Malaysia Market Focus Malaysia Strategy - DBS Bank Malaysia Market Focus Malaysia Strategy Refer to...

Transcript of Malaysia Market Focus Malaysia Strategy - DBS Bank Malaysia Market Focus Malaysia Strategy Refer to...

ed: TH/ sa: YM, CW, CS

Opportunities in oversold stocks

Trade war truce provides hope and potentially alleviates market

overhang

No cheer from 3Q18 results season; earnings cut by 0.8-2.7% for

2018-19

End-2019 KLCI target at 1,800; we see opportunities in sharply

oversold stocks

Bombed out plays: Axiata, Gamuda and CMMT. Other picks:

AMMB, Hong Leong Bank, Matrix, Time dotcom

Much-needed easing of trade tensions. While we remain cautious

on the medium-term outlook, the G20 meeting outcome provides hope

for resolving the trade war and potentially alleviates a major market

overhang in the near term. The KLCI is currently trading at 15.8x 2019

EPS. We look for the KLCI to end 2019 at 1,800, based on 17x EPS. The

recently concluded 3Q18 results season did not provide much cheer.

Although the percentage of disappointments remained in check, we

cut our 2018 and 2019 earnings forecast by 0.8% and 2.7%

respectively. We now expect KLCI earnings to grow 1.8% and 7.3% in

2018 and 2019 respectively.

Oversold plays. The KLCI’s 6.5% retracement YTD belies the degree

of losses felt by the broader market. Share prices of 69% of the top

100 stocks by market capitalisation in Malaysia were lower as at end-

November compared to the start of the year. More than 27 stocks in

this group have seen their share prices drop by more than 30% YTD.

Of these, 14 stocks have lost more than 50% of their value YTD

including Gamuda, Astro, Telekom Malaysia and Lafarge. We believe

the selldown brings out opportunities in bombed out names such as

Axiata, Gamuda, CapitaMall Malaysia Trust (CMMT) and Media

Chinese.

Positive measures for property sector. We see opportunities within

the property sector arising from the introduction of the National Home

Ownership Campaign. This initiative could see clearing of inventory and

ease cashflow pressures on developers. Within this sector, we believe

Matrix Concepts, SP Setia, UEM Sunrise and MKH are oversold. Our

other picks include AMMB and Hong Leong Bank as plays on the

country’s resilient domestic consumption; and Time dotcom – we

believe the stock presents a buying opportunity on the back of its

strong growth profile, supported by its wholesale and retail segments.

KLCI : 1,699.72 Analyst WONG Ming Tek +60 3 26043970 [email protected] Malaysian Research Team +603 2604 3333 [email protected]

Market Key Data

(%) EPS Gth Div Yield

2017A 7.1 3.1

2018F 3.0 3.1

2019F 6.6 3.2

(x) PER PB

2017A 17.3 1.7

2018F 16.8 1.6

2019F 15.8 1.6

DBS Group Research . Equity

4 Dec 2018

Malaysia Market Focus

Malaysia Strategy Refer to important disclosures at the end of this report

Top picks

12-mth

Price Mkt Cap Target Performance (%)

RM US$m RM 3 mth 12 mth Rating

Hong Leong Bank

20.62 10,126 23.15 1.1 36.2 BUY

Axiata Group 3.95 8,602 5.05 (16.1) (25.9) BUY AMMB Holdings

4.24 3,068 4.95 3.4 2.2 BUY Gamuda 2.26 1,339 3.50 (38.9) (53.8) BUY TIME dotCom Bhd

8.17 1,145 9.40 (0.6) (10.7) BUY CapitaLand Malaysia Mall Trust

1.02 501 1.40 (11.3) (30.6) BUY

Matrix Concepts Holdings Bhd

1.93 349 2.50 (7.2) (12.3) BUY

Source: AllianceDBS, Bloomberg Finance L.P.

Closing price as of 3 Dec 2018

Market Focus

Page 2

3Q18 earnings letdown

Corporate earnings disappointed again in 3Q18. Within

AllianceDBS’s coverage, 28% of companies reported negative

surprises, while 9% reported positive surprises. Companies

that met earnings expectations made up the remaining 63%

of our coverage universe vs 60% in 2Q18.

The telco sector (better than expected as broadband ARPU

remains healthy) beat our expectations.

The building materials (intense price competition, subdued

demand), consumer (lower sales), media (decline in adex),

plantation (low average crude palm oil (CPO) prices, property

(lower sales), technology (weak smartphone sales, poor

demand) and utilities (losses from overseas ventures, higher

effective tax rate and lower margins) sectors sprang negative

surprises.

3Q18 summary of financial performance

Performance vs AllianceDBS (%) vs consensus (%)

Above 9% 10%

In-line 63% 61%

Below 28% 29%

Source: AllianceDBS

Following the 3Q18 earnings season, our CY18 and CY19 KLCI

earnings estimates were cut by 0.8% and 2.7% respectively,

largely due to earnings cuts for Tenaga (higher expenses,

losses from overseas ventures) and the Genting group (higher

gaming tax and delay of its outdoor theme park). Post earnings

revision, KLCI earnings growth for CY18 and CY19 have been

revised to 1.8% and 7.3% respectively, from 2.7% and 9.5%

previously.

FBMKLCI free float-weighted earnings change (calendarised)

Nov-18

Oct-18

Change

% Change

CY18 CY19

CY18 CY19

CY18 CY19

CY18 CY19

RM m RM m

RM m RM m

RM m RM m

Axiata Group Bhd 1084.3 1560.8 1,084 1,561 0.3 -0.2 0.0% 0.0% CIMB Group Holdings Bhd 4750.2 5287.0 4,444 5,282 306.2 5.0 6.9% 0.1% DiGi.Com Bhd 1501.2 1511.8 1,501 1,512 0.2 -0.2 0.0% 0.0% Dialog Group 459.3 533.5 459 533 0.3 0.5 0.1% 0.1% Genting Malaysia Bhd 1621.2 998.4 1,741 1,888 -119.8 -889.6 -6.9% -47.1% Genting Bhd 2488.1 2382.4 2,641 2,888 -152.9 -505.6 -5.8% -17.5% Hap Seng Consolidated 719.7 719.7 719.7 719.7 0.0 0.0 0.0% 0.0% Hartalega Holdings 455.8 517.4 456 517 -0.2 0.4 -0.1% 0.1% Hong Leong Bank Bhd 2674.6 2844.7 2,718 2,887 -43.4 -42.3 -1.6% -1.5% Hong Leong Financial Group Bhd 1942.0 2092.9 1,959 2,108 -17.0 -15.1 -0.9% -0.7% IHH Healthcare Bhd 310.5 710.6 311 711 -0.5 -0.4 -0.2% -0.1% IOI Corp Bhd 1025.1 1006.3 1,025 1,006 0.1 0.3 0.0% 0.0% KLCCP Stapled Group 725.4 738.9 725 739 0.4 -0.1 0.1% 0.0% Kuala Lumpur Kepong Bhd 912.3 1144.0 973 1,144 -60.7 0.0 -6.2% 0.0% Malaysia Airports Holdings 407.1 549.2 407 549 0.1 0.2 0.0% 0.0% Maxis Bhd 1989.5 2050.4 1,990 2,050 -0.5 0.4 0.0% 0.0% Malayan Banking Bhd 7819.9 8766.0 7,820 8,766 -0.1 0.0 0.0% 0.0% MISC Bhd 1541.1 1774.0 1,541 1,774 0.1 0.0 0.0% 0.0% Nestle Malaysia Bhd 717.1 766.5 718.5 776.7 -1.4 -10.2 -0.2% -1.3% Public Bank Bhd 5669.5 6194.3 5,669 6,194 0.5 0.3 0.0% 0.0% Petronas Chemicals Group Bhd 4581.7 4634.8 4,342 4,494 239.4 141.2 5.5% 3.1% PPB Group Bhd 1256.0 1331.9 1,256 1,332 0.0 -0.1 0.0% 0.0% Petronas Dagangan BHD 1045.6 1071.8 1,046 1,075 -0.4 -3.2 0.0% -0.3% Press Metal Bhd 703.7 985.7 693 948 10.7 37.7 0.2% 0.8% Petronas Gas Bhd 1929.5 1991.5 1,929 1,992 0.5 -0.5 0.0% 0.0% RHB Bank Bhd 2365.6 2498.6 2,202 2,382 163.6 116.6 7.4% 4.9% Sime Darby Plantation Bhd 1123.0 1142.1 1,123 1,142 0.0 0.1 0.0% 0.0% Sime Darby Bhd 838.0 958.6 836 920 2.0 38.6 0.2% 4.2% Telekom Malaysia Bhd 666.7 568.9 561 555 105.7 13.9 18.8% 2.5% Tenaga Nasional Bhd 5964.9 6287.5 6,885 6,922 -920.1 -634.5 -13.4% -9.2% FBMKLCI (Free-float weighted) 59,288.5 63,620.1 59,775.5 65,367.0 -487.0 -1746.9 -0.8% -2.7% Source: AllianceDBS, Bloomberg Finance L.P

Market Focus

Page 3

Sector performance

Sector 3Q18

(RM m)

3Q17

(RM m)

Y-o-y

change %

vs

expectation

Comments

Automotive 205.28 (9.16) nm Below Sales volume were boosted by the tax holiday period and margins improved from the strengthening of ringgit.

