats

8/12/2019 CBRE Kuala Lumpur Retail MV 2010 Q2

http://slidepdf.com/reader/full/cbre-kuala-lumpur-retail-mv-2010-q2 2/4

M ar k et Vi ewK u al aL um p ur R et ai l

S e c on d Q u ar t er 2 0 1 0

© 2010, CB Richard Ellis, Inc.

Page 2

The total supply of retail space in the Klang Valley as of

end-2Q 2010 was 41.2 million square feet, up 3% over

end-2009 supply. We expect as many as 9-10 malls,

totaling over three million square feet of net lettable

area, to be completed during the second half of this

year.

Malls currently undergoing repositioning and

refurbishment include Fahrenheit 88 (formerly KL

Plaza) and Viva Mall (formerly Ue3).

Occupancy Rates

Total Supply

Rental Index

Rents rose slightly during 2Q 2010, as evidenced by our

prime retail rental index, which follows the prime rental

rates at selected shopping centres in the Kuala Lumpur city centre.

The base year for the index was in 1995, and over the

following decade, rents rose 64%. A sharp spike in prime

rents was seen in 2007, when prime rents rose over 20%

on average. This is partly due to 2007 being a review

year for a number of major shopping centres.

2010 is a review year for Suria KLCC, KL Pavilion,

Gardens, Mid-Valley and Sunway Pyramid, and we have

already received reports of rent increases of 10-30% for

some units.

0

10

20

30

40

50

'05 '06 '07 '08 '09 2Q '10 '10e '11e '12e '13e

T o t a l N L A ( m i l l i o n s f )

Cumulative Supply of Shopping Centres in the Klang Valley

2005 - 2013e)

Average Occ upancy R ates of Selected Major Shopping Centres

60%

70%

80%

90%

100%

2005 2006 2007 2008 2009 1Q 2010 2Q 2010

O c c u p a n c y R a t e ( % )

Kuala Lumpur city centre

S uburbs

Klang Valley

Prime Retail Rental Index

0

50

100

150

200

250

300

2 0 0 5

2 0 0 6

2 0 0 7

2 0 0 8

Q 1 2 0 0 9

Q 2 2 0 0 9

Q 3 2 0 0 9

Q 4 2 0 0 9

Q 1 2 0 1 0

Q 2 2 0 1 0

R e n t a l I n d e x

The average occupancy rate of selected shopping

centres (both prime and non-prime) in the Klang Valley

was estimated at 92% as of end-2Q 2010. The

occupancy rate for selected shopping centres in the

Kuala Lumpur city centre was just under 90%.

Occupancy rates have improved slightly during the first

half of 2010. Although we believe that there is an

oversupply situation in the Klang Valley overall, average

occupancy in general is high and some centres even

have a waiting list. This is because in the poorer

centres, rents are low, and upper floors or remotespaces in these centres are leased to trades that do not

require high traffic.

Source: CBRE Research

Source: CBRE Research

Source: CBRE Research

8/12/2019 CBRE Kuala Lumpur Retail MV 2010 Q2

http://slidepdf.com/reader/full/cbre-kuala-lumpur-retail-mv-2010-q2 3/4

M ar k et Vi ewK u al aL um p ur R et ai l

S e c on d Q u ar t er 2 0 1 0

© 2010, CB Richard Ellis, Inc.

Page 3

Our research shows that Malaysians, on average,

spend almost 16% of their gross income on retail

spending, compared to 17-18% for their counterparts

in Hong Kong and Singapore, and around 14% for

those in Thailand and the Philippines.

This suggests that there may be some truth to the

old adage about the favorite hobbies of Malaysians

being eating and shopping.

Based on CBRE Research’s How Global is the

Business of Retail? 2010 report, Kuala Lumpur is the

seventh most global retail city in Asia.

The percentages in the chart refer to the percentage

of 268 most global retailers chosen by CBRE who are

present in each city.

For a full copy of How Global is the Business of

Retail? 2010, please contact us.

