Malaysia Market Focus Malaysia Monthly Strategy › aics › pdfController.page?pdfpath=... ·...

Transcript of Malaysia Market Focus Malaysia Monthly Strategy › aics › pdfController.page?pdfpath=... ·...

ASIAN INSIGHTS VICKERS SECURITIES ed: CK / sa:WMT, PY

KLCI : 1,758.67 Analyst Bernard CHING +603 2604 3918 [email protected] Malaysian Research Team +603 2604 3333 [email protected]

Market Key Data

(%) EPS Gth Div Yield

2016 4.3 3.1

2017F 7.8 3.3

2018F 9.1 3.3

(x) PE PB

2016 17.8 1.8

2017F 16.5 1.7

2018F 15.1 1.6 Source: Bloomberg Finance L.P.

STOCKS

12-mth

Price Mkt Cap Target Price Performance (%)

RM US$m RM 3 mth 12 mth Rating

Maybank 9.20 21,641 10.00 13.2 4.8 BUY Genting Berhad 9.82 8,454 10.60 19.0 14.3 BUY Gamuda 5.28 2,960 6.30 8.2 13.6 BUY BIMB Holdings Berhad

4.48 1,695 5.00 5.4 14.3 BUY

Sunway Construction Group

2.00 597 2.13 17.7 25.0 BUY

VS Industry 1.99 545 2.35 32.7 64.5 BUY SKP Resources Bhd 1.26 353 1.60 (4.6) (3.8) BUY Globetronics Technology Bhd

5.43 355 6.35 28.7 67.6 BUY OldTown Berhad 2.66 279 3.05 39.3 83.5 BUY Yong Tai Bhd 1.54 155 2.10 20.3 77.0 BUY

Source: DBS Bank, AllianceDBS, Bloomberg Finance L.P.

Closing price as of 4 May 2017

DBS Group Research . Equity

5 May 2017

Malaysia Market Focus

Malaysia Monthly Strategy

Refer to important disclosures at the end of this report\

Don’t count the chips yet

Foreign net equity inflow continued to boost the

equity market while selldown of government

bonds was well absorbed

Fundamentals improving with stronger external

demand and rebound in earnings

Raise end-2017 KLCI target to 1,800; Buy on dips

Top picks: MAY, GENT, GAM, BIMB, SCGB, VSI,

SKP, GTB, OTB and YTB

Strong net inflows continued to boost equities. Buying interest of foreign institutional investors remained strong with net inflow of RM2.7bn in Apr, which represents the fourth consecutive month of net inflow.

Bond outflows well absorbed. In contrast, foreign holdings of government’s debt have been on a downtrend since the central bank introduced measures to curb speculative activities on the MYR via the non-deliverable forward (NDF) market in Nov 2016. But this was well absorbed given ample domestic liquidity. MGS yields have in fact compressed amid the selldown while MYR has gained 3.7% YTD.

Fundamentals improving. Positive GDP growth momentum which started in 3Q16 may be sustained in the near term due to strong external demand despite persistent weak consumer sentiment and consumption. The rebound in GDP growth trajectory coincides with the bottoming of corporate earnings downcycle. With steadier commodity prices, firmer external demand and low base effect from kitchen-sinking exercises in 2016 for the banking and oil & gas sectors, we expect FBMKLCI earnings growth of 7.8% in FY17 vs 4.3% in FY16.

Buy on dips as market uptrend likely to be sustained. Despite richer market valuations, concerns over geopolitical risks and impact of China’s capital controls on Chinese-led infrastructure projects in Malaysia, we believe the market uptrend will remain intact as long as the corporate earnings growth trajectory stays in positive territory. We raise our end-2017 FBMKLCI target from 1,750 to 1,800 which is derived using bottom-up valuation approach.

Top stock picks. We prefer cyclical to defensive stocks and favour those with clear earnings growth catalysts. Our big-cap picks are Maybank (MAY), Genting (GENT), and Gamuda (GAM) while our small-mid cap picks are BIMB, Sunway Construction (SCGB), VS Industry (VSI), SKP Resources (SKP), Globetronics (GTB), Oldtown (OTB) and Yong Tai (YTB).

Top sells are BAT, FGV, DIGI and MAXIS given their stretched

valuations and poor earnings outlook.

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 2

Market Review

The FBMKLCI continued its good run from 1Q17 with a 1.6%

gain in April, its fifth consecutive monthly gain. While the YTD

gain of 7.7% for the benchmark index was decent, small-mid

cap stocks continued to steal the limelight as the FBM Small

Cap Index gained 3.4% in Apr which brings its YTD gain to a

staggering 21.2%. Buying interest of foreign institutional

investors remained strong with net inflow of RM2.7bn

registered during the month.

Equity fund flow

Source: Bursa Malaysia

In contrast, foreign holdings of government’s debt, which

includes Malaysian Government Securities (MGS), have been

on a downtrend since the central bank introduced measures to

curb speculative activities on the MYR via the non-deliverable

forward (NDF) market in Nov 2016. Since then, foreign

investors have cited lack of liquidity in the NDF market to

hedge their currency risk as reason for the unwinding of their

Malaysian bond holdings. In the central bank’s latest data

release, foreign holdings of government’s debt have decreased

by RM27.5bn in Mar 2017. Despite the unwinding activities,

MGS yields for 3, 5 and 10-year tenures have been steady with

-34bps, -14bps and -42bps change since end-Oct 2015. This

suggests that the selldown of government bonds by foreign

investors has been well absorbed given ample domestic

liquidity.

Monthly change in foreign holdings of government debt

Source: Bank Negara

MGS yields

Source: Bloomberg Finance L.P

On the currency front, the MYR has also stabilised somewhat

with a YTD gain of 3.7% against the USD despite the heavy

selldown of government bonds by foreign investors. The

weakening of the USD, as evidenced by a YTD 3.3% drop in

the dollar index, has given much reprieve to the MYR. The

improvement in the MYR outlook could also stem from the

central bank’s foreign exchange rule introduced in Dec 2016

which requires resident exporters to repatriate and convert at

least 75% of foreign currency proceeds into MYR with a

licensed onshore bank.

-0.9

0.5

6.1

0.5

-4.3

-1.8

1.01.7

-0.3 -0.4

-3.9

-1.0

0.51.0

4.4

2.7

1.2

-0.4

-5.5

-0.6

3.8

1.8

-0.7-1.6

0.6 0.9

3.8

0.90.1

-0.7

-3.4

-1.3

-8.0

-6.0

-4.0

-2.0

0.0

2.0

4.0

6.0

8.0

Jan

-16

Feb

-16

Mar

-16

Ap

r-1

6

May

-16

Jun

-16

Jul-

16

Au

g-1

6

Sep

-16

Oct

-16

No

v-1

6

De

c-1

6

Jan

-17

Feb

-17

Mar

-17

Ap

r-1

7Foreign Institutional Local InstitutionalInflow/(Outflow)

RM bn

-30

-25

-20

-15

-10

-5

0

5

10

15

Jan

-15

Mar

-15

May

-15

Jul-

15

Sep

-15

No

v-1

5

Jan

-16

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6

Jan

-17

Mar

-17

RM bn GII Treasury bills BNM bills MGS

2.0

2.5

3.0

3.5

4.0

4.5

5.0

Oct

-16

No

v-1

6

De

c-1

6

Jan

-17

Feb

-17

Mar

-17

Ap

r-1

7

% 10Y MGS 5Y MGS 3Y MGS

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 3

US Dollar index and USD/MYR exchange rate

Source: Bloomberg Finance L.P

Market Outlook

An improving exports outlook continues to be a bright spot for

the Malaysian economy. Nikkei Malaysia Manufacturing

Purchasing Managers’ Index (PMI) has turned positive in Apr

2017 with a reading of 50.7, the highest since Feb 2015. This

is also reflected by the 26.5% y-o-y surge in gross exports in

Feb 2017 amid broad base improvement in external demand.

While E&E continues to be bedrock of a resilient Malaysian

export performance, recent improvement in crude oil and

crude palm oil prices have also lent a much needed helping

hand in boosting overall exports. Against such a backdrop, the

positive GDP growth momentum which started in 3Q16 may

be sustained in the near term despite persistent weak

consumer sentiment and consumption. Investors would be

keenly monitoring the release of the 1Q17 GDP data on 19

May whereby consensus estimate of 4.0% growth looks

conservative when compared to 4.5% growth in 4Q16.