Aviation 99.96 510.38 (80.4%) In-line Pax growth moderated amid slower season. Airlines saw margin compression from higher jet fuel costs with minimal pass-on via higher fares.

Banking 6,905.35 6,732.20 2.6% In-line Loan growth during the quarter was mainly driven by the retail segment, while NIMs were mostly lower due to deposit re-pricing following the OPR rate hike in January 2018. A softer capital market environment also resulted in lower non-interest income, particularly fee income and investment income.

Building Materials

(Cement)

(13.49) 20.06 nm Below Mainly dragged by huge losses from Lafarge as the market worsened with higher rebate price

Construction 77.67 346.59 (77.6%) In-line Most contractors met expectations. Muhibbah's earnings remained robust while Kimlun's manufacturing margins have normalised.

Consumer 440.52 501.63 (12.2%) Below Mainly dragged by Padini's disappointing 1QFY19 results due to lower-than-expected sales growth and cost pressure.

Electronics

Manufacturing Services

46.89 84.33 (44.4%) In-line Temporary production hiccups dampened the local EMS's strong growth momentum in the quarter.

Financial non-bank 149.43 127.41 17.3% In-line Led by solid growth in personal financing and auto financing (including moped easy payments) at ACSM.

Gaming 1,174.50 969.27 21.2% In-line The 3QFY18 results largely within expectations. Supported by higher contributions from Genting group's Malaysian and Singapore operations.

Glove 278.58 235.27 18.4% In-line Earnings supported by better sales volume and higher ASPs. Margin was steady as the company passed on higher costs.

Healthcare 55.06 510.12 (89.2%) In-line Both IHH and KPJ have reported decent core earnings for 3QCY18 that are largely within expectations.

Media 117.44 169.08 (30.5%) Below Sharp decline in adex continued to drag on revenue and earnings, despite cost-saving initiatives and restructuring measures taken by the media companies.

Oil & Gas 212.97 338.95 (37.2%) In-line Earnings were supported by strong Brent prices in the quarter and improvements in contract awards.

Plantation 876.64 1,321.39 (33.7%) Below Decline in average CPO prices was exacerbated by weaker production y-o-y by Malaysia-based estates. Certain players were cushioned by stabilised downstream margins or steady Indonesian operations.

Market Focus

Page 4

Sector performance (cont’d)

Sector 3Q18

(RM m)

3Q17

(RM m)

Y-o-y

change

%

vs

expectation

Comments

Port 142.32 142.50 (0.1%) In-line Container handling throughput at Port Klang is stabilising as y-o-y transshipment decline is moderating, while gateway volumes remain strong.

Property 350.15 317.07 10.4% Below Dragged by lower earnings from larger players like SP Setia and Eco World.

REIT 398.33 392.34 1.5% In-line Lower contribution from the office and retail assets.

Shipping 274.30 517.56 (47.0%) In-line Improvement in both petroleum and liquefied natural gas (LNG) charter rates. Demand due to pick up in seasonally high 4Q.

Technology 102.40 139.90 (26.8%) Below Affected by weak smartphone sales and slowdown in the industry due to poor demand outlook. Partly offset by favourable forex.

Telecommunication 1,224.83 1,458.54 (16.0%) Above Fixed-line players showed better-than-expected results as broadband ARPU remains healthy.

Utilities 2,372.27 2,107.79 12.5% Below Weighed down by TNB due to losses from overseas ventures, higher effective tax rate and lower margins.

Total 14,878.10 17,537.80 16.29

Source: AllianceDBS

Market Focus

Page 5

Opportunities from bombed-out stocks

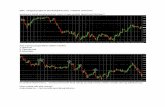

Following the KLCI’s losses of 4.7% and 1.7% in October

and November respectively (6.5% YTD), the benchmark

index could be looking at a stronger performance in

December. While we remain cautious on the medium-term

outlook given the slowdown of regional and domestic

economic growth, continued US$ strengthening and rising

interest rates – the G20 meeting between leaders of US and

China provides hope for resolving the trade war and

potentially alleviates a major market overhang in the near

term.

YTD performance of FBM KLCI, Small Cap and ACE indices:

Large caps performed relatively better

Source: AllianceDBS, Bloomberg Finance L.P

The KLCI is currently trading at 15.8x 2019 earnings. We

look for the KLCI to end 2018 at 1,750 while our end-2019

KLCI target remains at 1,800 based on 17x EPS. In terms of

preferred sectors, we like Banks and Healthcare which will

benefit from resilient domestic consumption. Banks should

continue to see resilient consumer support for loan growth.

We expect bank earnings in 2019 to remain steady on

healthy asset quality and do not foresee spikes in credit

costs. Cement and rubber gloves remain our key

underweight sectors on persistent oversupply and pricey

valuations respectively.

The KLCI’s YTD performance belies the degree of losses felt

by the broader market. Share prices of 69% of the top 100

stocks by market capitalisation in Malaysia were lower as at

end-November compared to the start of the year. The

collective losses have weighed down on the performance of

this pool of stocks. More than 27 stocks among the top 100

have seen their share prices drop by more than 30% YTD.

Fourteen stocks have lost more than 50% of their value YTD

including Gamuda, Astro, Telekom Malaysia, Lafarge and

Bumi Armada.

YTD performance of top 100 stocks by market

capitalisation: Share prices of 69% of stocks lower YTD

Source: Bloomberg Finance L.P

Biggest YTD movers and losers among the top 100 stocks

Source: Bloomberg Finance L.P

We are relatively positive on the measures to be introduced

for the property sector such as the introduction of the

National Home Ownership Campaign. The stamp duty

waivers for first-time homebuyers for properties priced

between RM300,000 and RM1m in 1H19 and a minimum

price discount of 10% to be offered by developers could see

a clearing of inventory and ease cashflow pressures on

developers. While the property sector remains in the

doldrums at this juncture, we believe the worst is over after

experiencing years of downturn. Selected stocks in the

sector are oversold, in our view. They include Matrix

Concepts, SP Setia, UEM Sunrise and MKH. There have been

two recent privatisation proposals in the sector, for Selangor

Properties and Daiman Development, indicating that

business owners are convinced share prices have excessively

discounted the fundamental values of the stocks.

-6.5%

-27.9%

-28.7%

-35.0%

-30.0%

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

2-Ja

n

18-J

an

3-Fe

b

19-F

eb

7-M

ar

23-M

ar

8-A

pr

24-A

pr

10-M

ay

26-M

ay

11-J

un

27-J

un

13-J

ul

29-J

ul

14-A

ug

30-A

ug

15-S

ep

1-O

ct

17-O

ct

2-N

ov

18-N

ov

FBM KLCI FBM Small Cap FBM ACE

(100)

(80)

(60)

(40)

(20)

-

20

40

60

80

100 % change

(10,000)

(8,000)

(6,000)

(4,000)

(2,000)

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Pu

blic

Ban

k B

hd

Pe

tro

nas

Ch

emic

als…

Dia

log

Gro

up

Bh

dN

estl

e M

alay

sia

Bh

dH

on

g Le

on

g B

ank

Bh

dP

PB

Gro

up

Bh

dQ

L R

eso

urc

es

Bh

dTo

p G

love

Co

rp B

hd

Har

tale

ga H

old

ings

Bh

dP

etr

on

as G

as B

hd

Sup

erm

ax C

orp

Bh

dSi

me

Dar

by

Bh

dFr

aser

& N

eave

…P

etr

on

as D

agan

gan

Bh

dH

on

g Le

on

g Fi

nan

cial

…Se

rba

Din

amik

…R

HB

Ban

k B

hd

HA

P S

en

g C

on

solid

ate

d…

KP

J H

ealt

hca

re B

hd

AEO

N C

red

it S

ervi

ce M

…M

ISC

Bh

dM

alay

an B

anki

ng

Bh

dLa

farg

e M

alay

sia

Bh

dM

axis

Bh

dSa

pu

ra E

ne

rgy

Bh

dB

um

i Arm

ada

Bh

dA

stro

Mal

aysi

a…SP

Se

tia

Bh

d G

rou

pM

y EG

Se

rvic

es B

hd

Sim

e D

arb

y P

rop

erty

…D

iGi.C

om

Bh

dSi

me

Dar

by

Pla

nta

tio

n…

Ten

aga

Nas

ion

al B

hd

IJM

Co

rp B

hd

CIM

B G

rou

p H

old

ings

…G

amu

da

Bh

dG

enti

ng

Bh

dTe

leko

m M

alay

sia

Bh

dG

enti

ng

Mal

aysi

a B

hd

Axi

ata

Gro

up

Bh

d

RMm

Market Focus

Page 6

Among our other picks, we continue to like Hong Leong

Bank as a play on the country’s resilient domestic

consumption. The company continues to stand out with low

cost-to-income and NPL ratios. Time dotcom is a recent

addition. We believe the recent share price drop provides a

buying opportunity on the back of its strong growth profile,

supported by its wholesale and retail segments.