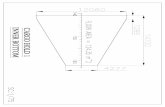

New Supply During H1 2010

Retail Sales & GDP

Global Retail Cities in Asia

New S upply of S hopping Malls dur ing 1H 2010

Kuala Lumpur

45.6%

S uburban

54.4%

Retail Sales as a % of GDP

15.7

17.6 18.0

13.7 14.3

0

5

10

15

20

Malaysia Singapore Hong Kong Thailand Phi lippines

%

Source: Business Monitor International, Mastercard, CIA World Factbook,

CBRE Research

Most Global Retail C ities in Asia

43 41 40 40 3936

3230

28 28

0

10

20

30

40

50

H o n g

K o n g

B e i j i n g

T o k y o

S h a n g h a i

S i n g a p o r e

T a i p e i

K u a l a

L u m p u r

B a n g k o k

S h e n z e n

S e o u l

%

Source: CBRE Research, How Global is the Business of Retail? 2010

New supply of retail space during the first half of

2010, equal to about 1 million square feet, was

almost equally divided between Kuala Lumpur and

suburban areas.

We expect this trend to hold for the remainder of the

year, as 46% of projected supply for H2 2010 is in

Kuala Lumpur, with the remainder in suburbanareas. These calculations include malls under

refurbishment as well.

Source: CBRE Research

8/12/2019 CBRE Kuala Lumpur Retail MV 2010 Q2

http://slidepdf.com/reader/full/cbre-kuala-lumpur-retail-mv-2010-q2 4/4

MarketView Kuala Lumpur Retail

© Copyright 2010 CB Richard Ellis (CBRE) Statistics contained herein may represent a differentdata set than that used to generate National Vacancy and Availability Index statistics publishedby CB Richard Ellis’ Corporate Communications Department or CB Richard Ellis’ research andEconometric Forecasting unit, Torto Wheaton Research. Information herein has been obtainedfrom sources believed reliable. While we do not doubt its accuracy, we have not verified it andmake no guarantee, warranty or representation about it. It is your responsibility to independentlyconfirm its accuracy and completeness. Any projections, opinions, assumptions or estimates usedare for example only and do not represent the current or future performance of the market. Thisinformation is designed exclusively for use by CB Richard Ellis clients, and cannot be reproducedwithout prior written permission of CB Richard Ellis.

For more information regarding

the MarketView, please contact

Nabeel HussainVice President, Research

CB Richard Ellis (Malaysia) Sdn Bhd

#9-1, Level 9 Menara MileniumJalan Damanlela

Bukit Damansara, Kuala Lumpur

50490 Malaysia

T 603 2092 5955 (Ext. 167)

F 603 2092 5966

Retail Services

Allan SooManaging Director

CB Richard Ellis (Malaysia) Sdn Bhd

#9-1, Level 9 Menara Milenium

Jalan DamanlelaBukit Damansara, Kuala Lumpur

50490 Malaysia

T 603 2092 5955 (Ext. 111)F 603 2092 5966

Retail Services

Outlook

The market is now much healthier than 2008-2009 and leasing has become more

positive and conversion rate faster. However, there is a significant amount of

supply coming in over the next year, and so some malls will continue to struggle.

Currently retailers are choosy about locations and are bargaining for rental

concessions and because there is so much choice, the winning factors are

predominantly safe bets like established centres (even if rents are high) and

obvious strong catchments.

The market is beginning to segment into well defined niche markets and

submarkets like the Bangsar/ Mont Kiara areas, the Subang areas and the PJ

areas. The battles that will be fought in the future will be localized and the winners

will be those with the superior locations, mix and concepts.

2010 will be significant in terms of another threshold, however. This is the year of

the rent reviews as Suria KLCC, Pavilion, MidValley, Gardens, Sunway Pyramid 2

and AEON Bukit Tinggi all undergo rent reviews. Suria KLCC prime rents have

surpassed RM 100 per square foot and it will be interesting to see the change in

the tenant mix as some under-performers exit this location.

As part of the world’s largest commercial property services group, CBRE Malaysia

focuses on developing new markets for international and domestic retail chainsand on providing creative end-to-end solutions for retail centre development,

leasing and marketing.

We advise tenants on leasing retail premises in Malaysia and we help them find

the retail spaces most suited to their needs. We also give advice on lease terms

and conditions as well as representing retail tenants on renewals and lease

restructuring.

Our services for landlords include development consultancy, marketing

consultancy, leasing agency, reporting and property management. CB RichardEllis has the resources, knowledge and experience required to enable landlords to

achieve success.

CBRE retail services professionals are able to meet both occupier/tenant and

owner/investor needs. These professionals, with a wealth of local market

knowledge, are supported by market research tools to ensure clients make

strategic and informed decisions.

(333510P) (VE(1)0232)