Malaysia PMI

Source: Markit

Malaysia exports growth

Source: Department of Statistics

MIER Consumer Sentiment Index and private consumption growth

Source: Department of Statistics, MIER

The rebound in GDP growth trajectory coincides with the

bottoming of corporate earnings downcycle. With steadier

commodity prices, firmer external demand and low base effect

from kitchen-sinking exercises in 2016 for the banking and oil

& gas sectors, we expect FBMKLCI earnings growth of 7.8% in

FY17 vs 4.3% in FY16.

KLCI earnings growth trend

Source: AllianceDBS

4.20

4.25

4.30

4.35

4.40

4.45

4.50

4.55

96

97

98

99

100

101

102

103

104

1-J

an

8-J

an

15

-Jan

22

-Jan

29

-Jan

5-F

eb

12

-Fe

b

19

-Fe

b

26

-Fe

b

5-M

ar

12

-Mar

19

-Mar

26

-Mar

2-A

pr

9-A

pr

16

-Ap

r

23

-Ap

r

30

-Ap

r

RM per USDUS Dollar Index (lhs) USDMYR (rhs)

46

47

48

49

50

51

52

53

54

55

Ap

r-1

4

Jun

-14

Au

g-1

4

Oct

-14

De

c-14

Feb

-15

Ap

r-1

5

Jun

-15

Au

g-1

5

Oct

-15

De

c-15

Feb

-16

Ap

r-1

6

Jun

-16

Au

g-1

6

Oct

-16

De

c-16

Feb

-17

Ap

r-1

7

-50

-40

-30

-20

-10

0

10

20

30

40

50

-50

-40

-30

-20

-10

0

10

20

30

40

50

Jan

-13

May

-13

Sep

-13

Jan

-14

May

-14

Sep

-14

Jan

-15

May

-15

Sep

-15

Jan

-16

May

-16

Sep

-16

Jan

-17

% y-o-y% y-o-yE&E O&G Exports growth

50

60

70

80

90

100

110

120

130

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

1Q

11

3Q

11

1Q

12

3Q

12

1Q

13

3Q

13

1Q

14

3Q

14

1Q

15

3Q

15

1Q

16

3Q

16

1Q

17

sa % q-o-q Private consumption growth (lhs)

Consumer sentiments index (rhs)

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

9.1%

4.3%

7.8%

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 4

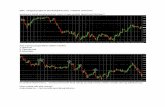

Amid a risk-on global investment climate, the recent rally in

Malaysian equities has raised FBMKLCI CY17 PE valuation to

16.5x which is at +1SD of its historical mean. Investors would

be wondering whether it is time to take some chips off the

table with the volatility index at a 10-year low, indicating a

high level of complacency. Newsflow on geopolitical risks

emanating from North Korea, France and the US could trigger

market pullbacks. Domestically, recent news flow on the

setback in developing the iconic Bandar Malaysia project will

dampen sentiment on the prospect of China-led infrastructure

projects in Malaysia which may also spill over to the broader

market. Nevertheless, we believe the market uptrend will

remain intact as long as the corporate earnings growth

trajectory stays in positive territory.

FBMKLCI PE trend

Source: Bloomberg Finance L.P, AllianceDBS

FBMKLCI forward EPS estimate

Source: Bloomberg Finance L.P

DJIA forward EPS estimate

Source: Bloomberg Finance L.P

VIX index

Source: Bloomberg Finance L.P,

We raise our end-2017 FBMKLCI target from 1,750 to 1,800

which is derived using bottom-up valuation approach. This

implies CY17 PE target of 16.9x. We continue to overweight

construction, gaming and utilities sectors while keeping

automotive, building materials and telecommunication sectors

at underweight.

For stock selection, we prefer cyclical to defensive stocks and

favour those with clear earnings growth catalysts. Our big-cap

picks are Maybank (replacing Public Bank which is more suited

for a risk-off trade), Genting, and Gamuda. We drop AMMB as

our target price has been achieved. For our small-mid cap

picks, we like BIMB, Sunway Construction, VS Industry, SKP

Resources, Oldtown, Globetronics (new) and Yong Tai (new).

Top sells are BAT, FGV, DIGI and MAXIS given their stretched

valuations and poor earnings outlook.

15.8x

16.6x

15.0x

12

13

14

15

16

17

18

19

Jan

-10

Ap

r-1

0Ju

l-1

0O

ct-1

0Ja

n-1

1A

pr-

11

Jul-

11

Oct

-11

Jan

-12

Ap

r-1

2Ju

l-1

2O

ct-1

2Ja

n-1

3A

pr-

13

Jul-

13

Oct

-13

Jan

-14

Ap

r-1

4Ju

l-1

4O

ct-1

4Ja

n-1

5A

pr-

15

Jul-

15

Oct

-15

Jan

-16

Ap

r-1

6Ju

l-1

6O

ct-1

6Ja

n-1

7A

pr-

17

P/E

95

100

105

110

115

120

2012 2013 2014 2015 2016 2017

EPS(sen)

950

1000

1050

1100

1150

1200

1250

2012 2013 2014 2015 2016 2017

EPS (cent)

0

10

20

30

40

50

60

70

80

90

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 5

Top Stock Picks

Maybank (TP: RM10.00) Gradual earnings improvement to be

expected this financial year. Apart from lower provisions, the

positive momentum in capital markets should aid earnings

growth. Its continued resilience for its consumer and SME

business should underpin growth. Spin-offs of its insurance

and Islamic banking units could unlock shareholder value if

these materialise. To top it off, although share price has risen,

Maybank remains a sweet dividend pick. Its dividend

reinvestment plan looks to be here to stay but the cash/share

options could be tweaked. Maybank currently carries the

higher capital ratios among peers. Maybank is also a key proxy

to ride this sentiment-driven rally among Malaysian large-cap

stocks.

Genting Bhd (TP: RM10.60) is expected to enjoy ongoing re-

rating in 2017, supported by progressive launches of key

developments in Genting Integrated Tourism Plan (GITP) and

expected earnings recovery in Genting Singapore (GENS),

which we believe will improve the growth prospects for the

group. Its valuation remains attractive when compared to

GENS and Genting Malaysia (GENM) after the recent price

appreciation of these subsidiaries. Being the parent company

of GENS and GENM, we believe that GENT offers a cheaper

exposure to both these subsidiaries.

Gamuda (TP: RM6.30) is the best transportation infrastructure

proxy play. Its current outstanding orderbook stands at

RM8.3bn, coming from MRT Line 2 tunnelling works and the

Pan Borneo Sarawak project. This does not include the 6%

PDP fees it will earn for the aboveground works for MRT Line

2. The company is confident of clinching another RM3-4bn

worth of new orders in the next one year, coming from largely

three projects, namely LRT 3, Pan Borneo Highway, and

Southern Double Tracking. The medium-term pipeline also

looks solid with MRT Line 3, HSR, ECRL and PTMP. While the

potential delay of Splash may be a near-term dampener, the

delay will ensure there will also be stronger earnings growth

this year.

BIMB (TP: RM5.00) has an arsenal of tools to lean on to

weather the current soft operating environment. The bank has

a niche in Islamic banking (which supports financing growth

momentum), high CASA ratio and liquid balance sheet (to

stave off NIM compression) as well as high financing loss

coverage (to buffer against potential deterioration in asset

quality). We believe the market is not assigning sufficient

premium to a franchise delivering ROEs of c.15% and better-

than-industry metrics.

Sunway Construction (TP: RM2.13) represents the best pure

construction proxy to the sector and also has a strong

execution track record. Its current outstanding orderbook

stands at RM4.9bn (including precast). The company is guiding

for RM2bn worth of new orders in FY17F which should come

from LRT 3, internal jobs and some other building jobs. It has

started 2017 strongly with YTD wins of RM0.9bn. Its strong

balance sheet will give it flexibility to raise its dividend payout

policy, take on PFI and bullet payment projects or even explore

overseas projects.