FBMKLCI PE trend

Source: Bloomberg Finance L.P, AllianceDBS

KLCI earnings growth breakdown by sectors

Source: AllianceDBS

15.9x

14.7x

16.9x

14.00

14.50

15.00

15.50

16.00

16.50

17.00

17.50

18.00

Jan

-14

Mar

-14

May

-14

Jul-

14

Sep

-14

No

v-1

4Ja

n-1

5M

ar-1

5M

ay-1

5Ju

l-1

5Se

p-1

5N

ov-

15

Jan

-16

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6Ja

n-1

7M

ar-1

7M

ay-1

7Ju

l-1

7Se

p-1

7N

ov-

17

Jan

-18

Mar

-18

May

-18

Jul-

18

Sep

-18

No

v-1

8

P/EKLCI P/E Average +1 SD -1 SD 0.8%

1.6%

2.1%

4.3%

4.6%

5.1%

5.2%

6.1%

6.7%

63.5%

0% 10% 20% 30% 40% 50% 60% 70%

Consumer

Utilities

Shipping

Healthcare

Aviation

Basic Materials

Plantation

Others

Telco

Banking

KLCI CY19 Earnings Growth Contributors

Market Focus

Page 7

Sector Outlook

Sector Outlook Top Stock Picks

Automotive

Neutral

We expect a more modest growth of c.2% in FY19, as there are no major catalysts to help lift

volume as customers bought ahead during the tax holiday period. Auto players have been

launching models in the 4Q18 during the motor show and this could help support volumes in

1H18. We believe the upcoming National Automotive Policy will help support the sector via better

incentives but this could be skewed towards energy-efficient and electric vehicles.

Margins are directly impacted by the USD/MYR rate. Current rates may compress margins in the

medium term. Additional promotional activities may also erode margins. Improvement in the

exchange rate could lift up margins significantly.

Bermaz Auto

Aviation

Neutral

Malaysian air passenger traffic is expected to continue its normalised growth in 2019, carrying over

from 2H18. 2018 will likely turn out to be a strong rebound year, with 9M18 pax growth of 2%

compared to -2% contraction in 2016. Our current assumptions are for Malaysia Airports (MAHB)

to chart 2.9% pax growth in 2018, following a projected 4.5% growth for 2017.

Jet fuel prices picked up over 2H18 alongside rising oil prices, ultimately averaging USD84/bbl in

2018 or 31% higher y-o-y. We expect an average of USD80/bbl in 2019, which present further

cost pressures for airlines – however this may be partially mitigated by a stronger ringgit.

Yield (fares/RPK) management will be crucial as carriers are targeting up to double-digit growth in

capacity. We think airlines will have to strike a balance between pushing higher fares (to pass on

higher costs) and maintaining load factors. All in, margin pressures will likely impact 2019 earnings.

Our top pick is MAHB as it will enjoy steady traffic though re-rating still hinges on its Turkish

operations. AIRA as its dominant market share will ensure more yield defensibility; while further

catalysts may come from value-accretive divestments. AAX is more exposed to fuel price factors

and faces the risk of losses in the event of severe yield deterioration.

MAHB

Banks

Overweight

Like 2018, we expect 2019 loans growth to be underpinned by the retail sector. Specifically,

mortgages have been propping the industry by contributing to more than 40% of system loan

growth y-o-y. Various budgetary measures to boost home ownership would also serve to expand

mortgage growth going forward. Business loans, which have seen comparatively slower traction in

9MCY18, may pick up in 2019 due to pent-up demand (after adopting a wait-and-see approach

through most of 2018) and better clarity on the new administration’s policies. However, this may

be dampened by moderating economic growth. We believe asset quality will stay mostly healthy,

given the banks’ relatively tight underwriting practices. We do not envisage significant spikes in

credit costs for the industry over the next year.

Net interest margins (NIMs) of the banks will remain pressured in 2019, fuelled primarily by

funding costs ahead of deposit competition. The 1-year extension of Bank Negara Malaysia’s

observation period for net stable funding ratio requirements should provide some short-term

respite from further aggression in deposit rates, but on the whole, we expect rates to remain high

as banks take defensive positions. Any kind of NIM expansion would originate from a changing

asset portfolio mix.

Most banks are expected to close 2018 with muted growth in non-interest income, particularly in

market-related fee income and trading & investment income. Non-interest income only expanded

by an uninspiring 1% y-o-y in 1HCY18 due to a soft capital market environment in 2QCY18. While

3QCY18 saw improved activity, we do not expect the second half to be able to offset the prior

weakness earlier in the year. Avenues for growth in this aspect may be more limited if the current

sentiment spills over into 2019.

AMMB Holdings is our top pick for the sector, premised on its turnaround strategy after a host of

M&A-related distractions over the past few years. Its ‘Top 4’ aspiration has resulted in moves that

have paid off – the group has recorded better-than-industry growth, driven by its targeted

segments. Despite the challenging market environment and normalising credit costs (lower

recoveries from legacy corporate NPLs), AMMB’s robust loans growth and BET300 initiative to save

RM300m in costs in FY19-20 would help it weather potential headwinds over the next year. A 9%

ROE is within reach in FY20 if the group is able to execute on its deliverables. We believe the

market has yet to price AMMB’s turnaround in – the stock is trading at an affordable 0.7x P/BV.

AMMB

Market Focus

Page 8

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Building materials

Underweight

While oversupply remains the biggest hurdle among cement players in Peninsular,

demand remains sluggish – largely affected by the slowdown in the construction

sector. Pricing pressure intensifies as cement players have been offering more

rebates this year compared to last year.

Not helping either is the rising thermal coal prices (~30% of costs) which are around

USD107/tonne this year, 22% higher than the average of USD88/tonne in 2017. On

top of that, electricity cost expected to increase following tariff hike by Tenaga

Nasional Bhd (TNB).

As such, we think the challenging operating environment for the cement industry is

likely to continue going to 2019 as earnings are expected to remain depressed.

Having said that, cement price increase could be a strong re-rating catalyst for the

sector.

Cahya Mata Sarawak is on a better footing as the Sarawak-based company will not

be impacted by price competition, unlike its Peninsular peers. The company is also

expected to benefit from 1) increased infrastructure spending such as the Pan

Borneo Highway, and 2) higher contribution from its associate – OM Sarawak.

Cahya Mata Sarawak

Construction

Neutral

2018 was an extremely volatile year for the sector which saw projects being deferred

and existing projects subjected to cost cuts. We think 2019 will be a less volatile and

also quiet year for the sector where the focus will be on executing and extracting

cost savings from current orderbook. Two larger projects will be in focus, namely the

Penang Transport Master Plan and Pan Borneo Sabah.

Contractors have to adjust to a new normal of lower margins and more competition

given the new landscape. On a more positive note, greater transparency and less

bureaucracy will be more apparent going forward.

While we are less excited on near-term prospects, valuations of -2SD of 5-year mean

would suggest the majority of bad news is already priced in and incremental positive

newsflow would act as a re-rating catalyst. Our large-cap BUY is Gamuda for its

exposure to the PTMP and other large-scale government projects when they are

eventually revived. Our small-cap pick is Kimlun for its exposure to the affordable

housing segment and also the expected surge in manufacturing contracts in

Singapore.

Gamuda, Muhibbah and

Kimlun

Market Focus

Page 9

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Consumer

Neutral

After surging to 132.9 points, the highest reading in 20 years in 2Q19, the recent

MIER consumer sentiment index (CSI) for 3Q19 contracted by 25.4 points q-o-q to

107.5points. The sharp decline was largely expected as we have forewarned that the

CSI would moderate from its 20-year high once the post-GE14 euphoria dissipates,

given that the survey was done right after GE14 with hopes riding high on the new

administration. Despite the sharp contraction, the index is still above 100 points

threshold of optimism, indicating still positive but more selective consumption pattern

going forward,

The improved consumer sentiments are reflected on the recent 3Q GDP announced by

the authorities where private consumption growth accelerated to 9.0% y-o-y in 3Q18

(2Q18: +8.0%). Furthermore, private consumption grew steadily at 2.5% on a

seasonally adjusted (SA) q-o-q basis (2Q18: +3.0%), above the 2015-2017 average SA

q-o-q growth of 1.5%.

In line with the CSI, we expect the consumption growth to be strong in 2H18 before

moderating in 2019. This is because we observe that many consumers have taken

advantage of the tax holiday (Jun-Aug 2018) to engage in big-ticket purchases such as

motor vehicles and household appliances prior to the implementation of the sales and

service tax (SST). We believe the bulk of these big ticket purchases are likely to involve

personal financing such as hire purchase and/or instalment loans, which could limit

their propensity to consume going forward, in view of the more leveraged household

balance sheet. Furthermore, the implementation of SST in September would also

weigh on consumption growth going forward.

In Budget 2017, The government has resorted to improve the livelihood of Malaysians,

particularly among the B40, by proposing measures such as (1) raising the minimum

wage to RM1,100 from RM1,050 initially – starting January, and (2) targeted petrol

and electricity subsidies. Overall, we believe that this Budget will be mildly positive for

the consumer sector as the initiatives outlined will help to offset the impact of rising

cost of living, but do not serve as a significant catalyst for the sector.

Among the consumer stocks under our coverage universe, British American Tobacco

(HOLD, TP: RM35.60) could be the beneficiary of Budget 2019 as the government has

reiterated its commitment to clamp down on smuggling activities. The government is

aiming to regain at least RM1bn in lost revenue due to illicit trade.

At present, the Bursa Malaysian Consumer Product Index (BMCPI) is trading at a

forward PE of 22x, which is at +2SD of its historical mean. Although we believe that

the sector could be subjected to potential earnings upgrades, given the improved

consumer sentiments, we believe that this has largely been priced in by the market in

view the relative outperformance of the index and its rich valuation.

On the other hand, we wish to highlight that increased cost pressures driven by (1)

labour shortage issues and rising labour costs due to a higher minimum wage

threshold, (2) weakening ringgit vs USD leading to more costly imported products, and

(3) higher cost of production with the authorities expected to float the RON95 price in

2Q19, and the implementation of digital tax. These could exert downward pressures

on companies’ profit margins, particularly in an increasingly competitive operating

environment, coupled with expectations of moderating consumption in 2019 that may

restrict companies’ ability to pass on any cost increase.

As a whole, we are maintaining our Neutral stance on the sector prospects, given that

(1) we expect consumption growth to moderate moving into 2019, (2) we believe that

the BMCPI has largely priced in the vastly improved consumer sentiments in view of its

rich valuation, and (3) rising cost pressures.

Market Focus

Page 10

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Gaming

Neutral

The sector is dominated by Genting Group and number forecasting operators (NFOs).

In Budget 2019, the bulk of the sin tax increase was primarily targeted at the Genting

group where the government proposed: (1) casino licence fees to be increased from

RM120m to RM150m per annum, and (2) casino duty to be raised from 25% to 35%

on gross gaming income.

The punitively high casino tax and increased license fees will adversely impact the

group’s earnings prospects. We estimate the Genting Malaysia’s (HOLD, TP: RM4.65)

earnings to drop by 26% y-o-y in FY19 even with the progressive launch of the

Genting Integrated Tourism Plan (GITP).

For the number forecast operators (NFOs), they are spared from increases in both

gaming tax and betting duty, although the special draws will be reduced by half. This

will have <5% earnings impact to the NFOs.

For NFO players, other than an attractive dividend yield of >6%, other positive

catalysts such as (1) sustainably high consumer sentiments, (2) ability to introduce

successful new game variants, and (3) intensified efforts by the regulators to curb

illegal number forecast operators’ (NFOs) activities could also boost their ticket sales.

Regulatory direction remains the major downside risk for the sector. The punitively

high casino tax and curbing of special draws announced in Budget 2019 have

illustrated the authorities’ commitment to (1) raise its fiscal revenue without causing

any social outcry, and (2) reduce gambling activities in Malaysia. We wish to highlight

that Act 65 of the Gaming Tax Act 1972 allows the government to adjust gaming tax

rate beyond the Budget period.

Genting Bhd (GENT) remains our top pick of the sector from a valuation perspective.

We maintain our BUY recommendation on GENT with RM9.45 TP. As the parent

company of GENS and GENM, we believe that GENT offers cheaper exposure to both

these subsidiaries.

Genting

Gloves

Neutral

We expect volume growth to be supported by higher demand and capacity expansion.

The sector has a 5-year volume CAGR of 12.0% from CY12-CY17. As for the type of

gloves, there is a gradual shift from latex to nitrile gloves that provide protection

against protein allergy and better comfort. Glove players are catching up to this trend

as they focus more on nitrile gloves for their upcoming expansion plans. We deem this

a positive development as nitrile gloves have higher margins vs. latex gloves. We

forecast volume growth for Malaysian glove players at 19%/11% for FY18/19F.

Glove players will see some margin expansion in the coming quarters as they benefit

from the more favourable exchange USD/MYR exchange rate as there is a timelag in

adjusting ASPs of 1-2 months. Margins will also improve as glove players enhance their

cost efficiency via higher automation.

We believe positives are priced in, given the elevated valuations of the sector. We have

FULLY VALUED calls on both Hartalega and Top Glove where as we have a HOLD call

for Kossan Rubber Industries.

None

Market Focus

Page 11

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Healthcare

Overweight

We maintain our positive stance on sector moving into 2019. The sustained strength

of domestic economic activities should improve healthcare affordability and help price-

sensitive patient switch back from public to private healthcare.

With the abolishment of GST, we expect the profit margin for private healthcare

services providers to be enhanced going forward given that they have been absorbing

the 6% GST input tax on drugs and medicine under the exempt supply.

In Budget 2019, the government has made the following proposals: (1) allocating

RM50m for the specific purpose of treating rare diseases; (2) widening the Public-

Private Partnership programme where the government will invest in the healthcare

facilities while the private sector will invest to deliver the best quality of service to the

people; and (3) allocating RM20m for the Malaysia Healthcare Tourism Council

(MHTC) to generate 25% growth in a year, and allocating RM10m per annum to make

available healthcare services for the parents of the contract service officers working

with the government.

Besides that, the government will pilot a national B40 Health Protection Fund to

provide free protection against the top 4 critical illnesses for up to RM8,000 and up to

14 days of hospitalisation with an income cover of RM50 per day starting 1 January

2019. In other words, a hospitalisation income of RM700 per annum is available.

We believe that the proposals outlined above, particularly the ones that focus on

growing the healthcare tourism industry and the national B40 Healthcare Protection

Fund, will strengthen the private healthcare sector and benefit the key players.

We maintain that the long-term structural dynamics, such as (1) an ageing population,

(2) growing affluence, and (3) broader insurance coverage, will remain supportive of

the private healthcare sector.

Nonetheless, the sustained weakening of MYR vs USD could increase the cost of

imported drugs, which will drag the profit margins of hospital operators. Other risks

include longer-than-expected gestation period for their new hospitals and increased

competition from other private healthcare providers.

We continue to like IHH Healthcare (BUY, TP: RM6.35), and KPJ Healthcare (BUY, TP:

RM1.30).

IHH Healthcare, KPJ

Media

Neutral

Despite the uptick in consumer sentiment post-GE14, industry adex spending still

remains on a downtrend, implying this is more of a structural issue rather than cyclical.

The liberalisation of media sector in Malaysia could introduce new players in the

market that would affect the dominant position of the existing players. The

government is also mulling new policies regarding the ownership of media companies

by political parties – Star and Media Prima will be the most affected.

Weakening ringgit vs. USD is also negative for the sector due to higher foreign content

fees and newsprint costs.

The saving grace is valuation is at depressed level, while balance sheets of media

companies are still very healthy (net cash position or low gearing, except for Astro).

None

Market Focus

Page 12

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Oil & Gas

Neutral

Oil prices have lost almost a third of their value since early Oct 2018, weighed down by an

emerging supply overhang and widespread financial market weakness. Saudi Arabia raised oil

production to an all-time high in Nov 2018, pumping 11.1 to 11.3 million barrels per day

(mmbpd).

Earlier expectations were that Saudi will lead talks to re-impose production quotas and cut

production by 1.0-1.4 mmbpd to tackle the supply glut. However, following the Jamal Khashoggi

incident, speculation is rife that the US may have more bargaining power with the Saudis to keep

oil prices low. OPEC will meet in Vienna on 6 December to discuss output policy together with

some non-OPEC producers, including Russia.

If there is indeed an agreement to reduce production, which is our base-case scenario, we expect

Brent crude oil prices to recover to around US$70/bbl and average in the range of US$70-75/bbl in

2019. On the other hand, if OPEC fails to come to a solution given the complex politics involved,

Brent could stay depressed and average in the US$60/bbl region in 2019. We do not expect a deep

rout to US$50/bbl or below for Brent, as any further oil price declines will lead to lower-than-

expected US shale production in 2019, thus supporting the case for a reversal of prices.

Serba Dinamik is our top pick for the O&G sector as demand for the maintenance and operation

(M&O) segment has proven to be reliable and less susceptible to volatile movements of oil prices.

Serba Dinamik,

Hibiscus Petroleum

Plantations

Neutral

We foresee higher CPO prices in 2019, on the back of: 1) stronger demand from CPO restocking

by major importing countries amid current low price levels – countries such as India need imported

CPO to meet their domestic edible oil demand; 2) the brief dip in global supply from declining

Indonesian output after a bumper 2018 crop; and 3) better biodiesel economics due to CPO’s price

differential with crude oil price. We expect CPO price to recover to US$610 per MT in 2019 before

reaching US$611 per MT in 2020.

We favour planters with younger tree age profiles for their higher volume growth. Volume and

yield expansion can benefit margins as long as costs are well-managed, we thus believe that

efficient planters can enjoy another leg of earnings expansion beyond a CPO price recovery. We

also like planters with a strong balance sheet, which would allow them to take advantage of any

opportunistic brownfield acquisitions, expand value chains downstream, and/or to diversify their

businesses to other crops.

TSH is a BUY as it remains well-positioned for any upturn and sustained recovery in CPO prices

given its pure upstream exposure and rising CPO yield.

TSH Resources

Property

Neutral

While the property market will remain challenging in the near term, we expect the unveiling of the

new National Housing Policy by Dec 2018 to help address the issues of affordability and supply

glut. A comprehensive review to the existing housing development policy is required to rectify the

structural problems.

We believe the introduction of the National Home Ownership Campaign in 1H2019 with stamp

duty waivers will be a major catalyst for developers to clear their unsold inventory. Nevertheless, it

could still take some time for the property overhang to be absorbed by the market to achieve a

balanced supply-demand dynamics.

As more developers venture into the affordable housing segment amid the challenging

environment, stiff competition in an increasingly crowded space is expected to result in weaker

profitability. Sustaining their sales momentum will be a key task for developers in 2019 given the

lack of earnings growth

Our top sector pick is Matrix Concepts which has consistently outperformed its larger peers with

record high property sales due to its impeccable track record in township developments. Low land

cost remains its inherent competitive advantage which will continue to underpin its strong

profitability. Its valuation remains undemanding at 6x FY19 PE despite its sustainable earnings

visibility and high dividend yield of ~6.5%.

Matrix Concepts

Market Focus

Page 13

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

REIT

Neutral

Rental reversion growth is expected to be moderate-to-low for all subsectors. Retail rents

and occupancy should remain resilient at prime locations, but weak consumer sentiment

and spending will cap rental reversion. Office assets will focus on maintaining occupancy

as oversupply conditions persist, while softer business conditions (weaker general

economy, a depreciated ringgit, minimum wage hikes) will pressure rents for both office

and industrial spaces.

Inorganic growth via acquisitions will be a running theme in the face of weak organic

growth. However, the key point remains whether the REITs can inject assets at a price that

will be DPU-accretive to unitholders.

CMMT is our top pick as we think its current valuations are attractive. Despite having

negative rental reversion for its Klang Valley malls, overall portfolio saw positive rental

reversions supported by the Gurney Plaza and East Coast Mall. We think that its asset-

enhancement projects will bear fruit in the coming quarters. We have BUY rating with a TP

of RM1.40 that is based on DDM with 7.7% cost of equity and 1.2% terminal growth. We

also like Sunway REIT, in view of its strong DPU growth as income contributions resume,

following the completion of Sunway Putra refurbishments, plus its visible pipeline of

potential asset injections from sponsor Sunway Bhd.

CMMT, Sunway REIT

Shipping

Neutral

LNG spot rates are expected to improve moderately in 2019 as newbuild deliveries are

toned down at an estimated 36 (51 in 2018, 26 in 2017), thus allowing demand to catch

up to the currently oversupplied market.

Crude tanker rates were generally tepid in 2018 on the back of vessel oversupply issues

with the Baltic Dirty Tanker Index (BDTI) averaging 9% lower for the year. With no major

vessel supply control measures in view, the current rates may persist with muted growth –

barring an uptick in petroleum shipping demand.

We have a HOLD call on MISC, as its organic earnings outlook remains mild from softer

charter rates which offset the positive impact of its fleet and asset expansion. The group is

still seeking inorganic growth, especially within the offshore space, which may have the

potential to transform its outlook.

None

Technology

Neutral

After two years of exceptionally strong growth (partly due to the memory segment), we

expect the semiconductor industry to register weak growth in 2019 amid slowing demand

and risks of escalation foe the ongoing US-China trade war. We expect the sector to

undergo a cyclical downturn in 1H19, before starting to recover in 2H19 after the

inventory adjustment period is over.

We think smartphone unit sales is a headwind going into 2019 as the replacement cycle

becomes longer, amid the lack of new innovative features. Similar to past few years, the

investment theme will still be on content winners that can sustain earnings growth (5G,

sensors, automotive, etc.), but investors might need to be mindful of their entry and exit

strategies as this is likely to be a “crowded” trade again.

For the near term, we advise investors to stay on the sidelines given the disappointing

smartphone sales and risks of potential escalation of the US-China trade war. While stocks

under our coverage have corrected substantially since then, we believe it is still early for

investors to bottom-fish. We recommend a re-visit in early 2019 when there is more

visibility on fresh catalysts – particularly on new business expansion (Inari, Unisem, MPI) or

new content wins (GTB).

None

Market Focus

Page 14

Sector Outlook (cont’d)

Sector Outlook Top Stock Picks

Telecommunication

Neutral

Amid already high penetration rates in Malaysia, we expect competition and data

pricing to remain stable in the mobile segment. Data now contribute approximately

55-60% of mobile operators’ revenue, which means diminishing impact from declining

legacy voice and SMS revenue over the next few years. It is possible for the mobile

industry to return to a low-growth period, as long as data pricing stays rational.

Spectrum could be a potential regulatory issue for mobile players as the 700MHz

spectrum auction has been delayed, while the 2600MHz spectrum extension period

will expire in 2019.

For the fixed-line segment, the implementation of MSAP (Mandatory Standard on

Access Pricing) had been a major regulatory change that has a huge impact on

lowering broadband pricing in Malaysia. We expect continued regulatory pressures to

weigh on TM’s share price.

We have a BUY call on Axiata given its undemanding valuation, and expect the

improvement in Celcom and XL’s results to be the key re-rating catalysts. Asset-

monetisation initiatives for its stake in edotco and associates (M1 and Idea-Vodafone)

will be a bonus, if they materialise.

Axiata

Utilities

Neutral

Energy demand is expected to grow in tandem with the relatively healthy economic

outlook in Malaysia, which will continue to underpin the growing recurring income for

utility players.

The government remains committed to the power sector reform with the

implementation of the incentive-based regulation (IBR) framework that will provide

strong earnings clarity for utility players as well.

Our top pick is Tenaga Nasional (TNB) for its more attractive valuation and improving

earnings visibility from the implementation of the IBR framework.

Tenaga Nasional

Market Focus

Page 15

Top stock picks

Source: AllianceDBS Price date: 3 Dec 2018

Top Stock Picks

Stocks Key Investment Merits

Hong Leong Bank Conservative yet solid. Even with the implementation of MFRS 9 in the most recent quarter, Hong Leong Bank (HLBK)

recorded lower annualised net credit costs y-o-y at 6bps (1QFY18: 8bps). On a q-o-q basis, this was only slightly higher

by 3bps. The group's asset quality continued to improve both q-o-q and y-o-y, while capital ratios remained solid. The

group has shown resilient performance despite challenging market conditions. HLBK is targeting to lower its cost-to-

income (CTI) ratio to <40% over the medium term, and is progressively making inroads – CTI ratio in 1QFY19 fell 1ppt

to 42% y-o-y.

BOCD to be a mainstay in HLBK’s earnings. Bank of Chengdu (BOCD), HLBK’s associate, has finally listed its shares on

the Shanghai Stock Exchange. As HLBK did not participate in the initial public offering (IPO), its stake in BOCD has been

slightly diluted as the issue size was relatively small. From its previous stake of 19.99%, its stake is now diluted to 18%.

As such, there was minimal impact on HLBK’s earnings. HLBK continues to equity account for this investment. BOCD’s

contribution to HLB’s pre-tax profit remains at 15-17%, which will provide robust support amidst a more challenging

domestic operating environment. BOCD has recorded strong performance during the quarter, with solid 16% ROE,

good loan growth of 19% and improving asset quality.

Potential catalyst: Loosening its grip on liquidity. What remains a resistance is the group’s conservative stance on tight

liquidity by keeping loan-to-deposit ratio one of the lowest in the industry at 82%. Should the bank decide to loosen

this metric, we believe there will be a lot more upside it can achieve in terms of NIM, earnings and ROE. HLBK’s digital

agenda could also add a twist to valuations.

BUY with RM23.15 TP. Our TP is based on the Gordon Growth Model (assuming 12% ROE, 4% growth and 8% cost of

equity), equivalent to 1.8x CY19F BV.

Axiata Gradual improvement to drive recovery. Axiata's share price is down by 34% YTD, and we believe this has largely priced

in the near-term weak performance by its OpCos. Gradual improvement in Celcom and XL results will be the key

catalyst to drive recovery in share price. Asset monetisation of its stake in edotco, M1 and Idea-Vodafone will be a

bonus, if they materialise.

Celcom. Celcom lost significant market share in 2015 and 2016, which heavily impacted its margins. Its EBITDA margins

had been relatively weak at 35-37% and below peers. We believe Celcom's margins should start to improve from FY19

onwards, underpinned by cost optimisation efforts, while network investment should also taper off as Celcom already

caught up to its peers in terms of 4G coverage.

XL. Early signs are pointing towards a recovery for the Indonesian mobile sector in 2H18 as incumbents start to raise

data pricing. With high service revenue exposure to data (60-70%), XL is well positioned to capitalise on improving data

yields in Indonesia. Rising contributions from regions outside Java, where XL has been aggressively expanding in over

the past two years, should also further buttress the carrier's revenue growth.

BUY, TP of RM5.05 based on SOP valuation.

Recommend

ationTarget Price Current Price

Market Cap

(RM)CY2018 CY2019 CY2018 CY2019 CY2018 CY2019 CY2018 CY2019 CY2018 CY2019

Hong Leong Bank BUY 23.15 20.62 42,180.3 15.6x 14.6x 13% 6% 2.6% 2.9% 1.7x 1.6x 11% 11%

Axiata BUY 5.05 3.95 35,830.4 32.7x 22.7x 19% 44% 2.6% 3.7% 1.4x 1.4x 4% 6%

AMMB BUY 4.95 4.24 12,780.1 10.0x 9.0x 9% 11% 4.0% 4.5% 0.7x 0.7x 8% 8%

Gamuda BUY 3.50 2.26 5,577.8 10.0x 8.7x (3%) 14% 3.9% 3.9% 0.7x 0.7x 7% 8%

TIME dotCom BUY 9.40 8.17 4,768.1 17.2x 16.3x 56% 6% 1.5% 1.5% 1.9x 1.7x 12% 11%

CapitaMall Malaysia Trust BUY 1.40 1.02 2,085.1 13.3x 13.2x (4%) 1% 8.0% 8.1% 0.8x 0.8x 6% 6%

Matrix Concepts BUY 2.50 1.93 1,452.9 6.4x 5.8x 8% 10% 6.5% 6.9% 1.1x 1.0x 18% 18%

Media Chinese BUY 0.29 0.21 345.9 15.3x 8.0x 233% 91% 7.8% 7.5% 0.4x 0.4x 3% 5%

Price/ BVPS ROAEP/E EPS Growth (YoY) Dividend Yield

Market Focus

Page 16

Top Stock Picks (cont’d)

Stocks Key Investment Merits

AMMB Holdings Results from business strategy ramping up. With most of the noise from merger talks out of the way, AMMB has been

looking to turn around its operations, which had previously been boosted by recoveries instead of organic growth. After

unveiling its Top 4 aspirations, we think the group is just beginning to reap the benefits from its new business strategy.

Over the past six quarters, AMMB’s SME loan growth has beaten the industry average (double digits against 2-8%),

gradually increasing its market share by c.1ppt over the same period. Its focus on the affluent and mass affluent

segments has also resulted in robust results for its credit card and mortgage businesses, both also showing strong

double-digit growth. Asset quality has been relatively stable, with blips coming more from its corporate loan portfolio.

We note that the group has been conservative in making impairments, with recovery surprises observed in previous

quarters.

Controlling its overheads. AMMB’s cost-to-income ratio for 1HFY19 was at the low end of its guidance of less than 55%.

Looking ahead, the group is committed to reining in its overheads through its BET300 initiative as well as stretching out

investments in view of the more challenging operating environment, i.e. soft capital markets impacting non-interest

income and keen deposit competition hurting NIMs. The group’s BET300 initiative is expected to save RM300m over

three years. With the conclusion of its MSS programme in 4QFY18, the group will save around RM80m in personnel

costs beginning FY19. It targets to realise around RM100m in costs this fiscal year, with the remainder to be recognised

in FY20. Our forecast assumes normalising credit costs and does not reflect the potential cost savings in FY20. If the

group is able to successfully deliver on its initiatives, we think reaching a 9.0% ROE in FY20F is not impossible.

Potential catalyst. The stock would likely re-rate as performance improvements continue to roll in to offset normalising

recoveries. Renewed interest in major shareholders potentially divesting their stakes could also spark a re-rating.

BUY with RM4.95 TP. AMMB’s valuations have remained depressed thus far, trading at levels below 1SD of its 6-year

mean. The stock is currently trading at 0.7x CY19F BV, and we think the market has yet to price in the group’s positive

results from its business strategy going forward.

Gamuda Valuations at trough levels and discount to sector average. Valuations appear to be a steal, trading at CY19F PE of 9x,

which is more than -2SD below mean and a discount to the sector average of 10x. With the changing construction

landscape now and loss of recurring earnings for Splash, it is unlikely that valuations will revert to even -1SD below mean

or 16x PE any time soon. At our new SOP-derived TP of RM3.50, the stock will trade at 13x FY20F EPS which is about -

2SD below mean.

PTMP approvals gaining traction. We understand there has been more progress over the last few months in terms of

securing the required approvals for the Penang Transport Master Plan (PTMP). The last few months have seen the public

display and concerns on the project being ironed out. As it stands, the Federal Government has approved the LRT project

in principle. We expect the consortium partners within SRS Consortium (Gamuda has a 60% stake) to sign and finalise

the PDP agreement in December 2018 which will likely coincide with the relevant federal government agencies' approval

of the railway scheme for the LRT and Environmental Impact Studies for Pan Island Link 1 and reclamation works.

Property sales to help fill earnings void from Splash. Gamuda's FY19F presales target stands at RM4bn, of which

RM2.3bn will come from local projects and the balance of RM1.7bn from overseas. Almost half or RM1.05bn of local

property sales is expected to be anchored by three newer townships which are Gamuda Cove, Gamuda Gardens and

Twentyfive7. Its recently announced new project Anchorvale Crescent in Sengkang Singapore (GDV of S$650m;

S$1,100-1,200 psf) is expected to do as well as Gem Residences, as it is designated as an Executive Condominium and is

not likely to be impacted by the cooling measures. The company is expecting to rake in RM550m in property sales from

this project in FY20F.

Market Focus

Page 17

Top Stock Picks (cont’d)

Stocks Key Investment Merits

TIME dotCom A data-centric player. We like TIME for its strong growth profile, contributed by both its wholesale (domestic and

international) and retail segments. While the reduction in fixed broadband prices might have short-term impact on

margins, we believe this is beneficial for TIME in the medium-to-long term as it gains meaningful market share.

Cutting retail broadband prices. TIME has responded to competition by lowering its entry-level fibre broadband prices as

well as significantly boosting its speed offerings. TIME broadband packages now start from RM99-199 for 100Mbps-

1Gbps, compared to its entry-level package of RM149 for 100Mbps previously.

Strong balance sheet to support capex. As at 30 September, TIME had a net cash position of about RM197m.

Management has indicated before that they are comfortable to gear up to 0.3x net-debt/equity, implying about RM1bn

of debt headroom. Coupled with its strong cashflow, we believe this is sufficient to fund any potential major capex in the

future, if needed (especially on the domestic network).

BUY, TP of RM9.40. Our TP is based on DCF-valuation assuming 7.6% WACC and 2.5% terminal growth.

CMMT Take opportunity. We believe CMMT’s current valuations represent an attractive opportunity. The stock offers a yield of

c.8%, the highest in our Malaysian REIT universe. At 0.8x NAV, the stock is trading at -2SD of its mean since 2014. We

believe the stock’s retracement (-20% YTD) in response to the general weakness of its Klang Valley malls has been

excessive. The attractive yields would appeal to dividend-seeking investors.

Portfolio steady with geographically diversified strategy. While CMMT’s Klang Valley malls saw negative rental reversions

in 1H18, the group’s overall portfolio rental reversions are positive – lifted by Gurney Plaza in Penang and the East Coast

Mall in Kuantan. Asset enhancements and reconfiguration of assets will benefit CMMT as it keeps up with the trends in

attracting shoppers. The improving consumer consumption would be supportive for the group’s business.

Jumpa to revive Sungei Wang. To improve Sungei Wang’s performance and to ensure the mall complements the Bukit

Bintang-KLCC shopping belt, CMMT has embarked on a major asset- enhancement initiative with an estimated cost of

RM55m. This is expected to complete in 1Q19.

BUY, TP of RM1.40. Our DDM-derived TP (7.7% cost of equity, 1.2% terminal growth) is at RM1.40. The share price is

supported by an attractive FY18 DPU yield of 8.0%.

Matrix Concepts Record-breaking property sales. Matrix raked in property sales of RM517m in 2QFY19 (+35% q-o-q, +48% y-o-y), which

is an all-time high. Accordingly, the company's unbilled sales stood at a record high of RM1.4bn. Matrix has continued to

chalk up strong sales despite the challenging environment which has affected most of its peers.

More launches in the pipeline. The company has a launch pipeline of RM1.7bn in FY19 (vs RM1.2bn in FY18), of which

RM807m has been rolled out in 1HFY19. We expect its maiden project in KL, Chambers KL serviced residences (with a

GDV of RM310.6m) to contribute strongly to its 2HFY19 property sales.

Low land cost is unrivalled competitive advantage. Bandar Sri Sendayan remains the jewel in its crown given the low

average land cost of RM7psf (with infrastructure in place) when its affordably-priced properties are already selling at

~RM200psf, leading to significantly higher-than-average profit margins.

BUY, TP of RM2.50. We continue to like Matrix for its impeccable track record in township developments. Its valuation

remains undemanding at 6x FY19 EPS despite having sustainable earnings visibility and a high dividend yield of ~6.5%.

We maintain our BUY recommendation and TP of RM2.50.

MCIL Unjustified valuation. At 14% FCF yield with net cash making up 78% of market capitalisation, MCIL is trading way

below its potential break-up value, which we believe is unjustified even though the industry outlook might not be

favourable. In our view, the controlling shareholder already holds a 50% stake in MCIL and it will not take much capital

to privatise the company. With the last tranche of its medium-term notes being redeemed by February 2019, any

potential corporate manoeuvre would be easier to execute by then.

Strong balance sheet and healthy cashflow. MCIL took up RM450m debt financing in FY13 to partly fund its 41

sen/share capital repayment exercise. With a slightly lower dividend payout of 50% (vs. 60% previously), the company

has built back its cash pile and is presently in a net cash position of RM270m after 4-5 years.

BUY, TP of RM0.29. We value MCIL conservatively at 0.6x BV (about -1.5SD) and derive a RM0.29 TP.

Market Focus

Page 18

Appendix: 3Q18 earnings summary

Financial EPS vs ADBS vs consensus

Company Sector quarters Change estimates estimates UMW Holdings Automotive 3QFY18 ▲ Below Above

Bermaz Auto Automotive 1QFY19 ◄► Inline Inline

AirAsia Aviation 3QFY18 ▼ Below Below

AirAsia X Aviation 3QFY18 ▼ Below Below

MAHB Aviation 3QFY18 ◄► Inline Inline

Affin Holdings Banking 3QFY18 ◄► Above Above

AMMB Banking 2QFY19 ▲ Above Above

BIMB Holdings Banking 3QFY18 ◄► Above Above

CIMB Group Banking 2QFY18 ▲ Above Above

Hong Leong Bank Banking 1QFY19 ▲ Inline Inline

Hong Leong Financial Group Banking 1QFY19 ▲ Inline Inline

Maybank Banking 3QFY18 ◄► Inline Inline

Public Bank Banking 3QFY18 ◄► Inline Inline

RHB Bank Bhd Banking 3QFY18 ▲ Above Above

Cahya Mata Sarawak Building Materials 2QFY18 ◄► Inline Inline

Lafarge Building Materials 2QFY18 ▼ Below Below

MMC Conglomerate 3QFY18 ▼ Below Below

Gamuda Construction 3QFY18 ▲ Above Above

IJM Corp Construction 2QFY19 ▼ Inline Inline

Muhibbah Engineering Construction 2QFY18 ◄► Inline Inline

Kimlun Corporation Construction 3QFY18 ▼ Inline Inline

Sunway Construction Construction 3QFY18 ▼ Inline Inline

WCT Holdings Construction 3QFY18 ▼ Inline Inline

BAT Consumer 3QFY18 ▲ Inline Inline

Padini Consumer 1QFY19 ◄► Inline Inline

Petronas Dagangan Consumer 3QFY18 ◄► Inline Inline

Sasbadi Holdings Consumer 4QFY18 ◄► Below Below

SKP Resources EMS 2QFY19 ▼ Inline Inline

VS Indsutry EMS 4QFY18 ▼ Below Below

QL Resources Consumer 2QFY19 ◄► Inline Inline

AEON Credit Finance non-bank 2QFY19 ◄► Inline Inline

Bursa Malaysia Finance non-bank 3QFY18 ◄► Inline Inline

Berjaya Sports Toto Gaming 1QFY19 ▼ Inline Inline

Genting Gaming 3QFY18 ◄► Inline Inline

Genting Malaysia Gaming 3QFY18 ◄► Inline Inline

Magnum Gaming 3QFY18 ◄► Inline Inline

Hartalega Glove 2QFY19 ◄► Inline Inline

Kossan Glove 3QFY18 ◄► Inline Inline

Top Glove Glove 4QFY18 ▲ Inline Inline

IHH Healthcare Healthcare 3QFY18 ◄► Inline Below

KPJ Healthcare Healthcare 3QFY18 ◄► Inline Inline

Astro Media 2QFY19 ▼ Below Below

Media Chinese Media 2QFY19 ◄► Inline Inline

Media Prima Media 3QFY18 ▼ Below Below

Star Media 3QFY18 ▼ Below Below

Market Focus

Page 19

Financial EPS vs ADBS vs consensus

Company Sector quarters Change estimates estimates Bumi Armada Oil & Gas 2QFY18 ▼ Below Below

Hibiscus Oil & Gas 4QFY18 ▲ Inline Inline

Dialog Group Bhd Oil & Gas 4QFY18 ◄► Inline Inline

Pantech Group Oil & Gas 1QFY19 ▼ Inline Inline

Sapura Energy Oil & Gas 1QFY19 ▼ Below Below

Serba Dinamik Oil & Gas 2QFY18 ◄► Inline Inline

Wah Seong Oil & Gas 2QFY18 ▼ Inline Inline

CB Industrial Product Plantation 3QFY18 ◄► Inline Inline

Genting Plantation Plantation 3QFY18 ▼ Below Below

IOI Corporation Plantation 1QFY19 ◄► Inline Inline

KL Kepong Plantation 4QFY18 ◄► Below Below

Sime Darby Plantation Plantation 1QFY19 ▼ Below Below

Felda Global Ventures Plantation 3QFY18 ▼ Below Below

PPB Group Plantation 3QFY18 ◄► Inline Inline

TSH Resources Plantation 3QFY18 ◄► Inline Inline

Westports Holdings Port 3QFY18 ◄► Inline Inline

Eastern & Oriental Property 2QFY19 ◄► Inline Below

MKH Property 4QFY18 ◄► Inline Inline

SP Setia Property 3QFY18 ▼ Below Below

UEM Sunrise Property 3QFY18 ◄► Inline Below

Eco World Development Property 3QFY18 ▼ Below Below

Matrix Concepts Property 2QFY19 ◄► Inline Inline

Yong Tai Property 1QFY19 ▼ Below Below

Sunway Property 3QFY18 ◄► Inline Inline

Axis REIT REIT 3QFY18 ◄► Inline Inline

CapitaMall Malaysia Trust REIT 3QFY18 ◄► Inline Inline

KLCC Stapled REIT 3QFY18 ◄► Inline Inline

Pavilion REIT REIT 3QFY18 ◄► Inline Inline

MRCB-Quill REIT REIT 3QFY18 ◄► Inline Inline

Sunway REIT REIT 1QFY19 ◄► Inline Inline

MISC Shipping 3QFY18 ◄► Inline Inline

Malaysian Pacific Industries Technology 1QFY19 ◄► Inline Inline

Globetronics Technology 3QFY18 ◄► Below Inline

Inari Amertron Technology 1QFY19 ▼ Below Below

Unisem Technology 3QFY18 ◄► Inline Inline

Axiata Telecommunication 3QFY18 ◄► Inline Inline

Digi Telecommunication 3QFY18 ◄► Inline Inline

Maxis Telecommunication 3QFY18 ◄► Inline Inline

TIME dotCom Telecommunication 3QFY18 ▲ Above Above

TM Telecommunication 3QFY18 ▲ Above Above

Gas Malaysia Utilities 3QFY18 ▼ Below Below

Petronas Gas Utilities 3QFY18 ◄► Inline Inline

Tenaga Utilities 3QFY18 ▼ Below Below

YTL Power Utilities 3QFY18 ▼ Below Below

Market Focus

Page 20

Macro Data

Key Data Period m-o-m / y-o-y

chg

Prev. / Consensus

(y-o-y)

GDP 3Q18 0.3% / 4.4% +4.5% / +4.6% In 3Q18, growth was driven mainly by improvement in Manufacturing

(+5.0%), Services (+7.2%) and Construction (+4.6%). On the other

hand, the demand side was supported by private consumption (+9.0%),

private investment (+6.9%) and public consumption (+5.2%). Private

consumption remains the main driver of growth (57.5% of total GDP);

expanding faster at 9.0% y-o-y, benefitting from the remaining two

months of tax-free period. Additionally, net exports of goods and

services contracted by 7.5% in 3Q18, from a 1.7% growth y-o-y in

2Q18. Nonetheless, we are still confident that current fiscal reforms by

the new government such as standardisation of minimum wage across

the country and targeted fuel subsidy will likely provide favourable

domestic demand conditions that will drive Malaysia’s private

consumption growth towards the end of the year, contributing positively

towards 4Q18 GDP growth.

CPI Oct 18 +0.2% / +0.6% +0.3% / +0.6% During the month, price pressures were driven by key items in the basket

of goods, namely Food and Non-alcoholic Beverages (+1.2%), Housing

and Utilities (+2.1%) and Transport (+0.8%) sectors. On a seasonally

adjusted m-o-m basis, the consumer price index (CPI) expanded 0.2%

(September: +0.4%), mainly attributed to a normalising trend in prices

after the transition period from zero-rated Goods and Services Tax (GST)

to Sales and Services Tax (SST). Overall, we expect a slower-than-

expected increase in prices of goods after the re-implementation of SST,

coupled with a higher-base effect.

OPR Nov 18 3.25%^ 3.25% / 3.25% Bank Negara Malaysia (BNM) kept rates unchanged in its November

meeting. BNM expects inflation to average lower than earlier projections

in 2018. Overall, we believe that BNM will keep OPR steady at 3.25% at

least until mid-2019. However, there may be a possible review for a rate

cut of 25bps to spur economic activity if GDP growth falls below 4% in

the coming quarters.

Exports Sep 18 1.1% / +6.7% -0.3% / +6.7% During the month, export growth was led by expansion in major

segments: E&E (+6.5%), refined petroleum products (+20.5%), crude

petroleum (+54.4%) and LNG (+1.8%), while exports of palm oil and

palm oil-based products (-11.5%) declined. The reduction on a m-o-m

basis was partly due to lower public consumption of goods and

investments in infrastructure as the tax holiday period ended and SST

was implemented on 1 September. We revised our export growth

projection to 5.5 - 6.0% y-o-y in 2018.

PMI Nov 18 48.2^ 49.2/ - Nikkei reported that Malaysia’s manufacturing conditions continued to

contract to a six-month low at 48.2 during November, in line with the

trend of global PMI and other major countries such as US, Japan and

Singapore. This was mainly due to a reduction in total sales as demand

eased domestically impacted by the implementation of Sales and Services

Tax (SST) as well as depicting downside risks as overall demand fell

sharply.

IPI Sep 18 -0.4% / +2.3% +2.2% / +2.3% Industrial production index (IPI) growth was supported by expansion in

the Manufacturing (+4.8%) and Electricity (+4.2%) sectors, while the

Mining sector contracted 6.2%. However, the 3-month moving average

growth of 4.8% (August: +4.7%) suggests that the underlying growth

momentum continues to moderate particularly for the mining sector.

Source: AllianceDBS, Bloomberg Finance L.P * q-o-q ^ latest reading

Market Focus

Page 21

Macro Graphs

Malaysia GDP and Consumer Price Index growth Malaysia exports growth

Source: Department of Statistics Source: Department of Statistics

Malaysia industrial production and PMI index MGS 10-year and US Treasury 10-year yield spread

Source: Department of Statistics, Markit Source: Bloomberg Finance L.P

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Jan

-16

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6

Jan

-17

Mar

-17

May

-17

Jul-

17

Sep

-17

No

v-1

7

Jan

-18

Mar

-18

May

-18

Jul-

18

Sep

-18

No

v-1

8

%y-o-y%y-o-yGDP growth CPI

-40

-30

-20

-10

0

10

20

30

40

50

60

70

-30

-20

-10

0

10

20

30

40

Jan

-16

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6

Jan

-17

Mar

-17

May

-17

Jul-

17

Sep

-17

No

v-1

7

Jan

-18

Mar

-18

May

-18

Jul-

18

Sep

-18

% y-o-y% y-o-y

Others

E&E

O&G

40.0

45.0

50.0

55.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

Jan

-15

Ap

r-1

5

Jul-

15

Oct

-15

Jan

-16

Ap

r-1

6

Jul-

16

Oct

-16

Jan

-17

Ap

r-1

7

Jul-

17

Oct

-17

Jan

-18

Ap

r-1

8

Jul-

18

Oct

-18

% y-o-yIPI growth (lhs)Mfg IPI growth (lhs)Mfg PMI (rhs)

0.80

1.00

1.20

1.40

1.60

1.80

2.00

2.20

2.40Ja

n-1

6

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6

Jan

-17

Mar

-17

May

-17

Jul-

17

Sep

-17

No

v-1

7

Jan

-18

Mar

-18

May

-18

Jul-

18

Sep

-18

No

v-1

8

%

Brexit

Trump election Ringgit

strengthening

Market Focus

Page 22

AllianceDBS recommendations are based an Absolute Total Return* Rating system, defined as follows:

STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame)

BUY (>15% total return over the next 12 months for small caps, >10% for large caps)

HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps)

FULLY VALUED (negative total return i.e. > -10% over the next 12 months)

SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends

Completed Date: 4 Dec 2018 09:40:34 (MYT) Dissemination Date: 4 Dec 2018 11:48:33 (MYT)

Sources for all charts and tables are AllianceDBS unless otherwise specified.

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by AllianceDBS Research Sdn Bhd (''AllianceDBS''). This report is solely intended for the clients of DBS Bank Ltd, its

respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in

any form or by any means or (ii) redistributed without the prior written consent of AllianceDBS Research Sdn Bhd (''AllianceDBS'').

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS

Bank Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively,

the “DBS Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other

factors which we may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or

warranty as to the accuracy, completeness or correctness of the research set out in this report. Opinions expressed are subject to change without

notice. This research is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific

investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees

only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal or financial

advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of profit)

arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not

to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons

associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group, may have

positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and

other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can

be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments.

The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed, it may

not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no obligation to

update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned

schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on

which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual

results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED