AMANAHRAYA REAL ESTATE INVESTMENT TRUST (“AMANAHRAYA REIT...

Transcript of AMANAHRAYA REAL ESTATE INVESTMENT TRUST (“AMANAHRAYA REIT...

1

AMANAHRAYA REAL ESTATE INVESTMENT TRUST (“AMANAHRAYA REIT” OR

“THE FUND”)

Proposed disposal by AmanahRaya REIT of the fifteen (15) storey purpose-built office building

with two (2) basement levels constructed on two (2) pieces of lands held under PN 25414, Lot 21,

Seksyen 32 and PN 25415, Lot 22, Seksyen 32, Bandar Kuala Lumpur, Daerah Kuala Lumpur,

Negeri Wilayah Persekutuan Kuala Lumpur (“Wisma AmanahRaya” or the “Property”), to

Annex Sentral Sdn Bhd (“Annex” or the “Purchaser”), a wholly-owned subsidiary of

AmanahRaya Development Sdn Bhd (“ARDSB”), a wholly-owned subsidiary of Amanah Raya

Berhad (“ARB”) for a disposal consideration of RM78.00 million (“Proposed Disposal”)

1. INTRODUCTION

On behalf of the Board of Directors (“Board”) of AmanahRaya-REIT Managers Sdn. Bhd.

(“ARRM” or the “Manager”), the management company of AmanahRaya REIT, MIDF

Amanah Investment Bank Berhad (“MIDF Investment”), wishes to announce that the trustee

of AmanahRaya REIT, CIMB Islamic Trustee Berhad (“Trustee” or the “Vendor”) had on 23

June 2015 entered into a conditional sale and purchase agreement (“SPA”) with Annex for the

Proposed Disposal.

The Proposed Disposal is deemed to be a related party transaction pursuant to Chapter 9 of

Securities Commission Malaysia Guidelines on Real Estate Investment Trusts (“REIT

Guidelines”) due to the interests of certain directors and major shareholders as set out in

Section 8 of this announcement.

Details of the Proposed Disposal are set out in the ensuing sections of this announcement.

2. DETAILS OF THE PROPOSED DISPOSAL

2.1 Proposed Disposal

The Proposed Disposal entails the disposal by the Trustee, for and on behalf of AmanahRaya

REIT, of the Property to the Purchaser, together with the benefit of the existing tenancy with

Amanah Raya Berhad (“ARB”) dated 23 December 2013 (“Existing Tenancy”) on the

Property and subject to the conditions and restrictions-in-interest expressed or implied in the

documents of title to the Property but otherwise free from all interests, liens, charges and with

possession for a total consideration of RM78.00 million (exclusive of Goods and Services

Tax (“GST”)) (“Disposal Consideration”) to the Purchaser subject to the terms and conditions

contained in the SPA.

2.2 Description of the Property

The Property is a fifteen (15) storey purpose-built office building with two (2) basement

levels constructed on two (2) pieces of lands held under PN 25414, Lot 21, Seksyen 32 and PN

25415, Lot 22, Seksyen 32, Bandar Kuala Lumpur, Daerah Kuala Lumpur, Negeri Wilayah

Persekutuan Kuala Lumpur, both with leasehold tenures of 99 years expiring on 10 June 2065.

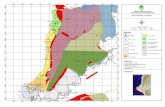

The Property is located in Section 32, Town of Kuala Lumpur and within the Central

Business District of Kuala Lumpur, the city’s traditional commercial centre and heart of the

banking sector. It fronts onto Jalan Ampang, and is sited close to the intersection of Jalan

Ampang with Jalan Gereja and Jalan Melaka. Located to the rear of the property is Sungai

Kelang.

2

Prominent office buildings in the vicinity include Menara Akademi Etiqa, Menara Bumiputra,

HSBC Building, OCBC Building, Wisma Lee Rubber, Wisma TAS, Wisma Damanjaya and

MOCCIS Building. Other notable landmarks within the wider vicinity include Bangunan

Sultan Abdul Samad, Rumah Persekutuan, Dataran Merdeka, Masjid Jamek and Central

Market (Pasar Seni).

Other information on the Property is as follows:

Postal Address Wisma AmanahRaya, 2, Jalan Ampang 50508, Kuala

Lumpur, Wilayah Persekutuan Kuala Lumpur, Malaysia

Land title details PN 25414 Lot 21 Seksyen 32 and PN 25415 Lot 22 Seksyen

32, Bandar Kuala Lumpur, Daerah Kuala Lumpur, Negeri

Wilayah Persekutuan Kuala Lumpur.

Tenure Leasehold tenures of 99 years each expiring on 10 June 2065

Registered owner CIMB Islamic Trustee Berhad (formerly known as CIMB

Trustee Berhad) (as trustee for AmanahRaya REIT)

Net land area for the Property 27,229 sq.ft.

Property use Fifteen (15) storey purpose-built office building with two (2)

basement levels

Age of the building Approximately 48 years

Number of car parking bays 64

Gross built-up area 237,386 sq.ft.

Net lettable area 153,908 sq.ft.

Occupancy rate as at 27 May 2015 100%

Gross Rental Income RM584,157.00 a month (equivalent to RM7,009,884.00 per

annum)

Encumbrances Charged to Affin Bank Berhad

Category of land use Not stated

Express conditions Condition(s) for PN 25414 Lot 21:

“(i)The Land hereby leased shall be used for the erection of

bank building and appurtenant thereto; (ii) The building or

buildings to be erected shall be of a type and to a plan

approved by Pesuruhjaya Ibu Kota Kuala Lumpur and shall

be erected on the land hereby leased within two (2) years from

the date of the commencement of this lease or within such

further term as may be approved by the Ruler-in Council and

the said building or buildings shall thereafter be maintained in

good order and condition to the satisfaction of the Ruler-in

Council; and (iii) The lessee shall pay and discharge all taxes,

rates, assessments and charges whatsoever which may be

payable for the time being in respect of the land hereby leased

or any buildings thereon or any part thereof whether levied by

the Kuala Lumpur municipality or any other Authority.”

Condition(s) for PN 25415 Lot 22:

“(i) The land hereby leased shall be used in conjunction with

the adjoining land held under A.A 4/62 for a Bank building

and shall not be used for any other purpose without the

consent of the Ruler in Council; and (ii) The lessee shall pay

and discharge all taxes, rates, assessments and charges

whatsoever which may be payable for the time being in

respect of the land hereby leased or any buildings thereon or

any part thereof whether levied by the Municipality or any

other Authority

3

Restriction in interest Nil

Net book value as at 31

December 2014

RM78.00 million

Market value as appraised by

valuer

RM76.00 million by Jones Lang Wootton

Date of valuation 27 May 2015

2.3 Salient terms of the SPA

The salient terms of the SPA are as follows:

(i) Agreement for Sale

Subject to the terms and conditions of the SPA, the Vendor shall sell and the

Purchaser shall purchase the Property together with the benefit of the Existing

Tenancy with ARB (“Existing Tenancy”) and subject to the conditions and

restrictions-in-interest expressed or implied in the documents of title to the Property

but otherwise free from all interests, liens, charges and with possession at the

Disposal Consideration.

On payment of the full Disposal Consideration, the Purchaser shall be granted the

following rights:

(a) all the Vendor’s rights, title and interest in and to the Property, including, for

the avoidance of doubt:

(i) the unfettered right to collect, demand, sue for, recover, receive and

give receipts for all moneys payable or become payable for the use or

possession or occupation of the Property including rights of way;

(ii) the benefit of and the right to sue on all obligations and covenants

with, or vested in, the Vendor and the right to exercise all powers of

the Vendor in relation to the Property, including the right to take

possession and/or sell the Property; and

(iii) all the Vendor’s causes and rights of action against any person in

connection with any report, valuation, opinion, certificate, consent or

other statement of fact or opinion given in connection with the

Property; and

(b) all the Vendor’s right, title, interest and benefit (whether present or future) in

relation to the Existing Tenancy including the right to receive the proceeds of

any claim insofar as they are related to the Property. All rentals paid or

payable and costs incurred in relation to the Existing Tenancy shall be

apportioned as at the date of full payment of the Disposal Consideration to

the Vendor.

[The rest of this page is intentionally left blank]

4

(ii) Terms of Payment

Subject to the fulfilment of all conditions precedent below, the Disposal

Consideration shall be satisfied in the following manner:

(a) Ringgit Malaysia Seven Million Eight Hundred Thousand

(RM7,800,000.00) (exclusive of GST) less any retention sum required to be

held under the Real Property Gains Tax Act 1976 shall be paid to the Vendor’s

solicitors on the execution of the SPA as deposit and towards account of the

Disposal Consideration (herein referred to as “the Deposit”) and the Deposit

shall be released to the Vendor within seven (7) business days from the date of

the SPA;

(b) Ringgit Malaysia Seventy Million Two Hundred Thousand

(RM70,200,000.00) (exclusive of GST) (hereinafter referred to as “the Balance

Disposal Consideration”) shall be paid by the Purchaser to the Vendor’s

solicitor as stakeholders on or before the expiry of ninety (90) days from the

date of receipt by the Purchaser’s solicitors from the Vendor’s Solicitors of the

letter confirming the fulfilment of the last condition precedent (“Completion

Period”).

(c) In the event that the Purchaser fails to pay the Balance Disposal Consideration

by the expiry of the Completion Period, the Vendor will grant to the Purchaser

an extension of time up to one (1) month from the expiry of the Completion

Period for the Purchaser to make payment of the Balance Disposal

Consideration as aforesaid PROVIDED ALWAYS THAT the Purchaser shall

pay to the Vendor interest on the Balance Disposal Consideration or any part

thereof remaining unpaid at the rate of 8% per annum hereto calculated from

the day next after the expiry of the Completion Period to the date of full

payment of the Balance Disposal Consideration based on a three hundred and

sixty-five (365) day year on the actual number of days elapsed, such interest to

be payable together with the Balance Disposal Consideration.

(iii) Conditional Agreement

Approvals

The effectiveness of the SPA and the obligations of the Parties under the SPA are

subject to the fulfillment and satisfaction of the following conditions precedent within

three (3) months from the date of the SPA or such other extended period as may be

mutually agreed between the Parties (“the Approval Period”):

(a) the Vendor shall have obtained the approval of the unitholders of

AmanahRaya REIT by way of general meeting for the disposal of the

Property in accordance to the terms and conditions contained in the SPA and

the execution of the SPA;

(b) The Purchaser shall increase its issued and paid up share capital to

RM5,000,000.00 comprising of 5,000,000.00 ordinary shares of RM1.00

each prior to the general meeting of AmanahRaya REIT as set out in Clause

2.3(iii)(a) of this Announcement; and

5

(c) the Purchaser shall have forwarded to the Vendor’s solicitors a certified true

copy of their board of directors and/or members’ resolution authorising the

acquisition of the said Property in accordance to the terms and conditions

contained in the SPA and the execution of the SPA by their authorized

signatories.

In the event that any of the above conditions precedent is not obtained within the

Approval Period or any extension granted, the Vendor shall refund to the Purchaser

all monies paid by the Purchaser together with interest as deposit pursuant to Clause

2.3(ii)(a) of this Announcement and thereupon the SPA shall automatically determine

and be of no further effect and neither Party have any claim against the other except

for any antecedent breach.

The SPA shall become unconditional on the date the last of the conditions precedent

is obtained, fulfilled or waived by the Purchaser in writing.

(iv) Special Conditions

The Vendor endeavours to replace the lifts and shall reimburse the cost for

replacement of chillers to be carried out by the Purchaser, subject to the approval of

the Vendor and a maximum reimbursement cost of RM2.00 million.

The Proposed Disposal is also subject to the execution of a deed of novation in the

form and substance acceptable to the Vendor and the Purchaser for novation of the

Existing Tenancy and assignment of all the rights, benefits, interest and obligations of

the Vendor under the Existing Tenancy to the Purchaser in accordance to the terms

and conditions of the deed of novation.

(v) Limited Power of Attorney

The Vendor agrees that upon the SPA becoming unconditional, it shall grant to the

Purchaser a limited power of attorney in respect of the Property, which shall enable

the Purchaser and/or its nominee to prepare, submit to, apply and obtain the approval

from any government or other competent authorities on applications which shall

include but is not limited to layout plans, building plans, specifications, development

orders, architectural and engineering plans and other related plans which are

necessary or expedient for the proper construction, implementation, launching and

practical completion of the development over the Property.

In the event the Purchaser subsequently fails, refuses and/or neglects to complete the

purchase of the Property and/or is in breach of any of the material conditions of the

SPA, the Purchaser shall at its own costs within fourteen (14) days from the date the

Vendor issues a termination notice, revoke the power of attorney and indemnify the

Vendor in respect of the powers granted therein.

(vi) Non-Completion By Vendor

In the event the Vendor shall default in the observance or performance of any of its

obligations under the SPA or commits any breach of the terms and conditions

contained in the SPA, the Purchaser shall be entitled to give the Vendor a notice in

writing to rectify the alleged breach or default as stipulated in the said notice within

fourteen (14) days thereof and in the event of the Vendor failing to rectify the breach

within the aforesaid period the Purchaser shall be entitled at law:

6

(a) to specific performance of the sale and purchase of the Property and to all other

reliefs flowing therefrom in which event the Vendor shall be liable for all costs

and expenses incurred by the Purchaser in relation thereto (including the fees, on

a solicitor and client basis, of the solicitors acting for the Purchaser); or

(b) by notice in writing (hereinafter referred to as the “Election Notice”) served on

the Vendor to elect to rescind the SPA and the Vendor shall on or before the

expiry of fourteen (14) days from the date of receipt by the Vendor of the

Election Notice, cause all moneys paid by the Purchaser to the Vendor under the

SPA to be refunded to the Purchaser free of interest, subject to the prior receipt

by the Vendor from the Purchaser of:-

(i) possession of the Property to the Vendor (if possession has been

delivered to the Purchaser);

(ii) a valid and registrable notice of withdrawal of private caveats duly

executed by the Purchaser and the necessary registration fees (if the

Purchaser has lodged and not withdrawn any private caveat over the

Property);

(iii) the memorandum of transfer (“Transfer”) (where the same is not required

by the stamp office for cancellation for the purpose of refund of the

stamp duty paid thereon) and the issue documents of title to the Property

with the Vendor’s title thereto intact;

(iv) the memorandum of discharge of the existing charge and the duplicates

of the charge; and

(v) all other documents delivered to the Purchaser or to the Purchaser’s

solicitors or the solicitors for the Purchaser’s financier;

whereupon the SPA shall terminate and be of no further effect whatsoever but

without prejudice to any right which either party may be entitled to against the

other party in respect of any antecedent breach of the SPA and the Vendor shall

be entitled to dispose the Property in such manner in its absolute discretion

deemed fit.

(vii) Non-Completion By Purchaser

In the event the Purchaser fails for any reason whatsoever to complete the purchase of

the Property pursuant to the SPA (including, without limitation, the payment of the

interest (if applicable)) save and except due to the default of the Vendor, the Vendor

shall be entitled at its option:

(a) to specific performance and to all other reliefs flowing therefrom in which event

the Purchaser shall be liable for all costs and expenses incurred by the Vendor in

relation thereto (including the fees, on a solicitor and client basis, of the

solicitors acting for the Vendor); or

(b) to forfeit the Deposit as agreed liquidated damages and within fourteen (14)

days thereof, cause all other moneys paid thereunder by the Purchaser to the

Vendor (if any) to be refunded to the Purchaser free of interest, subject to the

prior receipt by the Vendor from the Purchaser of:-

7

(i) possession of the Property to the Vendor (if possession has been

delivered to the Purchaser);

(ii) a valid and registrable notice of withdrawal of private caveats duly

executed by the Purchaser and the necessary registration fees (if the

Purchaser has lodged and not withdrawn any private caveat over the

Property);

(iii) the Transfer (where the same is not required by the stamp office for

cancellation for the purpose of refund of the stamp duty paid thereon) and

the issue documents of title to the Property with the Vendor’s title thereto

intact;

(iv) the memorandum of discharge of the existing charge and the duplicates

of the charge; and

(v) all other documents delivered to the Purchaser or to the Purchaser’s

Solicitors or the solicitors for the Purchaser’s Financier;

whereupon the SPA shall terminate and be of no further effect whatsoever but

without prejudice to any right which either party may be entitled to against the

other party in respect of any antecedent breach of the SPA and the Vendor shall

be entitled to dispose the said Property in such manner in its absolute discretion

deemed fit.

2.4 Basis of determining the Disposal Consideration

The Disposal Consideration was arrived at based on the market value of the Property of

RM76.00 million as appraised by Jones Lang Wootton (“Valuer”) on a willing-buyer willing-

seller basis. The Valuer, has in its Valuation Report, assessed the market value of the Property

based on the Comparison Approach and Investment Method of Income Approach.

The Disposal Consideration of Wisma AmanahRaya complies with clause 9.03 of the SC

Guidelines on Real Estate Investment Trusts (“REIT Guidelines”).

2.5 Original cost and date of investment

The original total cost of investment by AmanahRaya REIT for the property was

approximately RM68.00 million as at 26 February 2007.

2.6 Expected realised gain to AmanahRaya REIT

Based on the audited financial statements for the financial year ended (“FYE”) 31 December

2014, AmanahRaya REIT had recorded an unrealised gain of RM10.00 million due to

revaluation of the Property which was undertaken on 16 July 2014.

In relation to the Proposed Disposal, the Fund shall undertake to carry out certain replacement

and repairs exercise on the Property with estimated costs amounting to approximately

RM3.21 million. Hence, the Proposed Disposal is expected to result in a one-off net realised

gain of approximately RM6.02 million after setting off the total estimated expenses of

RM3.98 million. Such net realised gain is expected to be recognised during the financial year

ended 31 December 2015.

8

2.7 Liabilities to be assumed

The Purchaser will not assume any liabilities pursuant to the Proposed Disposal under the

SPA, save and except for the liabilities arising from the Existing Tenancy, if any, novated and

assigned by the Vendor to the Purchaser upon full payment of the Balance Disposal

Consideration.

2.8 Information on the Purchaser

Annex was incorporated as a private limited company in Malaysia on 10 September 2014

under the Companies Act, 1965. Its present authorised share capital is RM400,000.00

comprising 400,000 ordinary shares of RM1.00 each of which RM2.00 comprising two (2)

ordinary shares of RM1.00 each have been issued and fully paid-up. It is principally involved

in investment holding property development. As at the date of this Announcement, the

directors are Ahmad Syukri bin Abdullah and Husin bin Jidin.

The shareholders of Annex and their shareholdings as at the date of this Announcement are as

follows:

Direct Indirect

Shareholders Number of

shares

% Number of

shares

%

AmanahRaya Development Sdn Bhd 2 100 - -

Amanah Raya Berhad - - 2 100

Pursuant to the SPA, one of the condition precedents of the SPA is for the Purchaser to

increase its issued and paid up capital to RM5.00 million prior to the extraordinary general

meeting of AmanahRaya REIT to obtain the approval of the unitholders for the Proposed

Disposal. In the event the Purchaser is unable to increase its issued and paid up share capital

within the stipulated time, the sale and purchase transaction shall automatically determine and

be of no further effect.

3. RATIONALE FOR THE PROPOSED DISPOSAL

The Manager is of the opinion that there is limited upside potential to the future value of the

Property hence rationalising this opportunistic disposal.

Further, the Property is currently being tenanted to ARB where the tenancy agreement will

expire on 16 August 2016. ARB has the right not to renew the tenancy agreement and if the

tenancy is not renewed, the Manager believes that it would be difficult to find a new tenant

considering that the Property is an approximately a 48 years old building with old facilities.

The Manager believes that it would need to undertake major and extensive refurbishment

exercise considering the age of the Property in order to entice new tenants.

Based on the above, the Manager believes that this is an opportunistic disposal and the

proceeds from the Proposed Disposal is intended to be redeployed for more yield and value

accretive properties.

9

In the event the Manager fails to acquire any new properties within the next twelve (12)

months, the Manager plans to utilise the proceeds from the disposal to settle part of its

borrowings, thus simultaneously minimising AmanahRaya REIT’s exposure to gearing. The

current cost of borrowing is approximately 4.85% per annum and based on part settlement of

the borrowings estimated to be at RM78.00 million, the cost savings of annual interest

expense is estimated to be RM3.78 million.

The Proposed Disposal will allow AmanahRaya REIT to realize the value of its investment in

Wisma AmanahRaya at a premium to its current market value.

4. UTILISATION OF PROCEEDS

The Proposed Disposal will raise gross proceeds of RM78.00 million. The gross proceeds

from the Proposed Disposal will be utilized by AmanahRaya REIT in the manner set out

below:

Proposed Utilisation Estimated timeframe for utilisation RM’000

New Acquisition of Properties(a)

Twelve (12) months from the date of SPA 74,015

Estimated expenses for the Proposed

Disposal(b)

Six (6) months from the date of SPA 3,985

78,000

Notes:

(a) The proceeds from the Proposed Disposal will be redeployed for new investments within the next twelve

(12) months. In the event the Manager fails to secure any accretive investments within the next twelve

(12) months, the Manager will use the proceeds from the Proposed Disposal to part settle the existing

borrowings of AmanahRaya REIT. The total borrowings of AmanahRaya REIT as at 31 December 2014

are approximately RM364.15 million. Hence, such repayment is expected to result in a financing cost

savings of approximately RM3.78 million per annum; and

(b) The expenses for the Proposed Disposals consist of professional fees, charges payable to the related

authorities and other incidental expenses to be incurred in relation to the Proposed Disposal.

5. EFFECTS OF THE PROPOSED DISPOSAL

For illustration purposes, the proforma effects of the Proposed Disposal on AmanahRaya

REIT’s Unitholders’ capital, NAV and gearing, earnings and earnings per unit, substantial

Unitholders’ unitholdings are set out below.

5.1 Unitholders’ capital

The Proposed Disposal will not have any effect on the Unitholders’ capital of AmanahRaya

REIT.

[The rest of this page is intentionally left blank]

10

5.2 Net asset value (“NAV”) and gearing

Based on the audited financial statements of AmanahRaya REIT for the financial year ended

31 December 2014, the proforma effects of the Proposed Disposal on the NAV and gearing of

AmanahRaya REIT are as follows:

Audited as at

31 December 2014

After the

Proposed Disposal

RM’000 RM’000

Unitholders’ capital 519,686 519,686

Distributable Income 138,265 134,281(1)

Total Unitholders’ funds/ NAV 657,951 653,967

No. of units (‘000) 573,220 573,220

NAV per Unit (RM) 1.148 1.141

Total Borrowing 364,147 364,147

Total Assets 1,077,297 1,077,297

Gearing (%)(2)

33.80 33.80

Notes:

(1) After taking into consideration the estimated expenses for the Proposed Disposal of RM3.98 million

comprising the replacement and repair cost and estimated expenses for the Proposed Disposal.

(2) Total interest-bearing borrowings over audited total assets value.

5.3 Substantial Unitholders’ unitholdings

The Proposed Disposal will not have any effect on the substantial Unitholders’ unitholdings

in AmanahRaya REIT.

5.4 Earnings and distributable income

The Manager had declared and paid an income distribution of approximately 1.40 sen per

Unit for the financial quarter ended 31 March 2015. The Manager intends to distribute at least

95% of the distributable income of AmanahRaya REIT for each financial year. The Proposed

Disposal is not expected to have any material effect on the above distribution policy as

determined by the Board. The decision to declare and pay any distributable income in the

future would depend on, inter alia, the financial performance, cash flow position and

financing requirements of AmanahRaya REIT.

The Proposed Disposal is expected to cause a dilution to the distribution per unit during the

interim period pending the injection of new property to be identified. Nevertheless, the

Proposed Disposal will unlock the value of the Property as it is expected to realised an

estimated distributable income of RM6.02 million. The effects of the Proposed Disposal on

the distributable income of AmanahRaya REIT are set out in Section 5.2 above.

11

6. APPROVALS REQUIRED AND INTER-CONDITIONALITY OF THE PROPOSED

DISPOSAL

The Proposed Disposal is subject to the following approvals from the following parties being

obtained:

(i) The Trustee’s approval for the Proposed Disposal, which was obtained on 11 March

2015;

(ii) the approval of the Unitholders of AmanahRaya REIT for the Proposed Disposal at

an Extraordinary General Meeting (“EGM”) to be convened; and

(iii) any other relevant regulatory authorities or parties, if required.

Save as disclosed above, the Proposed Disposal is not conditional upon any other proposal.

7. INTEREST OF MAJOR SHAREHOLDERS AND DIRECTORS OF ARRM, MAJOR

UNITHOLDERS OF AMANAHRAYA REIT AND PERSONS CONNECTED TO

THEM

Save as disclosed below, none of the directors or major shareholders of ARRM, substantial

unitholders of AmanahRaya REIT or persons connected to them have any interests, direct or

indirect, in the Proposed Disposal.

7.1 Major Shareholders of ARRM

ARRM is a wholly-owned subsidiary of ARB who is a major unitholder of

AmanahRaya REIT.

ARB is the ultimate holding company of Annex via its interest in ARDSB, which

holds 100% equity interest in Annex. ARDSB is a wholly-owned subsidiary of ARB.

Accordingly, ARB via its interest in Annex is deemed interested in the Proposed

Disposal.

7.2 Directors of ARRM

The following directors are collectively referred to as “Interested Directors”:-

(i) Datuk Johar Che Mat, Non-Independent, Non-Executive Director of ARRM

is also a Director of ARB;

(ii) Dato’ Haji Che Pee Haji Shamsudin, Non- Independent, Non-Executive

Director of ARRM is also a Director of ARB; and

(iii) Dato’ Anthony @ Firdauz Bujang, Independent, Non-Executive Director of

ARRM is also a Director of ARB.

As at the date of this Announcement, none of the Interested Directors have any

interest, direct or indirect in AmanahRaya REIT.

12

The above Interested Directors is not deemed to be interested in the Proposed

Disposal pursuant to Section 131 of the Companies Act 1965 as the Interested

Directors are only holding directorship in the companies and not shareholding or

material interest in the companies.

The Board of Directors have ensured that the Proposed Disposal is conducted on an

arm’s length basis and is done in the best interest of AmanahRaya REIT.

Save as disclosed above, none of the Directors and/or major shareholders of ARRM

and/or persons connected to them, have any interest, direct or indirect, in the

Proposed Disposal.

7.3 Major Unitholders

ARB is a major Unitholder of AmanahRaya REIT. As at 31 May 2015, the details of

ARB’s unitholding in AmanahRaya REIT are as follows:

Number of

shares

%

Amanah Raya Berhad

Kumpulan Wang Bersama

359,201,958 62.66

Amanah Raya Berhad

Amanah Raya Capital Sdn Bhd

2,032,600 0.35

ARB is a related party to the Manager by virtue of ARB being the holding company

of ARRM.

Accordingly, in accordance with the REIT Guidelines, ARB will not be counted in

the quorum and will abstain from voting on the resolution pertaining to the Proposed

Disposal in respect of their direct and indirect unitholdings (if any) on the resolution

pertaining to the Proposed Disposal to be tabled at the forthcoming EGM, and it shall

undertake to ensure that persons connected to it shall abstain from voting on the

resolution pertaining to the Proposed Disposal.

8. MANAGER’S STATEMENT

The Board (excluding the Interested Directors) having considered all aspects of the Proposed

Disposal including but not limited to the rationale for the Proposed Disposal, the Disposal

Consideration, the terms of SPA, the independent valuation report prepared by Independent

Valuer and the financial effects of the Proposed Disposal and after careful deliberation, is of

the opinion that the Proposed Disposal is carried out at arm’s length and is in the best and

long-term interests of the Fund and the Unitholders.

9. ADVISER

The Manager has appointed MIDF Amanah Investment Bank Berhad as the Principal Adviser

for the Proposed Disposal.

13

10. ESTIMATED TIME FRAME FOR APPLICATION TO AUTHORITIES AND

COMPLETION

The application to the Bursa Malaysia Securities Berhad in respect of the Proposed Disposal

is expected to be made within two (2) months from the date of this announcement.

Barring any unforeseen circumstances, the Proposed Disposal is expected to be completed by

the fourth (4th) quarter of 2015, subject to all relevant approvals being obtained on a timely

basis.

11. DOCUMENTS AVAILABLE FOR INSPECTION

The SPA and the Valuation Report of the Property are available for inspection at the office of

ARRM, as the Manager of AmanahRaya REIT, Level 8 Wisma TAS, No 21, Jalan Melaka,

50100 Kuala Lumpur, Malaysia during normal office hours from Monday to Friday (except

public holidays) for a period of 3 months from the date of this announcement.

[The rest of this page is intentionally left blank]

![Politeknik Sultan Idris Shah...Terangkan LIMA (5) kelebihan pelaburan unit amanah. [10 marks] [10 markah] Determme FIVE (5) parties involved in Islamic Real Estate Investment Trust](https://static.fdokumen.site/doc/165x107/60d0e9b9a953271cc863da74/politeknik-sultan-idris-terangkan-lima-5-kelebihan-pelaburan-unit-amanah.jpg)