VS Industry’s (TP: RM2.35) growth is expected to be driven by

its largest client (with 30% of total revenue in FY16) – Client

D. We forecast strong growth from Client D due to

contributions from two box-build assembly orders for cordless

vacuum cleaners worth c.RM400m per job p.a. and another

two box-build assembly orders for corded vacuum cleaners

worth c.RM150m per job p.a. We have now included another

two prospective jobs for box-build assembly orders for a new

product worth c.RM400m per job p.a., which are expected to

progressively start operation from Oct 2017. Taking these

contracts into account, we forecast Client D’s revenue

contribution to grow at a CAGR of 58% in FY16-FY19F.

Beyond these contracts, we believe there is high potential for

further contract wins from Client D as it launches more

products.

SKP Resources (TP: RM1.60) has clinched a four-year contract

from Client D totalling RM2bn, or RM500m p.a. for the

manufacturing of hairdryers. However, SKPRES would be

foregoing the previous RM400m p.a. contract, for the

manufacturing of the V6 cordless vacuum cleaners. The move

is to optimise and shift the existing limited labour resources to

work on the higher-value product, following the government’s

decision to freeze the hiring of foreign labour in February

2016. Given its longstanding relationship with Client D, we are

positive about SKPRES’ long-term prospects as it has been able

to continuously secure manufacturing contracts for Client D’s

latest flagship products.

Globetronics (TP: RM6.35). We believe the earnings visibility of

GTB is improving with clearer signs supporting strong earnings

recovery in FY17 from new sensor products (particularly

gesture sensors and light sensors). This is also underpinned by

the recent acquisition by its new Swiss-listed customer, where

acquisition details revealed are pointing towards substantial

revenue growth from new product programmes starting in

mid-2017.

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 6

Oldtown (TP: RM3.05) could be a multi-year growth stock in

view of the potentially lucrative opportunities offered by its

regional expansion story, particularly in the China market. We

maintain our positive stance on Oldtown given that (1) the

strong 3QFY17 results has reaffirmed our investment thesis

that the group is firmly on a growth trajectory, (2) its valuation

remains attractive despite the recent run-up, and (3) its

expansion to regional markets can bring about multi-year

growth potential.

Yong Tai (TP: RM2.10) is our top pick for the Malaysia property

sector given its unrivalled competitive advantages arising from

its unique tourism appeal and synergistic property product

offerings. It is set to deliver exponential EPS CAGR of 57%

over FY16-19F. We envisage long-term earnings visibility for

Yong Tai as its value-adding 138-acre Impression City and

Impression Melaka ride on booming Chinese tourism,

reflecting the unprecedented close Malaysia-China ties. We

believe the vast potential of Yong Tai is under-appreciated by

investors, and the official opening of Impression Melaka in Feb

2018 will be a key re-rating catalyst.

Please refer to pages 14-16 for detailed key investment merits

of these stock picks.

Earnings estimates for AllianceDBS's coverage sectors (CY17 and CY18)

Top stock picks

Source: AllianceDBS Price date: 4 May 2017

ADBS Universe vs KLCI (CY)

Sector Call RM m RM m % % CY2017 CY2018 CY2017 CY2018 CY2017 CY2018 CY2017 CY2018 CY2017 CY2018

Automotive Underweight 8,209.0 7,071.5 (13.9) 0.6 28.1x 19.2x 140% 44% 1.3% 1.7% 1.4x 1.3x 5% 7%

Aviation Neutral 26,327.4 24,508.0 (6.9) 2.0 32.4x 22.8x 310% 30% 1.3% 1.7% 1.5x 1.4x 9% 9%

Banking Neutral 316,160.2 327,285.9 3.5 24.3 13.0x 12.0x 7% 9% 3.9% 4.2% 1.4x 1.3x 11% 11%

Building Materials Underweight 10,512.1 9,203.3 (12.5) 0.8 32.9x 31.2x 51% 7% 1.8% 1.9% 2.0x 1.9x 7% 7%

Chemicals Underweight 57,040.0 44,000.0 (22.9) 4.4 22.4x 0.0x 4% 0% 2.3% 0.0% 2.1x 0.0x 10% 0%

Conglomerate Neutral 7,764.9 10,657.7 37.3 0.6 15.0x 13.7x (6%) 9% 1.8% 1.8% 0.8x 0.8x 5% 6%

Construction Overweight 33,132.2 35,155.5 6.1 2.5 19.3x 18.0x 24% 7% 2.3% 2.4% 1.8x 1.7x 10% 10%

Consumer Neutral 53,848.5 54,246.7 0.7 4.1 22.6x 21.1x 5% 8% 3.2% 3.4% 9.9x 9.3x 42% 48%

Financial non-bank Neutral 7,813.2 8,512.1 8.9 0.6 30.0x 28.1x 21% 13% 6.7% 7.2% 6.5x 6.2x 40% 40%

Gaming Overweight 76,009.2 76,594.5 0.8 5.8 17.5x 14.5x 13% 21% 1.4% 1.6% 1.4x 1.3x 9% 10%

Glove Neutral 18,770.4 20,187.0 7.5 1.4 19.7x 17.4x 14% 12% 2.5% 2.8% 3.5x 3.1x 18% 19%

Healthcare Neutral 55,340.2 63,812.1 15.3 4.3 47.7x 40.9x 41% 17% 0.6% 0.7% 2.3x 2.2x 5% 6%

Media Neutral 18,091.7 19,828.0 9.6 1.4 17.8x 15.8x 32% 13% 5.7% 6.3% 17.4x 16.8x 98% 110%

Oil & Gas Neutral 32,232.9 33,684.0 4.5 2.5 27.6x 20.1x 59% 38% 0.8% 1.1% 1.7x 1.6x 6% 7%

Plantation Neutral 157,626.2 149,354.2 (5.2) 12.1 22.6x 20.0x 27% 13% 2.3% 2.6% 2.0x 1.9x 9% 10%

Port Neutral 13,230.8 14,663.0 10.8 1.0 10.4x 9.8x 2% 6% 3.4% 3.6% 0.6x 0.6x 6% 6%

Property Neutral 32,241.7 31,186.1 (3.3) 2.5 19.7x 17.9x 30% 17% 2.7% 2.6% 1.0x 1.0x 7% 7%

REIT Neutral 36,718.9 38,595.6 5.1 2.8 18.2x 7.7x 7% 1% 5.1% 5.4% 1.3x 1.3x 10% 11%

Shipping Neutral 33,121.3 35,933.5 8.5 2.5 10.0x 9.2x 14% 6% 3.4% 3.4% 0.6x 0.6x 4% 5%

Technology Neutral 10,433.0 10,909.5 4.6 0.8 16.3x 14.0x 40% 16% 3.2% 3.7% 3.5x 3.1x 21% 23%

Telecommunication Underweight 163,021.1 141,977.0 (12.9) 12.5 26.5x 24.7x 2% 7% 3.0% 3.6% 21.9x 21.7x 88% 89%

Utilities Overweight 131,940.2 145,834.0 10.5 10.2 14.6x 13.6x (2%) 6% 3.2% 3.4% 1.8x 1.7x 13% 13%

ADBS Universe 1,299,585.3 1,303,199.1 0.3 100.0 20.4x 17.0x 20% 11% 3.0% 3.1% 4.8x 4.6x 23% 23%

FBMKLCI 1,758.67 1,800.00 2.4 16.5x 15.1x 8% 9% 3.3% 3.3% 1.7x 1.6x

Dividend Yield Price/ BVPS ROAEMarket Cap Target Mkt Cap Upside Weightage P/E EPS Growth (YoY)

Recommen

dation

Target

Price

Current

Price

Market

CapCY2017 CY2018 CY2017 CY2018 CY2017 CY2018 CY2017 CY2018 CY2017 CY2018

Maybank BUY 10.00 9.20 93,682.5 13.1x 12.3x 4% 7% 5.8% 6.2% 1.3x 1.2x 10% 10%

Genting BUY 10.60 9.82 36,596.5 16.9x 13.2x 18% 29% 0.4% 0.5% 1.0x 0.9x 6% 7%

Gamuda BUY 6.30 5.28 12,814.9 20.8x 19.6x 9% 7% 1.7% 1.7% 2.0x 1.8x 10% 10%

BIMB Holdings BUY 5.00 4.48 7,337.1 11.6x 10.9x 8% 7% 2.9% 3.1% 1.7x 1.6x 15% 15%

Sunway Construction BUY 2.13 2.00 2,585.8 16.7x 14.5x 26% 15% 2.7% 3.1% 4.5x 3.8x 29% 28%

VS Industry BUY 2.35 1.99 2,360.9 13.1x 10.6x 22% 23% 3.0% 3.8% 2.4x 2.1x 19% 21%

SKP Resources BUY 1.60 1.26 1,529.1 11.9x 9.6x 28% 24% 4.2% 5.2% 3.5x 3.0x 32% 34%

Globetronics BUY 6.35 5.43 1,535.0 22.9x 14.5x 157% 58% 3.7% 5.0% 5.5x 5.0x 25% 36%

Oldtown BUY 3.05 2.66 1,209.0 17.5x 16.9x 10% 4% 2.5% 2.6% 2.9x 2.6x 17% 16%

Yong Tai BUY 2.10 1.54 670.4 18.3x 7.7x 1076% 139% 0.9% 3.0% 1.4x 1.4x 10% 22%

ROAEP/E EPS Growth (YoY) Dividend Yield Price/ BVPS

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 7

Sector Outlook

Sector Outlook Top Stock Picks

Automotive

Underweight

We expect minimal growth to be the norm for auto players in FY17, as there are no

major catalysts to help lift numbers. The continued weak consumer sentiment and

tighter hire purchase controls will weigh on growth.

While exciting launches and promotions may be able to support volume, margins will

remain pressured by higher costs. Promotions and road shows to spur excitement in

the market will incur costs and eat into margins.

None

Aviation

Neutral

Malaysian air passenger traffic seems to be turning around, with 10-10.5% growth in

1Q17 and 2H16 after around 24 months or two years of growth averaging <1%.

This suggests recovery in travel demand following the after-effects of airline

incidences in 2014 plus scaling down by Malaysia Airlines (MAB). We expect Malaysia

Airports' (MAHB) 2017 passenger growth to be decent in 2017 at 7.5% (6% in

2016).

Yields (fares/RPK) will see pressure from larger industry capacity, given recovered

growth ambitions by Malaysia Airlines (MAB), while AirAsia and Malindo are ramping

up capacity after a slower 2016. Airlines may leverage on routes on which they have

a larger market share, or seek out unique routes to maintain average yields.

2017 jet fuel spot prices of around USD60-65/bbl are higher y-o-y than the 2016

average of USD52.9/bbl, in line with crude oil prices. Airlines’ unit costs will be

pushed slightly upwards as fuel makes up 20-40% of operating costs, though this is

partially mitigated by hedges where most have covered more than half of

requirements. The persistence of a strong USD is also a cost risk as the majority of

costs are USD-denominated. Overall, we expect thinner margins for airlines.

AIRA remains in a strong position to defend and grow market share though re-rating

catalysts may hinge on divestments or substantial associate improvements. AAX is

more exposed to fuel and currency factors and faces the risk of losses in the event of

severe yield deterioration. Despite its better domestic growth, MAHB will see

headwinds from its Turkish operations.

None

Banks

Neutral

Earnings recovery in 2017 is largely driven by lower credit cost (decline from a high

base in 2016). Top-line growth is limited as loan growth is expected to remain

modest. Upside surprises could arise from better-than-expected NIM trends. Capital

markets are expected to pick up.

Most banks are looking to grow loans at mid-single digits, which is broadly in line

with the expectation for system loan growth.

Uncertainties on asset quality issues have waned and we are tilting to a more positive

bias. Near term, while banks have indicated that they have prudently impaired loans

and provided for them, vulnerable segments (such as oil & gas, commodities, steel

and commercial property) may still cause more incidences of restructured and

rescheduled (R&R) loans. Meanwhile, on the retail front, asset quality has been largely

held up by mortgages. That said, if the operating environment improves, asset quality

could also surprise on the upside from a reclassification of R&R loans to non-impaired

(allowed upon observance of continuous repayment for at least six months)..

The Malaysian banks are clearly turning the corner and escaped the wrath of NPL

woes unlike regional peers, although selected banks did suffer in 2016. We prefer

Maybank to CIMB as Maybank has more holistic business engines it can ramp up in

an improved operating environment; CIMB relies mainly on one engine – corporate

banking. Public Bank and Hong Leong Bank remain our fundamental picks, as both

banks continue to demonstrate resilience; Hong Leong Bank’s associate, Bank of

Chengdu could spring a positive surprise. We also like AMMB and BIMB for a

compelling turnaround story and superior growth, respectively.

Maybank, Public Bank

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 8

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Building materials

Underweight

We believe competition among cement players is unlikely to improve in 2017, given

the slow construction activities (MRT Line 1 mostly completed) amid further capacity

expansion by industry players.

Not helping either are the rising thermal coal prices (~30% of costs) and the weaker

ringgit.

CMS is on a better footing as the Sarawak-based company will not be impacted by

price competition, unlike its Peninsular peers. The company is also expected to benefit

from the increased infrastructure spending such as the Pan Borneo Highway.

None

Construction

Overweight

The higher development expenditure for the 11MP (RM260bn over the next five years)

gives some assurance that project flows will continue to be forthcoming.

Transportation-related projects which are government backed have very little risk of

being shelved.

We expect continuity of project awards to follow in 2017 but the quantum will likely

be lower compared to 2016. The focus will be on three key projects – LRT 3, Southern

Double Tracking and Pan Borneo Sabah. The medium-term pipeline also looks

promising with the East Coast Railway Link, High Speed Rail and MRT Circle Line.

Our top picks are Gamuda and Sunway Construction. We continue to like Gamuda for

its position as the best infrastructure transportation proxy where its strong reputation

for MRT Line 1 will enable it to capitalise on more projects such as the High Speed Rail

and East Coast Railway Link. We also like Sunway Construction as our mid-cap proxy

where we expect it deliver stronger earnings over the next few years given its strong

orderbook. Our small-cap pick is Kimlun which continues to surprise the market with

its strong earnings delivery and execution track record.

Gamuda, Sunway

Construction, Kimlun

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 9

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Consumer

Neutral

Private consumption (55% of GDP) remained expansionary, growing by 2.2% in q-o-q

terms in 4Q16, up from 0.2% sequential expansion in 3Q16. Nonetheless, we remain

cautious as the q-o-q expansion could be driven by (1) heavy sales promotions and

discounting activities towards the end of the year, (2) shopping for Chinese New Year

which fell in Jan 2017, and (3) the sharp weakening of the ringgit since November

2016 that may have encouraged local travelling among Malaysians, which supported

end-of-year sales.

In fact, our cautious stance is supported by consumer leading indicators such as MIER

Consumer Sentiment Index (CSI), job vacancies data and household loan approval rate.

CSI statistics released by the Malaysian Institute of Economic Research (MIER) increased

q-o-q to 76.6 points in 1Q17 (4Q16: 69.8), significantly below the 100 points

threshold and pointing towards a sluggish recovery in consumer spending. Besides

that, data on recent job vacancies and household loan approval rates remain below the

historical average, which could continue to drag consumption.

4Q16 corporate results were above expectations partly due to already low market

expectations. We maintain our cautious stance on the sector whose earnings prospects

going forward are expected to remain weak, dragged by (1) continued slow recovery

in consumer spending, (2) weakening ringgit inflating the cost of imported materials,

(3) higher minimum wage effective from July 2016 adding on to the cost pressure, and

(4) an increasingly competitive operating environment and weak consumer market may

restrict companies’ ability to pass on the rising costs.

While potential election goodies could help to temporarily create a ‘feel good’

sentiment, we do not expect it to be a significant re-rating catalyst for the sector. With

no significant catalysts on the horizon, bottom-up stock picking remains our strategy

for investors to generate alpha returns.

Given the concerns outlined above, we favour stocks with (1) resilient business models,

(2) established brand names in their respective sectors to withstand the continued

challenging operating environment, (3) strong balance sheets to undertake earnings-

accretive M&A activities to drive growth and/or engage in capital management

exercises to reward shareholders, (4) regional exposure to mitigate (potential) domestic

earnings risks, and (5) attractive value propositions. Oldtown (BUY, TP: RM3.05)

remains our preferred pick in the sector.

Oldtown

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 10

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Gaming

Overweight

We maintain our Overweight recommendation for the gaming sector as we foresee

ongoing re-rating for the Genting Group. While we have downgraded Genting

Malaysia (GENM) to HOLD in view of its recent strong share price performance, we

maintain our BUY recommendation on Genting Bhd (GENT) given that it offers a lower

entry point for exposure to GENM and Genting Singapore (GENS).

With the progressive launch of its major GITP developments, we expect the number of

visitors to Resort World Genting to grow by about 8% per annum from an expected

21m in 2016 to 25m by 2018, on track to meet the group’s target of 30m by 2020.

The increased visitations, coupled with the potential availability of 300 new gaming

tables, are expected to drive its earnings.

While GENS’ share price has rallied since we upgraded GENS to BUY in August 2016,

we believe the re-rating will continue on the back of a sustained earnings recovery in

2017. Its improved profitability in 2017 (17% jump in adjusted EBITDA) will be driven

by (i) a recovery in VIP volumes (we have pencilled in a 3% uplift) as management is

now focusing on growing its top line, (ii) VIP win rate normalising to the 2.85%

theoretical rate from c.2.67% in 2016, and (iii) lower bad debts given GENS’s more

selective and conservative credit policy over the past year.

On the other hand, we are less optimistic on the prospects of number forecasting

operators (NFOs) as the weak domestic consumer sentiment could slow down

discretionary spending, which may in turn hamper ticket sales of NFOs.

Genting

Gloves

Neutral

We expect the supply-demand mismatch to narrow in FY17, backed by glove players

expanding capacity at a more gradual pace to better track demand growth. We

forecast glove output for glove players at 10%/11% for FY17/18F in contrast to their

FY16 volume growth of 14%, which is significantly above demand growth of c.10%.

With demand catching up to supply and pressures on ASPs expected to ease, we see

margins stabilising moving forward as continuous efforts in increasing efficiency and

automation can contribute to steady operating margins due to improving economies

of scale. Margins would get a boost from the downtrend in raw material prices but

this is unlikely to be sustained as savings will be passed on to customers.

Valuation is at a fair level in the absence of catalysts to re-rate the sector. We have

HOLD calls on glove companies under our coverage.

None

Healthcare

Neutral

We remain optimistic about the growth prospects of private hospital operators due to

increasing demand for quality healthcare amid rising disposable income. Capacity

constraints at government healthcare facilities are also expected to drive affluent

patients to private hospitals. The constraints are expected to worsen with the cut in

public hospital development expenditure from RM3.7bn in fiscal year 2010 to

RM536m in fiscal year 2017.

Generic pharmaceutical players are expected to enter a new growth phase as they

approach the patent cliff, providing an opportunity for them to launch new generic

products and improve sales.

Our top pick for the sector is IHH Healthcare for its robust revenue growth across most

of its business units, boosted by contributions from new hospitals including Gleneagles

Kota Kinabalu, Gleneagles Medini Hospital, Acibadem Taksim Hospital, and newly

acquired hospitals such as Global Hospitals and Tokuda Group and City Clinic Group.

IHH Healthcare

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 11

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Media

Neutral

With the challenging market environment and rising cost of living, there is generally a

lack of feel-good factors to spur a recovery in consumer sentiment and for advertisers

to lift adex spending in 2017.

Low newsprint cost is a blessing for newspaper publishers, though this will be offset by

the weaker ringgit.

Nevertheless, we believe downside risks are limited given the low valuation and decent

dividend yields for the sector. Our top pick for the sector is Astro for its resilient

earnings which are predominantly driven by Pay-TV subscriptions rather than adex.

Astro Malaysia

Oil & Gas

Neutral

OPEC reached a landmark consensus on 30 November to reduce output by about

1.2mmbpd, effective 1 January 2017. The duration of the agreement is six months. An

understanding has also been reached with various non-OPEC countries including

Russia that they would be contributing towards a reduction of 600,000bpd which

brings the total supply curtailment to 1.8mmbpd. This will likely bring forward

demand-supply equilibrium to 1H17 and we adjust Brent crude oil price average to

US$50-60 per barrel accordingly from US$50-55bbl.

According to Rystad Energy Dcube (March 2017), total global offshore capex has

bottomed out and will progressively improve from CY2018-2020. Upstream players

will be boosted by the prospect of higher oil prices while service providers will be

uplifted by improvement in capex spending by oil majors.

Sapura Energy (SAPE) is a BUY as it benefits from an oil price recovery given its direct

exposure to the exploration and production segments. For every USD5/barrel increase

in crude oil price, we estimate c.17% earnings growth for SAPE in FY18F (FYE Jan

2018). Furthermore, its position as a global integrated upstream company with

operations spanning the entire O&G service provider value chain allows it to benefit

from an eventual recovery in O&G capex cycle.

We believe Pantech is one of the key beneficiaries of RAPID contract flows. Following

its strong 4QFY17 results, we believe the earnings rebound momentum to be

sustained in FY18, underpinned by more orders from RAPID. Valuations are attractive

at 9x 2018F FD EPS. Pantech also offers one of the highest dividend yields at c.5% in

our oil & gas universe. Together with its dividend yield, the stock offers a total upside

potential of c.27%. Pantech remains our top small-cap pick for the sector.

Sapura Energy, Pantech

Plantation

Neutral

The adverse El Nino impact reduced global palm oil output by 7% in 2016. This caused

an inventory drawdown of 2.6m MT (-20% y-o-y) – as Indonesia’s B20 mandate kicked

in.

Following 15% and 14% drops last year, we expect this year’s FFB yields to rebound

6% in Indonesia and 8% in Malaysia. Even as global supply rebounds 10% this year;

we expect palm oil stockpile to stay flat on continued y-o-y demand growth.

We expect Indonesia’s CPO Fund to collect US$865m of export levies this year; based

on a 9% rebound in export volumes. Hence, coupled with non-subsidised volume, we

expect Indonesia’s biodiesel output to expand 0.5m MT y-o-y to 3.3m MT (5% of

global palm oil demand).

Our current CPO average price forecast is US$659 or RM3,040 per MT for 2017 –

higher than the US$640/RM2,652 average in 2016.

TSH is a BUY for its better-than-peer internal FFB growth pipeline due to its favourable

tree age profiles, allowing it to capitalise on CPO price upside from currency

movements.

TSH Resources

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 12

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Property

Neutral

We expect slower property sales volumes in 2017, although prices should hold up due

to cost-push factors. Sentiment should remain poor given the tightening measures and

inflationary pressures, but mass-market products at strategic locations will continue to

enjoy healthy sales as affordability remains an important factor among purchasers.

Developers' margins could be affected by rising development costs, as selling price

hikes would be capped by relatively more subdued demand. However, there is no

property bubble for now but we fear an oversupply of KL office space, hybrid high-rise

units and Iskandar Malaysia high-end condos.

Our top sector pick is Yong Tai which enjoys unrivalled competitive advantages arising

from its unique tourism appeal and synergistic property product offerings which are

set to deliver exponential EPS CAGR of 57% over FY16-19F. We envisage long-term

earnings visibility for Yong Tai as its value-adding Impression City and Impression

Melaka ride on booming Chinese tourism, reflecting the unprecedented close

Malaysia-China ties.

Yong Tai

REIT

Neutral

Rental reversion growth is expected to be moderate-to-low for all subsectors. Retail

rents and occupancy should remain resilient at prime locations, but weak consumer

sentiment and spending will cap rental reversion. Office assets will focus on

maintaining occupancy as oversupply conditions persist, while softer business

conditions (weaker general economy, a depreciated ringgit, minimum wage hikes) will

pressure rents for both office and industrial spaces.

Inorganic growth via acquisitions will be a running theme in the face of weak organic

growth. However, the key point remains whether the REITs can inject assets at a price

that will be DPU-accretive to unitholders.

Sunway REIT remains our top pick, predicated on its strong DPU growth as income

contributions resume following the completion of Sunway Putra refurbishments, plus

its visible pipeline of potential asset injections from sponsor Sunway Bhd.

Sunway REIT

Shipping

Neutral

LNG spot rates are expected to remain low in 2017 continuing the weakness in 2016,

as newbuild deliveries are expected to be strong at 57 (up from 33 in 2016), thus

exacerbating the vessel oversupply.

Crude tanker rates had on average performed worse last year with the Baltic Dirty

Tanker Index (BDTI) averaging 11% lower in 2016. In line with seasonality, rates

typically pick up towards 4Q-1Q, before softening in 2Q-3Q. For full-year 2017, the

BDTI is expected to chart another y-o-y decline as newbuild deliveries are also likely to

outstrip demand.

We have a HOLD call on MISC. The group’s organic earnings outlook is mild-to-weak

in the near term due to the soft charter rates outlook. However, the group intends to

pursue inorganic growth especially within the offshore space, which may have the

potential to transform its outlook.

None

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 13

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Technology

Neutral

The iPhone 7 is generally well received, and this is sufficient to serve as a re-rating

catalyst for the supply chain because prior expectations were very low. With a decent

iPhone 7 cycle till 2Q17, followed by a 2H17 supercycle where a major design overhaul

and new features are expected, we believe the outlook for Apple's supply chain looks

favourable over the next 12 months.

We have a BUY call on Globetronics (TP: RM6.35) as we believe the risk-reward is

compelling, with clearer signs emerging to underpin growth recovery in FY17 from

new sensor products (i.e. light sensor and gesture sensor).

The whole Malaysian tech sector has re-rated significantly since early 2017 amid

positive industry data and positive sentiment on the equity market. These have helped

to narrow the valuation gap of laggards such as Unisem and MPI which were trading

at undemanding valuations. In particular, we like Unisem (BUY, RM3.65 TP) for its

wafer bumping and WLCSP segment, which is seeing higher demand and is a key

differentiator compared to its Malaysian peers.

Globetronics

Unisem

Telecommunication

Underweight

The intense price competition in the market is not showing any signs of abating soon,

as mobile players are still offering attractive promotions in a bid to gain market share

amid the weak consumer environment. We believe a persistent fall in data pricing is a

key threat to mobile operators’ data monetisation strategy to offset declines in voice

and SMS.

Spectrum pricing for 900MHz and 1800MHz has been announced, and the RM6.3bn

total fee is manageable and within market expectations. However, with the move

towards new spectrum regime as well as a stronger U Mobile (which has gained more

spectrum), we believe questions will eventually be raised on competition risk and

margin sustainability, as well as the premium valuations of Malaysian mobile operators.

We are optimistic about the eventual rollouts of HSBB2, SUBB, and wireless services

that would drive further growth for TM, as it expands the coverage of its high-speed

broadband network to more areas.

Telekom Malaysia

Utilities

Overweight

Energy demand is expected to grow in tandem with the relatively healthy economic

outlook in Malaysia, which will continue to underpin the growing recurring income for

utility players.

The government remains committed to the power sector reform with the

implementation of the incentive-based regulation (IBR) framework that will provide

strong earnings clarity for utility players as well.

Our top pick is Tenaga Nasional (TNB) for its more attractive valuation and improving

earnings visibility from the implementation of the IBR framework.

Tenaga Nasional

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 14

Top Stock Picks

Stocks Key Investment Merits

Maybank Gradual improvement in core earnings expected; positive capital markets momentum an added boost; Maybank

Indonesia chugging along.

Etiqa (insurance business) and Maybank Islamic banking are hidden jewels of Maybank Group; market could be mis-

pricing Maybank's ability to unlock shareholder value

Dividend remains appealing with 5-6% yield; dividend reinvestment plan to persist; strong capital ratios is Maybank's key

advantage over peers.

BUY with RM10.00 TP; spinoffs could add RM0.40 to TP

Genting Let’s enjoy the game! We maintain our BUY recommendation on Genting Bhd (GENT). We believe that progressive

launches of key developments in Genting Integrated Tourism Plan (GITP) and expected earnings recovery in Genting

Singapore (GENS) will improve the growth prospects for the group.

Expect gaming tables to increase by >45% by 2018. GITP launches to boost outlook. We are positive on GITP launches

as we foresee improving earnings prospects for the group: (1) additional gaming capacity arising from GITP’s launch, and

(2) weak ringgit to attract more foreign tourist visitations and encourage more local visits from Malaysians, which could

benefit Genting Malaysia (GENM).

Ride on sustained GENS earnings recovery in 2017. While GENS’ share price has rallied over 25% since we upgraded

GENS to a BUY in August 2016, we believe the re-rating will continue on the back of sustained earnings recovery in

2017. Its improved profitability in 2017 (17% jump in adjusted EBITDA) will be driven by (i) a recovery in VIP volumes (we

have pencilled in 3% uplift) as management is now focusing on growing its top line, (ii) VIP win rate normalising to the

2.85% theoretical rate from c.2.67% in 2016, and (iii) lower bad debts given GENS’s more selective and conservative

credit policy over the past year.

BUY, TP of RM10.60. We keep our BUY recommendation for GENT with a target price of RM10.60, based on SOP

valuation. We believe that GENT offers a lower entry point for exposure to both these subsidiaries.

Gamuda Best transportation proxy. Gamuda has solidified its position for MRT Line 2 with the award of the tunnelling package

worth RM15.47bn to MMC-Gamuda JV or RM7.7bn per contractor. We expect margins to be at least in the 12-15%

range (similar to MRT Line 2) given the Swiss Challenge was not used, coupled with the cost savings from the

depreciated tunnelling boring machines. Additionally, on a cost-per-km basis, it is 30% higher than MRT Line 1. It is also

confident of clinching another RM3-4bn of new orders coming from LRT 3, Southern Double Tracking and Pan Borneo

Sabah.

Earnings to resume growth in FY17F. We expect FY17F earnings to grow by 10% in FY17F, anchored by its RM8.3bn

orderbook which comprises MRT Line 2 tunnelling and Pan Borneo Sarawak. However, this has yet to take into account

the sale of Splash, where there may be delays in finalising the sale.

BUY, TP of RM6.30. Gamuda remains the best large-cap infrastructure proxy in Malaysia. We expect the company to be

present in most of the large-scale transportation-led infrastructure projects in Malaysia, given its strong execution track

record and reputation.

BIMB Earnings risk overplayed. BIMB has an arsenal of tools to lean on to weather the current soft operating environment. The

bank has a niche in Islamic banking (which supports financing growth momentum), high CASA ratio and liquid balance

sheet (to stave off NIM compression) as well as high financing loss coverage (to buffer against potential deterioration in

asset quality). We believe the market is not assigning sufficient premium to a franchise delivering ROEs of c.15% and

better-than-industry metrics.

Growing cautiously in FY17. BIMB is keeping defences up in 2017, with a financing growth target of 8%. This remains

higher than the banking system’s loan growth, which we expect to reach 5%, at best. Deposit (including investment

accounts) is also expected to grow at a similar pace, i.e. 7-8%. BIMB hopes to contain NIM compression at less than 5bps

and increase in charge-off by a few bps in the coming year. We believe the selective growth strategy by the bank will

bode well for safeguarding asset quality. Nonetheless, we would not discount the possibility of financing growth

exceeding management guidance, as we understand that BIMB continues to see healthy demand for financing.

BUY, undervalued franchise. Our RM5.00 TP is derived from the Gordon Growth Model (assuming 15% ROE, 4% long-

term growth and 10% cost of equity) and implies 1.9x FY17F BV. We believe its current valuation presents a good

opportunity to gain an inexpensive entry into a solid Islamic banking franchise.

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 15

Top Stock Picks (cont’d)

Stocks Key Investment Merits

Sunway

Construction

Malaysia’s leading pure construction player. Sunway Construction Group (SCG) is the largest listed pure play construction

player in Malaysia. Given its strong track record with MRT, LRT and BRT jobs previously, we are of the view that SCG is

on a strong footing to bag several key infrastructure packages such as LRT 3 and BRT as well as other major highway

projects. SCG has also established itself as the only construction specialist to be involved in all three Rapid Line infra

projects (MRT, LRT and BRT). This makes the group one of the strongest contenders to win the pipeline of 11MP projects.

Riding on Singapore’s public housing development. Its precast division is a strong proxy to the growing demand for HDB

residences in Singapore where the government is targeting to build an additional 88,000 units of public housing in FY16-

FY19. With premium EBIT margins recorded over the past few years, the business is ROE-enhancing and also synergistic

to its construction business. The completion of its 3rd precast plant in Iskandar should give it ample capacity to cater for

more orders while also compensating for the eventual return of the Tampines plant.

Guiding for RM2bn of new contracts in 2017. SCG has exceeded its RM2.5bn revised order forecast for 2016 with wins

of RM2.6bn. For FY17, it has set a more conservative target of RM2bn and this is expected to come from some internal

jobs, LRT 3, building job and its usual precast projects in Singapore. YTD wins already amount to RM0.9bn.

VS Industry High-growth company with potential for significant contract wins. We expect VSI’s growth to be driven by its largest

client (with 30% of total revenue in FY16) – Client D. We initially forecast contributions from two box-build assembly

orders for cordless vacuum cleaners worth c.RM400m per job p.a. and another two box-build assembly orders for corded

vacuum cleaners worth c.RM150m per job p.a. We have now included another two prospective jobs for box-build

assembly orders for a new product worth c.RM400m per job p.a., which are expected to progressively start operation

from Oct 2017.Taking these contracts into account, we forecast Client D’s revenue contribution to grow at a CAGR of

58% in FY16-FY19F. Beyond these contracts, we believe there is high potential for further contract wins from Client D as

it launches more products.

More orders from Keurig. The group has clinched a full-assembly contract for Keurig’s upcoming new coffee machine

model. We believe production has been ramped up due to positive market feedback on the new product.

Additional plant for box-build assembly. VSI is constructing a specialised factory-cum-warehouse in preparation for

potential orders from its existing clientele. The built-up area of the factory is 130k sq ft, while the warehouse provides

another 130k sq ft. Based on the built-up size, we believe the new facility can house an additional six production lines.

The warehouse is expected to be completed soon and the factory is slated for completion by early-2018.

BUY, TP of RM2.35. Our fair value of RM2.35 is based on 13x fully diluted CY18F EPS, which is the industry’s average. In

the mid-term, we conservatively forecast VSI’s revenue/core EPS to grow at a 3-year CAGR of 29%/28% over FY16-

FY19F. A +/- 0.1% shift in net margin will affect earnings by +/-2%, causing our fair value to increase/decrease by 3%.

SKP Resources Earnings visibility intact despite near-term headwinds. SKPRES has clinched a four-year contract from Client D totalling

RM2bn, or RM500m p.a. for the manufacturing of hairdryers. However, SKPRES would be foregoing the previous

RM400m p.a. contract, for the manufacturing of the V6 cordless vacuum cleaners. The move is to optimise and shift the

existing limited labour resources to work on the higher-value product, following the government’s decision to freeze the

hiring of foreign labour in February 2016. Taking these into account, we see improved visibility for the group’s earnings

from 3QFY17 onwards, arising from; 1) the earnings accretion of the recent hairdryer contract from Client D, 2)

improved operating margins from the high-value contract, and 3) resolution of the labour issues in September 2016.

New celebrated product. The cordless vacuum cleaner is Client D’s most popular product which contributed more than

half of its revenue in 2015. Consequently, the recent launch of the Supersonic (V9) hairdryer has the potential to be the

next best-selling product with glowing reviews from the Japan and UK launches. The recent US launch in September has

also received encouraging response. As such, we are positive of the developments as SKPRES is currently the sole

manufacturer for this product.

BUY, TP of RM 1.60. Our TP is pegged to FY18 PE of 13.5x, which is +1SD of its 5-year average forward PE. We believe

that it deserves a premium valuation given its much stronger earnings growth compared to peers, especially post

resolution of its recent labour woes.

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 16

Top Stock Picks (cont’d)

Stocks Key Investment Merits

Globetronics BUY, RM6.35 TP. The earnings visibility of Globetronics (GTB) is improving with clearer signs supporting a strong earnings

recovery in FY17-18 from new sensor products (particularly light sensors and gesture sensors). Amid the positive

newsflows and strong interest in 3D sensors suppliers, we believe GTB’s valuation could re-rate up to 17-18x PE, based on

historical trends as well as local and global peers comparison.

Production ramping up starting 3Q17. For light sensors, GTB already started initial production of 4m units in April, with

target to ramp up to 15m units by June and ultimately more than 25m units by 3Q17 when equipment are progressively

delivered and installed over the months. Meanwhile, production of gesture sensors are also currently at 4m units, with

visibility to ramp up to 8m units by early 3Q17, while plans for additional capacity are still being discussed with the

customer.

Positive outlook from Swiss-listed customer. GTB’s Swiss-listed customer has reaffirmed that preparation for ramp-ups in

2H17 are fully on-track. Furthermore, it is also seeing significantly increased customer forecasts and higher revenue

pipeline for 2017 and particularly 2018 from new projects and additional design wins. As a result, the Swiss-listed

customer is increasing its capex spending in 2017, which we believe is positive for GTB as this could possibly translate into

higher volume and/or new sensor products from the Swiss-listed customer.

Oldtown Craving for a nice cup of coffee. We maintain our positive stance on OldTown Berhad (Oldtown) given that (1) the strong

3QFY17 results has reaffirmed our investment thesis that the group is firmly on a growth trajectory, (2) its valuation

remains attractive despite the recent run-up, (3) its expansion to regional markets can bring about multi-year growth

potential, and (4) we maintain that there is now higher chance of paying out dividends amounting to 9 sen/share for

FY17, giving a decent yield of about 4%.

3Q strong earnings, multi-year sustained growth path ahead. To recap, Oldtown has delivered a set of impressive

quarterly figures. The group reported strong core earnings of RM24.4m for 3QFY17 (+119% y-o-y, +92% q-o-q), mainly

boosted by 26% y-o-y growth for FMCG revenue. We understand that the strong FMCG sales were mainly driven by > 1-

fold revenue growth to the China market. Given that China sales still accounts for <15% of its total FMCG sales, we

believe that its regional expansion story, particularly to the China market, offers Oldtown multi-year growth potential.

BUY, TP of RM3.05. We maintain our BUY recommendation with a TP of RM3.05 pegged to an unchanged forward PE of

19x, which is below its regional peers’ forward PE of >20x.

Yong Tai Best proxy to booming Chinese tourism. As the first Impression Series outside China, the Melaka Straits-fronting

Impression Melaka is poised to be a resounding success by tapping into the booming Chinese tourism in Malaysia which

has seen an impressive 11% tourist arrivals CAGR over 2000-2016 (vs 1% for Malaysia’s overall tourist arrivals), making it

the third-largest tourist source market.

Emerging cash cow. Impression Melaka offers compelling value proposition given its estimated ~20% IRR over the 30-year

concession, thus transforming Yong Tai into an emerging cash cow with strong recurring income.

Under-appreciated Melaka property market. There is immense potential in the Melaka property market which is targeting

not just its 0.9m local population but also >16m tourists that visit the World Heritage City annually. Yong Tai’s impressive

unbilled sales of RM990m – anchored by en-bloc sales of 262 retail lot units in Impression City for RM873m – will

underpin strong earnings visibility over the next two years. We believe Impression City’s attractive investment merit is

under-appreciated by investors, and the official opening of Impression Melaka in Feb 2018 will be a major catalyst.

BUY, TP of RM2.10. Given Yong Tai’s unrivalled competitive advantages arising from its unique tourism appeal and

synergistic property product offerings, it is expected to deliver exponential EPS CAGR of 57% over FY16-19F. We reiterate

our BUY rating and SOP-derived TP of RM2.10, which implies an FY18 PE of 13x.

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 17

Revisions to recommendations

Company Revision to Recommendation Revision Date Rationale

Current Previous

Upgrade

Maybank BUY HOLD 20-Apr We have reduced our credit cost assumption to 46/42/37bps over FY17-19 (from 50/44/37bps) given the improving economic outlook (firmer commodity prices and exchange rate). We have also raised non-interest income growth as the positive momentum from capital markets should give a boost to fee income. These collectively led us to raise FY17-19F earnings by 4-6%.

Unisem BUY HOLD 26-Apr We are upgrading our call on Unisem to BUY (from HOLD) with a higher TP of RM3.65 after raising our earnings forecasts, target P/B multiple, as well as rolling forward our valuation base to FY18. We like Unisem for its wafer bumping and wafer-level chip-scale packaging (WLCSP) segment which is seeing higher demand and is a key differentiator for the company compared to its Malaysian peers. Its valuation is also undemanding at 12.5x FY18 PE with an attractive net dividend yield of 5%.

Source: AllianceDBS

Significant reports

Date Report

Strategy report

5-Apr Malaysia Strategy: Riding the wave cautiously

Sector report

11-Apr Malaysia Automotive: Excise duty up

27-Apr Malaysian Construction: China contractors: Friend or foe?

Initiating Coverage

6-Apr Yong Tai: Diamond in the rough Source: AllianceDBS

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 18

Best and worst-performing stocks in AllianceDBS’ coverage in April

Big Caps (>USD2bn) Small & Mid-Caps (<USD2bn)

Source: AllianceDBS, Bloomberg Finance L.P

-10% 0% 10% 20% 30%

Petronas GasBAT

AstroPetronas Dagangan

IOI CorporationMISC

Petronas ChemicalWestports Holdings

Public BankGenting Plantation

GentingMaybank

Hong Leong Financial…AXIATAAMMB

CIMB GroupGenting Malaysia

MAHBDialog Group Bhd

AirAsia

-20% 0% 20% 40% 60%

MKH

Top Glove

Kossan

Coastal Contracts

CapitaMall Malaysia…

Supermax

SKP Resources

MSM Malaysia

TSH Resources

Berjaya Sports Toto

Muhibbah Engineering

Media Prima

Felda Global Ventures

UNISEM

Globetronics

WCT Holdings

Dayang Enterprises

Malaysian Pacific…

VS Industry

Pantech Holdings

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 19

Macro Data

Key Data Period m-o-m / y-o-y

chg Prev. / Consensus

(y-o-y)

GDP 4Q16 +3.4%* /

+4.5%

+4.3% / +4.4% During the quarter, domestic demand was led by private consumption (4Q16: +6.2%), and private investment (4Q16: +4.9%), while public consumption and public investments contracted 4.2% and 0.3% respectively. Net exports growth remained steady at 5.8% (3Q16: +5.9%). Looking ahead, we pay attention to signs of improvements in labour market conditions and sustained expansion in household-related consumption. If these fail to materialise by year-end, our subdued take on growth prospects could persist into 2018.

CPI Mar 17 -0.1% / +5.1% +4.5% / +5.2% March inflation rate was the highest recorded since 2008. During the month, price pressures were mainly driven by key items in the basket of goods, namely Transport (+23.0%), Food and Non-alcoholic Beverages (+4.1%) and Housing and Utilities (+2.1%) sectors. Looking ahead, we continue to expect double-digit growth in the Transport sector this year (Transport sector inflation YTD-avg: +16.4% vs 2016: -4.6%), in line with rising global crude oil prices.

OPR Mar 17 3.00%^ 3.00% / 3.00% Although BNM anticipates brighter global macro prospects this year, significant structural risks – threats of trade protectionism and geopolitical developments – persist. A premature hike in OPR could dampen the weak consumer sentiments; while a surprise cut in interest rate could induce volatility in the ringgit exchange rate.

Exports Feb 17 +2.1% /

+26.5%

+13.6% / +15.1% During the month, E&E exports continued to be the main driver of

growth, contributing to 7.7% of total exports growth. Following the

gradual recovery in commodity prices, O&G exports also continued to

contribute positively to exports growth during the month. Looking

ahead, the recovery in manufacturing exports volume growth (YTD-

Feb17: 5.5% vs 2016: -5.1%) could indicate a sustainable uptick in

global demand and therefore expect stronger exports performance,

moving forward.

PMI Apr 17 50.7^ 49.5 / - April’s reading was the highest since February 2015. Growth was underpinned by solid gain in new export orders, as foreign demand for Malaysian goods strengthened, which helped to offset subdued demand domestic demand.

IPI Feb 17 -5.8% / +4.7% +3.5% / +6.1% Growth was supported by expansion across all sectors: Manufacturing

(+6.5%), Mining (+0.4%) and Electricity (+1.5%) during the month. On

a seasonally adjusted m-o-m basis, industrial production expanded 2.0%,

which was the highest since Oct 2016. The manufacturing sector output

continued to remain high at 6.5% (Jan: +4.6%), largely due to E&E

production, which expanded YTD-Feb: 7.6%.

CPO Output

Mar 17 +16.3% / +20.1%

+20.7% / n.a. Production broke out of its seasonal successive declines as FFB yields achieved decent y-o-y and m-o-m growth. Expect further gradual improvements m-o-m as the weather impact recedes.

CPO Inventory Mar 17 +6.5% / -17.6%

-32.8% / n.a. Stock levels rebounded to 1.55m MT from its six-year low in Feb, as production recovered. Exports also rebounded 14.3% m-o-m but did not outpace output growth. Total demand (including local use) is still flattish YTD, implying further inventory build-up as output grows, unless exports rise strongly.

Source: AllianceDBS, Bloomberg Finance L.P * q-o-q ^ latest reading

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 20

Macro Graphs

Malaysia GDP and Consumer Price Index growth Malaysia exports growth

Source: Department of Statistics

Source: Department of Statistics

Malaysia industrial production and PMI index Malaysia palm oil output

Source: Department of Statistics, Markit

Source: Department of Statistics

Malaysia palm oil inventory MGS 10-year and US Treasury 10-year yield spread

Source: Malaysian Palm Oil Board Source: Bloomberg Finance L.P

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Jan

-12

Ap

r-1

2

Jul-

12

Oct

-12

Jan

-13

Ap

r-1

3

Jul-

13

Oct

-13

Jan

-14

Ap

r-1

4

Jul-

14

Oct

-14

Jan

-15

Ap

r-1

5

Jul-

15

Oct

-15

Jan

-16

Ap

r-1

6

Jul-

16

Oct

-16

Jan

-17

%y-o-y%y-o-yGDP growth CPI

-60

-50

-40

-30

-20

-10

0

10

20

30

40

50

-50

-40

-30

-20

-10

0

10

20

30

40

50

Jan

-13

Ap

r-1

3

Jul-

13

Oct

-13

Jan

-14

Ap

r-1

4

Jul-

14

Oct

-14

Jan

-15

Ap

r-1

5

Jul-

15

Oct

-15

Jan

-16

Ap

r-1

6

Jul-

16

Oct

-16

Jan

-17

% y-o-y% y-o-y

Others

E&E

O&G

40.0

45.0

50.0

55.0

0.0

2.0

4.0

6.0

8.0

10.0

12.0

Jan

-14

Mar

-14

May

-14

Jul-

14

Sep

-14

No

v-1

4

Jan

-15

Mar

-15

May

-15

Jul-

15

Sep

-15

No

v-1

5

Jan

-16

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6

Jan

-17

% y-o-yIPI growth (lhs)Mfg IPI growth (lhs)Mfg PMI (rhs)

-30%

-20%

-10%

0%

10%

20%

30%

40%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Malaysian production ( L ) Y-o-y production change % ( R )k MT

-20%

-10%

0%

10%

20%

30%

40%

0

500

1,000

1,500

2,000

2,500

3,000

Malaysian stock level ( L ) Y-o-y stock change % ( R )k MT

0

50

100

150

200

250

300

Jan

-10

Jun

-10

No

v-1

0

Ap

r-1

1

Sep

-11

Feb

-12

Jul-

12

De

c-1

2

May

-13

Oct

-13

Mar

-14

Au

g-1

4

Jan

-15

Jun

-15

No

v-1

5

Ap

r-1

6

Sep

-16

Feb

-17

bps

Crude

oil price slump, Ringgit decline

Trump election

Market Focus

ASIAN INSIGHTS VICKERS SECURITIES

Page 21

DBS Bank, AllianceDBS recommendations are based an Absolute Total Return* Rating system, defined as follows:

STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame)

BUY (>15% total return over the next 12 months for small caps, >10% for large caps)

HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps)

FULLY VALUED (negative total return i.e. > -10% over the next 12 months)

SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends

Completed Date: 5 May 2017 08:27:05 (MYT) Dissemination Date: 5 May 2017 08:51:49 (MYT)

Sources for all charts and tables are DBS Bank, AllianceDBS unless otherwise specified.

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Bank Ltd, AllianceDBS Research Sdn Bhd (''AllianceDBS''). This report is solely intended for the clients of DBS Bank

Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or

duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd, AllianceDBS Research Sdn Bhd

(''AllianceDBS'').

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS

Bank Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively,

the “DBS Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other

factors which we may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or

warranty as to the accuracy, completeness or correctness of the research set out in this report. Opinions expressed are subject to change without

notice. This research is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific

investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees

only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal or financial

advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of profit)

arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not

to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons

associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group, may have

positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and

other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can

be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments.

The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed, it may

not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no obligation to

update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned

schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on

which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual

results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED

UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that: