NeracadanArusKas

Transcript of NeracadanArusKas

Neraca dan Laporan Arus Kas 1

NERACA DAN LAPORAN ARUS KAS

Neraca dan Laporan Arus Kas 2

1. Manfaat dan kelemahan informasi Neraca2. Neraca menurut PSAK 13. Laporan Arus Kas menurut PSAK 24. Neraca menurut US GAAP5. Laporan Arus Kas menurut US GAAP

Topik

Neraca dan Laporan Arus Kas 3

Usefulness and Purpose of the Balance Sheet.

Provides information about entity’s assets, liabilities, and equity.

Evaluation of liquidity, solvency, and financial flexibility.

Aids in assessing risk and predicting future cash flows.

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 4

Limitations of the Balance Sheet.

Current value is not reflected. Estimates and judgments must be utilized:

in determining the collectibility of receivables. in assessing the salability of inventory. in determining the useful lives of long-term assets.

Omits many items that are of financial value to the business. Assets such as the value of a company’s human resources

and research and development are not reported. Some liabilities or commitments such as leases and

certain contractual arrange ments are reported in an “off balance sheet” manner.

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 5

Perubahan - Penyajian Laporan Keuangan

Cakupan minimal dalam laporan keuangan: Laporan posisi keuangan awal periode komparatif sajian

akibat penerapan retrospektif, penyajian kembali, atau reklasifikasi pos-pos laporan keuangan.

Informasi yang disajikan dalam laporan keuangan: aset, kewajiban, ekuitas, pendapatan dan beban, kontribusi dari dan distribusi kepada pemilik.

Tidak mengatur pihak yang bertanggung jawab atas laporan keuangan

PSAK 1

Neraca dan Laporan Arus Kas 6

Perubahan - Penyajian Laporan Keuangan

Entitas membuat pernyataan kepatuhan atas SAK dalam laporan keuangan

Penyimpanan dari PSAK diijinkan jika kepatuhan PSAK bertentangan dengan tujuan keuangan dalam KPPPLK

Memilih menerapkan kebijakan akuntansi yang tidak diatur dalam PSAK.

Tidak diatur waktu penyampaian laporan

PSAK 1

Neraca dan Laporan Arus Kas 7

Laporan Posisi Keuangan

PSAK 1

IAS 1

PSAK 1

Neraca dan Laporan Arus Kas 8

Pos Laporan Posisi Keuangan

Properi investasi Aset biolojik Total asset yang diklasifikasikan sebagai dimiliku

untuk dijual dan aset yang masuk dalam kelompok lepasan (disposal group) yang diklasifikasikan sebagai dimiliki untuk dijual.

Kewajian dan aset pajak kini Kewajian pajak tangguhan dan aset pajak tangguhan Kewajiban yang termasuk dalam kelompok lepasan

yang diklasifikasikan sebagai dimiliki untuk dijual.

PSAK 1

Neraca dan Laporan Arus Kas 9

Laporan Posisi Keuangan

Entitas menyajikan pos-pos tambahan, judul dan subtotal dalam laporan posisi keuangan jika penyajian tersebut relevan untuk pemahaman posisi keuangan entitas.

Entitas menyajikan aset lancar dan tidak lancar dan laibilitas jangka pendek dan jangka panjang sebagai klasifikasi yang terpisah dalam laporan posisi keuangan, maka aset (laibilitas) pajak tangguhan tidak boleh diklasifikasikan sebagai aset lancar (laibilitas jangka pendek).

PSAK 1

Neraca dan Laporan Arus Kas 10

Pos dalam Laporan

Penyajian aset lancar dan tidak lancar dan laibilitas jangka pendek dan jangka panjang sebagai klasifikasi yang terpisah.

Kecuali penyajian berdasarkan likuiditas memberikan informasi yang lebih relevan dan dapat diandalkan maka digunakan urutan likuiditas.

Perusahaan keuangan berdasarkan likuiditas Pemisahan jumlah yang diharapkan dapat dipulihkan

atau diselesaikan setelah lebih dari dua belas bulan untuk setiap pos aset dan laibilitas, jika nilainya digabung.

PSAK 1

Neraca dan Laporan Arus Kas 11

Aset lancar

Klasifikasi aset lancar, jika: mengharapkan akan merealisasikan aset, atau bermaksud untuk

menjual atau menggunakannya, dalam siklus operasi normal; memiliki aset untuk tujuan diperdagangkan; mengharapkan akan merealisasi aset dalam jangka waktu 12 bulan

setelah pelaporan; atau kas atau setara kas (PSAK 2: Laporan Arus Kas) kecuali aset tersebut

dibatasi pertukarannya atau penggunaannya untuk menyelesaikan laibilitas sekurang-kurangnya 12 bulan setelah periode pelaporan.

Entitas mengklasifikasikan aset yang tidak termasuk kategori tersebut sebagai aset tidak lancar.

PSAK 1

Neraca dan Laporan Arus Kas 12

Liabiltas lancar

Klasifikasi laibilitas lancar, jika: mengharapkan akan menyelesaikan laibilitas tersebut

dalam siklus operasi normalnya; memiliki laibilitas tersebut untuk tujuan diperdagangkan; laibilitas tersebut jatuh tempo untuk diselesaikan dalam

jangka waktu 12 bulan setelah periode pelaporan; atau tidak memiliki hak tanpa syarat untuk menunda

penyelesaian laibilitas selama sekurangkurangnya 12 bulan setelah periode pelaporan.

Entitas mengklasifikasi laibilitas yang tidak termasuk kategori tersebut sebagai laibilitas jangka panjang.

PSAK 1

Neraca dan Laporan Arus Kas 13

Liabilitas

Laibilitas keuangan yang dibiayai kembali yang akan jatuh tempo dalam 12 bulan setelah periode pelaporan diklasifikasikan sebagai laibilitas jangka pendek, jika entitas tidak memiliki hak tanpa syarat untuk membiayai kembali.

Pelanggaran perjanjian utang yang mengakibatkan kreditur meminta percepatan pembayaran, maka laibilitas tersebut disajikan sebagai laibilitas jangka pendek, meskipun kreditur mengijinkan penundaan pembayaran selama 12 bulan setelah tanggal pelaporan tetapi persetujuan tersebut diperoleh setelah tanggal pelaporan

PSAK 1

Neraca dan Laporan Arus Kas 14

Three General Classifications Assets, Liabilities, and Stockholders’ Equity

Companies further divide these classifications:

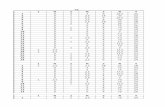

Classification in the Balance Sheet

Balance Sheet

Illustration 5-1 Balance Sheet Classification

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 15

Cash and other assets a company expects to convert into cash, sell, or consume either in one year or in the operating cycle, whichever is longer.

Current Assets

Balance Sheet

Illustration 5-2 Accounts and basis of valuation

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 16

Current Asset Classification

Neraca dan Laporan Arus Kas 17

Generally any monies available “on demand.”Cash equivalents are short-term highly liquid investments that will mature within three months or less.Any restrictions or commitments must be disclosed.

Cash

Balance Sheet – “Current Assets”

Illustration 5-3

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 18

Portfolios

Short-Term Investments

Type Valuation ClassificationHeld-to-

Maturity Debt Amortized Cost

Current or Noncurrent

Trading Debt or Equity Fair Value Current

Available- for-Sale

Debt or Equity Fair Value Current or

Noncurrent

Balance Sheet – “Current Assets”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 19

Claims held against customers and others for money, goods, or services.

Accounts receivable – oral promisesNotes receivable – written promises

Major categories of receivables should be shown in the balance sheet or the related notes.

Receivables

Balance Sheet – “Current Assets”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 20

Accounts Receivable – Presentation OptionsCurrent Assets:

Cash $ 346Accounts receivable 500 Less allowance for doubtful accounts 25 475Inventory 812Total current assets $1,633

Current Assets:Cash $ 346Accounts receivable, net of $25 allowance 475 Inventory 812Total current assets $1,633

1

2

Balance Sheet – “Current Assets”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 21

Company discloses: basis of valuation (e.g., lower-of-cost-or-market) andthe method of pricing (e.g., FIFO or LIFO).

Inventories

Balance Sheet – “Current Assets”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 22

Payment of cash, that is recorded as an asset because service or benefit will be received in the future.

insurancesuppliesadvertising

Cash Payment Expense RecordedBEFORE

rentmaintenance on equipment

Prepayments often occur in regard to:

Prepaid Expenses

Balance Sheet – “Current Assets”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 23

Generally consists of four types: Securities Fixed assetsSpecial fundsNonconsolidated subsidiaries or affiliated companies.

Long-Term Investments

Balance Sheet – “Noncurrent Assets”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 24

Long-Term Investments

Securities I nvestments:

I nvesment in ABC bonds 321,657 I nvestment in UC I nc. 253,980 Notes receivable 150,000 Land held f or speculation 550,000 Sinking f und 225,000 Pension f und 653,798 Cash surrender value 84,321 I nvestment in Uncon. Sub. 457,836

Total investments 2,696,592 Property, Plant, and Equip.

Building 1,375,778 Land 975,000

Balance Sheet – “Noncurrent Assets”

bonds, stock, and long-term notes

For marketable securities, management’s intent determines current or noncurrent classification.

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 25

Fixed Assets I nvestments:

I nvesment in ABC bonds 321,657 I nvestment in UC I nc. 253,980 Notes receivable 150,000 Land held f or speculation 550,000 Sinking f und 225,000 Pension f und 653,798 Cash surrender value 84,321 I nvestment in Uncon. Sub. 457,836

Total investments 2,696,592 Property, Plant, and Equip.

Building 1,375,778 Land 975,000

Balance Sheet – “Noncurrent Assets”

Land held for speculation

Long-Term Investments

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 26

Special Funds I nvestments:

I nvesment in ABC bonds 321,657 I nvestment in UC I nc. 253,980 Notes receivable 150,000 Land held f or speculation 550,000 Sinking f und 225,000 Pension f und 653,798 Cash surrender value 84,321 I nvestment in Uncon. Sub. 457,836

Total investments 2,696,592 Property, Plant, and Equip.

Building 1,375,778 Land 975,000

Balance Sheet – “Noncurrent Assets”

Sinking fundPensions fundCash surrender value of life insurance

Long-Term Investments

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 27

Nonconsolidated

Subsidiaries or Affiliated Companies

I nvestments:I nvesment in ABC bonds 321,657 I nvestment in UC I nc. 253,980 Notes receivable 150,000 Land held f or speculation 550,000 Sinking f und 225,000 Pension f und 653,798 Cash surrender value 84,321 I nvestment in Uncon. Sub. 457,836

Total investments 2,696,592 Property, Plant, and Equip.

Building 1,375,778 Land 975,000

Balance Sheet – “Noncurrent Assets”

Long-Term Investments

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 28

Property, Plant, and Equipment

Total investments 2,696,592 Property, Plant, and Equip.

Building 1,375,778 Land 975,000 Machinery and equipment 234,958 Capital leases 384,650 Leasehold improvements 175,000 Accumulated depreciation (975,000)

Total PP&E 2,170,386 I ntangibles

Goodwill 3,000,000 Patents 177,000 Trademarks 40,000

Balance Sheet – “Noncurrent Assets”

Assets of a durable nature used in the regular operations of the business.

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 29

Intangibles

Accumulated depreciation (975,000) Total PP&E 2,170,386

I ntangiblesGoodwill 2,000,000 Patents 177,000 Trademark 40,000 Franchises 125,000 Copyright 55,000

Total intangibles 2,397,000 Other assets

Prepaid pension costs 133,000 Def erred income tax 40,000

Total other 173,000

Balance Sheet – “Noncurrent Assets”

Lack physical substance and are not financial instruments.

Limited life intangibles amortized.Indefinite-life intangibles tested for impairment.

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 30

Other Assets

I ntangiblesGoodwill 2,000,000 Patents 177,000 Trademark 40,000 Franchises 125,000 Copyright 55,000

Total intangibles 2,397,000 Other assets

Prepaid pension costs 133,000 Def erred income tax 40,000

Total other 173,000 Total Assets 9,210,978$

Balance Sheet – “Noncurrent Assets”

This section should include only unusual items sufficiently different from assets in the other categories.

Balance Sheet (in thousands)Current assets

Cash 285,000$

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 31

“Obligations that a company reasonably expects to liquidate either through the use of current assets or the creation of other current liabilities.”

Balance Sheet

Current Liabilities Balance Sheet (in thousands)Current liabilities

Notes payable 233,450$ Accounts payable 131,800 Accrued compensation 43,000 Unearned revenue 17,000 I ncome tax payable 23,400 Current maturities LT debt 121,000

Total current liabilities 569,650 Long- term liabilities

Long-term debt 979,500 Obligations capital lease 345,800 Def erred income taxes 77,909

Total long-term liabilities 2,093,859 Stockholders' equity

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 32

“Obligations that a company does not reasonably expect to liquidate within the normal operating cycle.”

All covenants and restrictions must be disclosed.

Balance Sheet

Balance Sheet (in thousands)Current liabilities

Notes payable 233,450$ Accounts payable 131,800 Accrued compensation 43,000 Unearned revenue 17,000 I ncome tax payable 23,400 Current maturities LT debt 121,000

Total current liabilities 569,650 Long- term liabilities

Long-term debt 979,500 Obligations capital lease 345,800 Def erred income taxes 77,909

Total long-term liabilities 2,093,859 Stockholders' equity

Long-Term Liabilities

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 33

Companies usually divide equity into three parts, (1) Capital Stock, (2) Additional Paid-In Capital, and (3) Retained Earnings.

Balance Sheet

Owners’ Equity

Illustration 5-15

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 34

(a) Investment in preferred stock

Balance Sheet Classification Exercise

Account

(b) Treasury stock(c) Common stock(d) Cash dividends payable(e) Accumulated depreciation(f) Interest payable(g) Deficit(h) Trading securities(i) Unearned revenue

(a) Current asset/Investment(b) Equity (c) Equity(d) Current liability(e) Contra-asset(f) Current liability(g) Equity(h) Current asset(i) Current liability

Classification

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 35

Classified Balance SheetAccount formReport form

Balance Sheet - Format

Accounting Trends and Techniques—2004 (New York: AICPA) indicates that all of the 600 companies surveyed use either the “report form” (506) or the “account form” (94), sometimes collectively referred to as the “customary form.”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 36

ContingenciesAccounting PoliciesContractual SituationsFair Values

Additional Information Reported

There are normally four types of information that are supplemental to account titles and amounts presented in the balance sheet:

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 37

Parenthetical ExplanationsNotesCross-Reference and Contra ItemsSupporting SchedulesTerminology

Techniques of Disclosure

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 38

Laporan Arus Kas

Kegunaan: memberikan informasi yang memungkinkan para pengguna untuk

mengevaluasi perubahan dalam aset bersih entitas, struktur keuangan (likuiditas dan solvabilitas) dan kemampuan mempengaruhi jumlah serta waktu arus kas dalam rangka penyesuaian terhadap keadaan dan peluang yang berubah.

menilai kemampuan entitas dalam menghasilkan kas dan setara kas dan memungkinkan para pengguna mengembangkan model untuk menilai dan membandingkan nilai sekarang dari arus kas masa depan (future cash flows) dari berbagai entitas.

meningkatkan daya banding pelaporan kinerja operasi berbagai entitas

PSAK 1

Neraca dan Laporan Arus Kas 39

Laporan Arus Kas

Bunga Beban bunga dapat disajikan sebagai arus kas operasi atau

pendanaan Pendapatan bunga dapat disajikan sebagai arus kas operasi atau

investasi Dividen

Dividen yang dibayarkan dapat disajikan sebagai arus kas operasi atau pendanaan

Pendapatan dividen dapat disajikan sebagai arus kas operasi atau investasi

PSAK 1

Neraca dan Laporan Arus Kas 40

Laporan Arus Kas

Untuk penyajian metode tidak langsung :Pembayaran bunga disajikan dengan metode

langsungPajak panghasilan disajikan dengan metode

langsung

PSAK 1

Neraca dan Laporan Arus Kas 41

Laporan Arus Kas - ED

A r u s k a s yang berasal dari beberapa transaksi serta keuntungan atau kerugian dari transaksi tersebut.

Dihapuskan Penyesuaian atas laba atau rugi termasuk berasal dari

hak minoritas dalam laba/rugi konsolidasi. (metode tidak langsung)

Arus kas dari pos luar biasa.

PSAK 1

Neraca dan Laporan Arus Kas 42

Laporan Arus Kas - ED

Arus kas dari pelepasan kepemilikan pada entitas anak yang tidak mengakibatkan hilangnya pengendalian. Arus kas dari transaksi tersebut diakui sebagai arus kas

pendanaan.

Neraca dan Laporan Arus Kas 43

The Statement of Cash Flows

One of the three basic objectives of financial reporting is “assessing the amounts, timing, and uncertainty of cash flows.”

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 44

To provide relevant information about the cash receipts and cash payments of an enterprise during a period. The statement provides answers to the following questions:

1. Where did the cash come from?2. What was the cash used for?3. What was the change in the cash

balance?

Purpose of the Statement

The Statement of Cash Flows

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 45

The Statement of Cash Flows

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 46

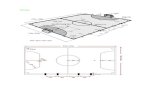

Three different activities:Operating,

Content and Format

The Statement of Cash Flows

Investing, Financing

Illustration 5-24

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 47

Content and Format

The Statement of Cash Flows

OperatingCash inflows and outflows from operations.

InvestingCash inflows and outflows from non-current assets.

FinancingCash inflows and outflows from non-current liabilities and equity.

The statement’s value is that it helps users evaluate liquidity, solvency, and financial flexibility.

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 48

Information obtained from several sources: (1) comparative balance sheets, (2) the current income statement, and (3) selected transaction data.

Preparation

The Statement of Cash Flows

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 49

PreparationStatement of Cash Flow (in thousands)Operating activities

Net income 40,000$ I ncrease in accounts receivable (10,000) I ncrease in accounts payable 5,000 Depreciation expense 40,000

Cash flow f rom operations 75,000 I nvesting activities

Purchase of equipment (8,000) Financing activities

Proceeds f rom notes payable 20,000 Dividends paid (5,000)

Cash flow f rom financing 15,000 I ncrease in cash 82,000$

The Statement of Cash Flows

Noncash credit to revenues.

Noncash charge to expenses.

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 50

Issuance of common stock to purchase assets.Conversion of bonds into common stock.Issuance of debt to purchase assets.Exchanges on long-lived assets.

Additional Information Reported

Significant financing and investing activities that do not affect cash are reported in either a separate schedule at the bottom of the statement of cash flows or in the notes. Examples include:

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 51

High amount - company able to generate sufficient cash to pay its bills.Low amount - company may have to borrow or issue equity securities to pay bills.

Usefulness of the Statement of Cash Flows

Without cash, a company will not survive. Cash flow from Operations:

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 52

Usefulness of the Statement of Cash Flows

Ratio indicates whether the company can pay off its current liabilities from its operations. A ratio near 1:1 is good.

Financial Liquidity

Net Cash Provided by Operating Activities

Average Current Liabilities

Current Cash Debt Coverage

Ratio

=

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 53

Usefulness of the Statement of Cash Flows

This ratio indicates a company’s ability to repay its liabilities from net cash provided by operating activities, without having to liquidate the assets employed in its operations.

Financial Flexibility

Net Cash Provided by Operating Activities

Average Total Liabilities

Cash Debt Coverage

Ratio

=

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 54

Usefulness of the Statement of Cash Flows

The amount of discretionary cash flow a company has for purchasing additional investments, retiring its debt, purchasing treasury stock, or simply adding to its liquidity.

Free Cash FlowIllustration 5-34

Ref: Kieso Weygant ed 13

Neraca dan Laporan Arus Kas 55

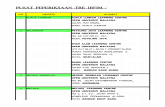

Aset held for sale

Neraca dan Laporan Arus Kas 56

Aset held for sale

Neraca dan Laporan Arus Kas 57

Aset held for sale

Neraca dan Laporan Arus Kas 58

Aset held for sale

Neraca dan Laporan Arus Kas 59

Aset held for sale

Neraca dan Laporan Arus Kas 60

Aset held for sale

Neraca dan Laporan Arus Kas 61

Aset held for sale

Neraca dan Laporan Arus Kas 62

Aset held for sale

Neraca dan Laporan Arus Kas 63

Aset held for sale

Neraca dan Laporan Arus Kas 64

Aset held for sale

Ref : PSAK 58 Jumadi

Neraca dan Laporan Arus Kas 65

Aset held for sale

Ref : PSAK 58 Jumadi

Neraca dan Laporan Arus Kas 66

Main References Intermediate Accounting

Kieso, Weygandt, Walfield, 13th edition, John Wiley

Standar Akuntansi KeuanganDewan Standar Akuntansi Keuangan, IAI, Penerbit Salemba 4

International Financial Reporting Standards – Certificate Learning Material The Institute of Chartered Accountants, England and Wales